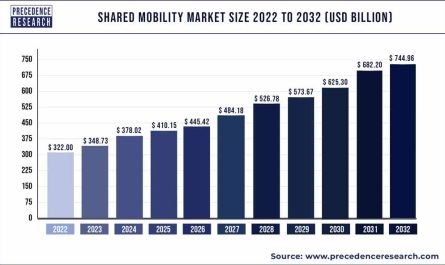

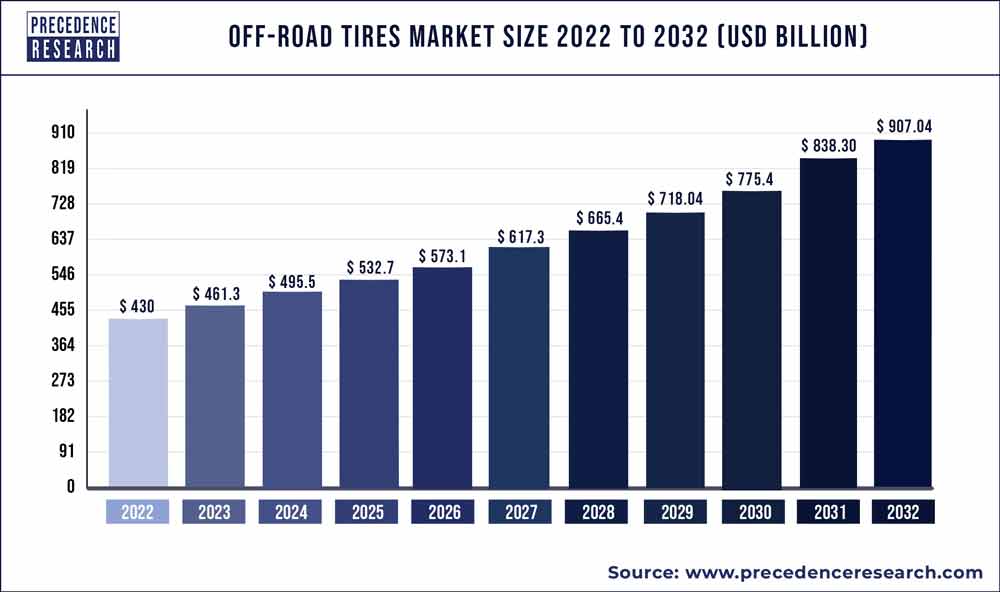

The global off-road tires market size is predicted to be worth around US$ 907.04 billion by 2032 and expanding growth at a noteworthy CAGR of 7.80% from 2023 to 2032.

The off-road tires are a type of vehicle tire with a deep tread pattern to increase friction on uneven surfaces such as mud, dirt, and sand. When it comes to off-road driving, off-road tires are the best option. Off-road tires allow a vehicle to glide over rocks and boulders with ease. The different regional, local, and global service providers in the global off-road tires market are looking to expand their market share. Off-road tires market players are also concentrating on increasing their geographical reach and upgrading their services in order to meet customer requests.

The off-road tires market expansion is being fueled by infrastructure development initiatives and an expanding construction sector. Off-road vehicle demand is being fueled by government investments, particularly in developing countries.

Get the Report Sample Copy@ https://www.precedenceresearch.com/sample/1499

Report Highlights

- Based on the materials, the synthetic rubber segment dominated the global off-road tires market in 2020 with highest market share. Due to its good ageing stability and great abrasion resistance, synthetic rubber is commonly utilized in the off-road tires. It also gives directional stability, rolling resistance, wet traction, speed and run flat capabilities, high fuel efficiency, and weather resistance to the tires, allowing it to perform under difficult situations.

- Asia-Pacific is the largest segment for off-road tires market in terms of region. The increased government investment in construction operations is expected to boost demand for construction vehicles, boosting the off-road tires market across the Asia-Pacific region.

- Europe region is the fastest growing region in the off-road tires market. The surge in demand for off-road tires in the Europe region is due to a number of factors, including increased construction activities, increased industrial development, and an increase in the demand for energy efficient technologies.

Scope of the Off Road Tires Market

| Report Coverage | Details |

| Market Size in 2023 | US$ 461.39 Billion |

| Growth Rate from 2023 to 2032 | 7.80% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Material, Tires Height, Vehicle, Region |

| Companies Mentioned | Hengfeng Rubber, Continental AG, GITI Tire, Triangle Group, Nokian Tires, Toyo Tire, Michelin, Hankook, Yokohama, Maxxis |

Market Dynamics

Drivers

Surge in farm mechanization

Off-road machines are used in the farm and agriculture industry to carry out major day-to-day operations. Off-road utility vehicles are used in agricultural operations such as crop plotting and scouting, rock selection, irrigation, and so on. Nowadays, most of the work in the fields is done with this machinery, which necessitates tires replacement at regular intervals, boosting the growth of the global off-road tires market during the forecasting period.

Restraints

Volatility in the prices of raw materials

The raw material of any automotive component is an important factor in determining the component’s price. As a result, changes in the prices of raw materials have an impact on the prices of finished goods. The cost of raw materials varies by country, depending on regulations and season. Rubber is the most common raw material used in the production of off-road tires, followed by steel and fibers. Natural and synthetic rubber are the most essential raw materials, therefore changes in demand and price have a big impact on the cost of off-road tires. Thus, the volatility in the cost of raw materials is the restricting factor for the growth of the off-road tires market.

Opportunities

Rise in sales of off-highway vehicles

The global manufacturing of off-road vehicles is currently undergoing a radical transformation. The increased use of off-road vehicles in military and recreational operations is a major factor driving the growth of the off-road vehicles market. Military operations use off-road trucks to transport cargo, fuel, and ammunition. During wartime, these vehicles are also used to transport heavy-loaded weapons. Furthermore, advanced technologies such as global positioning system (GPS) on these vehicles, which are used to create field boundaries and mark field lines, allow for less soil compaction and faster planting by plotting the lines. As a result, the rise in sales of off-highway vehicles is creating lucrative opportunities for the growth of the off-road tires market during the forecast period.

Read Also: Automotive Suspension Market Size to Hit US$ 70.19 Bn by 2032

Challenges

High research and development costs

Off-road tires are used in a variety of commercial off-road vehicles, including those used in construction, mining, agriculture, and industrial applications. These tires are designed and engineered to work in extreme conditions such as high load-bearing, rough surfaces, various weather conditions, and traction. Material compositions tread patterns, and a variety of other off-road tire parameters vary depending on vehicle type and requirements. Designing, manufacturing, and testing off-road tires entails research and development activities in which tires are developed while taking into account all requirements and standards. Large special press machines are used in the production of OTR tires, where processes such as vulcanization and curing take place. The cost of raw materials used in the production of OTR tires, as well as the cost of press machines used in the process, is both high. As a result, no key market player can afford to invest heavily in research and development, which is a major challenge for the growth of the off-road tires market.

Some of the prominent players in the global off-road tires market include:

- Hengfeng Rubber

- Continental AG

- GITI Tire

- Triangle Group

- Nokian Tires

- Toyo Tire

- Michelin

- Hankook

- Yokohama

- Maxxis

Segments Covered in the Report

By Material

- Synthetic Rubber

- Natural Rubber

- Fabrics & Wire

- Carbon Black

By Tire Height

- Below 31 inches

- 31-40 inches

- 41-45 inches

- Above 45 inches

By Vehicle

- 4WD

- HDT

- SUV

- UTV

- Dirt Bikes & Quad

- OTR

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Secondary/ Replacement

- Distributor/ Dealer Equipped

By Application

- Agriculture

- Construction

- Material Handling

- Mining

By Construction Type

- Solid

- Radial

- Belted Bias Tire

- Bias Tire

- Non-Pneumatic Tires

By Process

- Pre-Cure

- Mold Cure

By Industrial Equipment

- Forklifts

- Aisle Trucks

- Tow Tractors

- Container Handlers

By Agriculture Tractors

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa