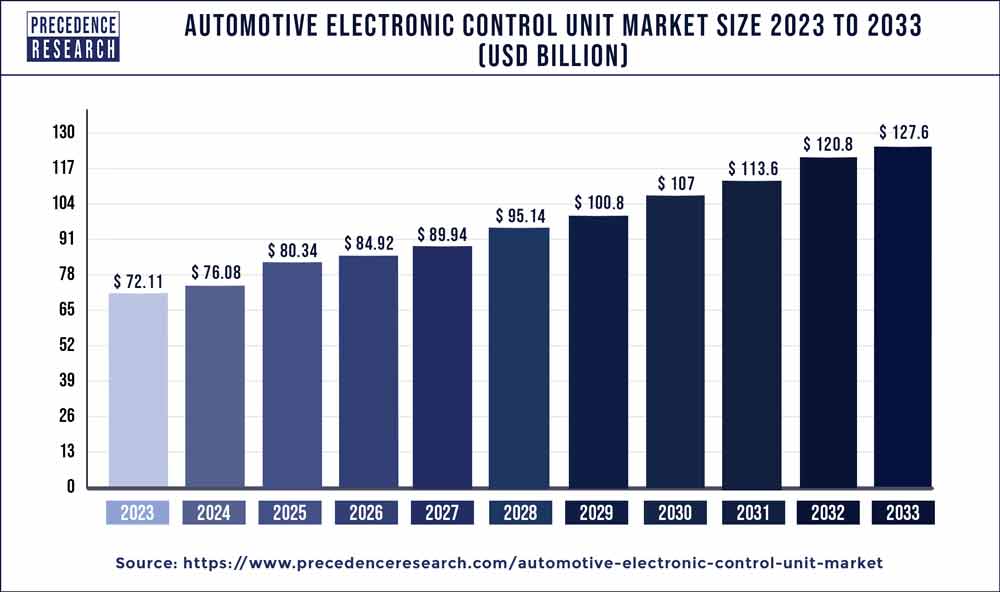

The global automotive electronic control unit market size is predicted to touch US$ 120.8 billion by 2032 from at USD 68.42 Billion in 2022 with a CAGR of 5.90% between 2023 to 2032.

The Automotive Electronic Control Unit (ECU) stands as a pivotal component within an automobile, belonging to the realm of computer systems responsible for overseeing and managing the comprehensive electronic, mechanical, and electrical systems of a vehicle. ECUs are classified based on their functions, encompassing entities such as the Body Control Module (BCM), Engine Control Module (ECM), Powertrain Control Module (PCM), General Electric Module (GEM), Electronic Brake Control Module (EBCM), Suspension Control Module (SCM), Transmission Control Module (TCM), Battery Management System (BMS), Door Control Unit (DCM), among others. These ECUs are integrated within the system, recording, analyzing, and storing data in microcontrollers to facilitate a spectrum of automotive functions, ranging from window movement to engine cylinder operation. The automotive industry’s technological evolution has propelled the integration of intricate and advanced ECUs into vehicles.

Get More Info: https://www.precedenceresearch.com/sample/1041

Factors Driving Growth

The mounting presence of ECUs in vehicles can potentially impact their efficiency. In light of this, automotive industry leaders are collaborating with ECU manufacturers to consolidate these units without compromising their performance. This move aligns with the growing public awareness concerning fuel consumption reduction and overall performance enhancement, thereby fostering significant growth in electric and hybrid vehicle segments. Additionally, regulatory bodies across various nations have imposed stringent directives related to road safety and fuel emissions. For example, initiatives like China’s New Car Assessment Program (NCAP) and the European Commission’s mandates have rendered automatic emergency braking and lane departure warning systems mandatory. This has consequently led to widespread deployment of active safety systems.

Report Highlights

- The Asia Pacific emerged as the dominant region in the global automotive ECU market accounting a revenue share of over 55% in the year 2019. Further, the region registered the fastest growth during the forecast period. The prominent growth of the region mainly attributed to rising trend of advanced and smart vehicles across the region. In addition, increasing purchasing power along with ever growing population in the region are the other most attractive factors that significantly drives the market growth.

- Internal Combustion Engine (ICE) vehicles led the global automotive electronic control unit (ECU) market with significant revenue share proportion in the year 2019, accounting for nearly 96%. Additionally, the segment projected to continue its dominance in the overall automotive ECU market over the forecast period. However, battery-powered vehicle encountered the fastest growth in the coming years.

- Passenger cars are the dominating vehicle type segment that contributed the major revenue portion of the global automotive ECUU market that accounted for more than 87% in the year 2019. A shift in consumer preference for hybrid and luxury vehicles with advanced safety and electronic features likely to influence the market growth for passenger cars.

- By application, ADAS & Safety System led the global automotive ECU market with revenue share of around 34% in the year 2019. Increasing number of accidents on-road along with mandatory government circulars for the implementation of advanced driver safety systems in the vehicle propels the growth

Read More: Automotive Logistics Market is Projected to Register a Robust high CAGR through 2032

Regional Insights

The Asia Pacific region has emerged as a beacon of promise in the global automotive ECU market. With a revenue share of around 56% and the swiftest growth trajectory throughout the forecast period, the region has taken the lead. This remarkable expansion can be attributed to the escalating interest in battery-powered vehicles and the stringent government regulations aimed at promoting green mobility solutions. These measures are instrumental in reducing carbon footprints and improving air quality across Asian nations. The integration of advanced and intelligent mobility features entails the use of ECUs that can oversee multiple hardware functions concurrently. This innovation, in turn, reduces the number of ECUs within a vehicle, thereby enhancing fuel efficiency and overall performance by decreasing vehicle weight.

Major Players and Strategies

The global automotive ECU market witnesses fierce competition, driven by the escalating demand for advanced ECUs catering to smart and hybrid vehicles. Government directives promoting the adoption of electric and battery-powered vehicles have substantially spurred the demand for sophisticated ECUs. Market participants are strategically investing in technological advancements and product development to fortify their standing in the market. Collaborations and strategic alliances with fellow automotive electronic component manufacturers are also embraced as tactics by industry players to solidify their presence in the market.

Some of the significant performers operating in the market include ZF Friedrichshafen AG, Robert Bosch GmbH, Continental AG, Denso Corporation, and Delphi Technologies among others.

Automotive Electronic Control Unit Market Segments

By Propulsion Type

- Hybrid

- Battery Powered

- Internal Combustion Engine (ICE)

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Capacity

- 64-Bit

- 32-Bit

- 16-Bit

By Application

- Body Electronics

- ADAS & Safety Systems

- Infotainment

- Powertrain

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Electronic Control Unit Market, By Vehicle Type

7.1. Automotive Electronic Control Unit Market, by Vehicle Type, 2020-2027

7.1.1. Commercial Vehicles

7.1.1.1. Market Revenue and Forecast (2016-2027)

7.1.2. Passenger Cars

7.1.2.1. Market Revenue and Forecast (2016-2027)

Chapter 8. Global Automotive Electronic Control Unit Market, By Capacity

8.1. Automotive Electronic Control Unit Market, by Capacity, 2020-2027

8.1.1. 64-Bit

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2. 32-Bit

8.1.2.1. Market Revenue and Forecast (2016-2027)

8.1.3. 16-Bit

8.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global Automotive Electronic Control Unit Market, By Propulsion Type

9.1. Automotive Electronic Control Unit Market, by Propulsion Type, 2020-2027

9.1.1. Hybrid

9.1.1.1. Market Revenue and Forecast (2016-2027)

9.1.2. Battery Powered

9.1.2.1. Market Revenue and Forecast (2016-2027)

9.1.3. Internal Combustion Engine (ICE)

9.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 10. Global Automotive Electronic Control Unit Market, By Application

10.1. Automotive Electronic Control Unit Market, by Application, 2020-2027

10.1.1. Body Electronics

10.1.1.1. Market Revenue and Forecast (2016-2027)

10.1.2. ADAS & Safety Systems

10.1.2.1. Market Revenue and Forecast (2016-2027)

10.1.3. Infotainment

10.1.3.1. Market Revenue and Forecast (2016-2027)

10.1.4. Powertrain

10.1.4.1. Market Revenue and Forecast (2016-2027)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2016-2027)

Chapter 11. Global Automotive Electronic Control Unit Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.1.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.1.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.1.4. Market Revenue and Forecast, by Application (2016-2027)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.1.5.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.1.5.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.1.5.4. Market Revenue and Forecast, by Application (2016-2027)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.1.6.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.1.6.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.1.6.4. Market Revenue and Forecast, by Application (2016-2027)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.2.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.2.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.2.4. Market Revenue and Forecast, by Application (2016-2027)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.2.5.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.2.5.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.2.5.4. Market Revenue and Forecast, by Application (2016-2027)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.2.6.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.2.6.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.2.6.4. Market Revenue and Forecast, by Application (2016-2027)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.2.7.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.2.7.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.2.7.4. Market Revenue and Forecast, by Application (2016-2027)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.2.8.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.2.8.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.2.8.4. Market Revenue and Forecast, by Application (2016-2027)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.3.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.3.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.3.4. Market Revenue and Forecast, by Application (2016-2027)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.3.5.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.3.5.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.3.5.4. Market Revenue and Forecast, by Application (2016-2027)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.3.6.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.3.6.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.3.6.4. Market Revenue and Forecast, by Application (2016-2027)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.3.7.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.3.7.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.3.7.4. Market Revenue and Forecast, by Application (2016-2027)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.3.8.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.3.8.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.3.8.4. Market Revenue and Forecast, by Application (2016-2027)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.4.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.4.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.4.4. Market Revenue and Forecast, by Application (2016-2027)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.4.5.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.4.5.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.4.5.4. Market Revenue and Forecast, by Application (2016-2027)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.4.6.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.4.6.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.4.6.4. Market Revenue and Forecast, by Application (2016-2027)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.4.7.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.4.7.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.4.7.4. Market Revenue and Forecast, by Application (2016-2027)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.4.8.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.4.8.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.4.8.4. Market Revenue and Forecast, by Application (2016-2027)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.5.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.5.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.5.4. Market Revenue and Forecast, by Application (2016-2027)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.5.5.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.5.5.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.5.5.4. Market Revenue and Forecast, by Application (2016-2027)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Vehicle Type (2016-2027)

11.5.6.2. Market Revenue and Forecast, by Capacity (2016-2027)

11.5.6.3. Market Revenue and Forecast, by Propulsion Type (2016-2027)

11.5.6.4. Market Revenue and Forecast, by Application (2016-2027)

Chapter 12. Company Profiles

12.1. Continental AG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Robert Bosch GmbH

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Denso Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ZF Friedrichshafen AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Delphi Technologies

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Advics Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Altera Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Atmel Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Hitachi Automotive Systems Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Hyundai Mobis

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Panasonic Corporation

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

About Us

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.