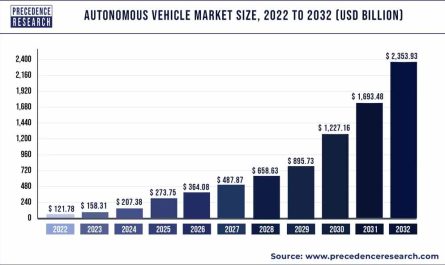

The global small commercial vehicle market size reached USD 482.20 billion in 2023 and is projected to hit around USD 819.74 billion by 2032, registering a CAGR of 5.5% from 2023 to 2032.

Key Points

- North America led the global market with the major market share of 56% in 2022.

- Asia-Pacific is expected to grow at the fastest CAGR of 8.1% during the forecast period.

- By Fuel Type, the diesel segment has held the maximum revenue share of 65% in 2022.

- By Fuel Type, the gasoline segment is projected to expand at a notable CAGR of 6.7% during the projected period.

- By Application Type, the bus segment had the largest market share of 26% in 2022.

- By Application Type, The SUVs segment is anticipated to grow at the fastest CAGR over the projected period.

The small commercial vehicle (SCV) market encompasses a range of light-duty vehicles designed primarily for commercial purposes, including delivery vans, pickups, and small trucks. These vehicles play a crucial role in urban logistics, last-mile delivery services, and small-scale transportation needs. The SCV market is characterized by vehicles with payloads typically ranging from 1 to 3.5 tons, offering a balance between affordability, maneuverability, and utility for businesses across various industries.

Get a Sample: https://www.precedenceresearch.com/sample/3416

Growth Factors:

Several key factors contribute to the growth of the small commercial vehicle market. Urbanization and the rise of e-commerce have increased the demand for efficient last-mile delivery services, driving the need for agile and economical vehicles. Additionally, advancements in technology, such as electric and hybrid powertrains, are making SCVs more sustainable and appealing to environmentally conscious businesses. Moreover, the flexibility and adaptability of SCVs make them attractive for a wide range of applications, further fueling market growth.

Regional Insights:

The demand for small commercial vehicles varies significantly by region. Emerging economies, especially in Asia-Pacific and Latin America, exhibit robust growth due to expanding urban populations and increasing trade activities. In developed regions like North America and Europe, the emphasis on efficient urban logistics and the proliferation of online shopping contribute to sustained demand for SCVs. Regulatory policies, economic conditions, and infrastructure development also play critical roles in shaping regional SCV markets.

Small Commercial Vehicle Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.5% |

| Market Size in 2023 | USD 506.31 Billion |

| Market Size by 2032 | USD 819.74 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Fuel Type and By Application Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Small Commercial Vehicle Market Dynamics

Drivers:

Several drivers propel the expansion of the small commercial vehicle market. The need for cost-effective transportation solutions, particularly in densely populated areas, drives businesses to invest in SCVs. Additionally, regulatory initiatives promoting fuel efficiency and emissions reduction incentivize the adoption of modern SCV technologies. The growth of SMEs (small and medium-sized enterprises) and the gig economy further drive demand for flexible and affordable commercial vehicles.

Opportunities:

Opportunities abound in the small commercial vehicle market, particularly with the advent of new technologies. Electric SCVs are poised for significant growth as battery technology improves and charging infrastructure expands. Innovations in connectivity and telematics enable fleet management optimization, enhancing operational efficiency. Moreover, partnerships between automakers and logistics companies create synergies that open new avenues for market expansion and service offerings.

Challenges:

Despite its promising prospects, the small commercial vehicle market faces certain challenges. Economic uncertainties, fluctuations in fuel prices, and supply chain disruptions can impact market dynamics. Regulatory complexities related to emissions standards and safety requirements pose compliance challenges for manufacturers. Additionally, the competitive landscape is intensifying with the entry of new players and evolving customer preferences, necessitating continuous innovation and adaptation within the industry.

Read Also: Automotive Electronics Market Size to Reach USD 609.61 Bn by 2032

Recent Developments

- In August 2022, Ashok Leyland announced its plans to introduce an electric light commercial vehicle in India by mid-2023. This move aligns with their commitment to advancing electric mobility in the country.

- In May 2022, Tata Motors entered into a strategic Memorandum of Understanding (MoU) with prominent e-commerce and logistics service providers, including Amazon, BigBasket, City Link, DOT, Flipkart, LetsTransport, MoEVing, and Yelo EV. Under this MoU, Tata Motors is set to supply a substantial fleet of 39,000 ACE electric vehicles to support the logistics needs of these companies.

- In May 2022, Tata Motors launched the Ace EV, an electric variant of its renowned Ace truck model. This marks Tata Motors’ entry into the growing segment of small electric trucks designed for efficient freight delivery in India. The Ace EV boasts a 27kW (36hp) motor with 130Nm of peak torque and an impressive range of up to 158 kilometers on a single charge.

- In February 2022, BYD introduced a new all-electric Type A school bus in the United States. This battery-powered bus comes in three different lengths (26.7 feet, 24.5 feet, and 22.9 feet), offering flexibility for routes with varying student populations. Notably, the BYD Type A features the innovative Predictive Stop Arm, enhancing student safety by monitoring oncoming traffic and signaling students when it’s safe to disembark.

Small Commercial Vehicle Market Players

- Hyundai Motor

- Bajaj Auto

- Renault

- Nissan Motor

- Mazda Motor

- Isuzu Motors

- Shaanxi Automobile Group

- Shenyang Brilliance Jinbei Automobile

- Ashok Leyland

- Volkswagen AG

- Toyota Motor Corporation

- TATA Motors

- Golden Dragon

- Navistar International

- General Motors

- Ford Motor

- Nissan Motor

- Chongqing Changan Automobile

- Anhui Jianghuai Automobile

- Atul Auto

Segments Covered in the Report

By Fuel Type

- Gasoline

- Diesel

By Application Type

- Bus

- Truck

- Crossover

- SUVs

- Vans

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/