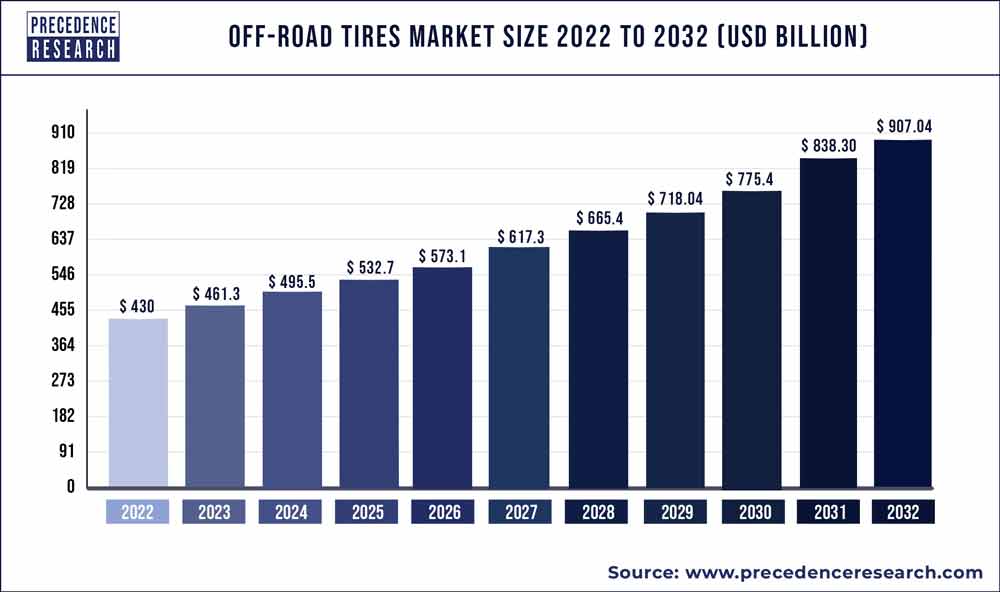

The global off-road tires market size reached US$ 430 billion in 2022 and is projected to surpass US$ 907.04 billion by 2032 with a CAGR of 7.80% from 2023 to 2032.

The off-road tires market is a critical segment within the broader automotive industry, catering to vehicles designed for rugged terrains such as trucks, SUVs, ATVs, and agricultural and construction equipment. Off-road tires are specially engineered to withstand rough conditions, offering enhanced traction, durability, and performance in challenging environments. This market plays a pivotal role in various sectors, including agriculture, mining, construction, and recreational off-roading, driving demand for specialized tire solutions globally.

Get a Sample: https://www.precedenceresearch.com/sample/1499

Growth Factors:

Several factors contribute to the growth of the off-road tires market. Firstly, the expansion of infrastructure development projects, particularly in emerging economies, fuels demand for construction and mining equipment equipped with off-road tires. Rapid urbanization, coupled with investments in transportation and infrastructure, drives the need for heavy-duty vehicles capable of operating in rough terrains, stimulating market growth.

Moreover, the rising popularity of recreational off-roading activities, such as off-road racing, trail riding, and overlanding, drives demand for high-performance off-road tires among enthusiasts. Manufacturers are innovating to meet the specific requirements of off-road enthusiasts, offering tires with superior traction, durability, and puncture resistance, thereby expanding the market for off-road recreational vehicles and accessories.

Additionally, the agriculture sector represents a significant market for off-road tires, with farmers increasingly adopting mechanized equipment for planting, harvesting, and field operations. Off-road tires play a crucial role in enhancing the efficiency and productivity of agricultural machinery, enabling farmers to navigate diverse terrains and challenging weather conditions with ease.

Furthermore, advancements in tire technology, including the use of innovative tread designs, advanced rubber compounds, and robust construction materials, contribute to improved performance and longevity of off-road tires. Manufacturers are investing in research and development to develop next-generation off-road tire solutions that offer superior traction, fuel efficiency, and overall durability, driving market growth and competitiveness.

Region Insights:

The demand for off-road tires varies across regions, influenced by factors such as terrain characteristics, economic development, and industrial activities. In North America, the off-road tires market is driven by a thriving off-road recreation culture, with enthusiasts flocking to explore rugged terrains, national parks, and off-road trails. The United States and Canada boast extensive networks of off-road parks and recreational areas, fueling demand for specialized off-road vehicles and tires.

In Europe, the off-road tires market is propelled by a combination of agricultural activities, construction projects, and recreational off-roading. Countries such as Germany, France, and the United Kingdom have robust agricultural sectors, driving demand for agricultural machinery equipped with off-road tires. Additionally, the presence of off-road racing events and outdoor recreation areas contributes to the growth of the recreational off-roading segment in the region.

In the Asia Pacific region, rapid industrialization, infrastructure development, and agricultural mechanization drive demand for off-road tires. Countries such as China, India, and Australia witness significant investments in construction, mining, and agriculture, stimulating demand for heavy-duty off-road vehicles and equipment. Moreover, the growing popularity of off-road adventure tourism in countries like Australia and New Zealand further boosts demand for off-road tires among recreational enthusiasts.

In Latin America and the Middle East & Africa, the off-road tires market is driven by the agriculture, mining, and construction sectors. Countries with vast agricultural landscapes, such as Brazil and Argentina, rely heavily on off-road machinery for crop cultivation and harvesting, generating substantial demand for agricultural tires. Similarly, mining and construction activities in regions like South Africa, Chile, and Saudi Arabia drive demand for off-road tires used in heavy-duty vehicles and equipment.

Scope of the Off Road Tires Market

| Report Coverage | Details |

| Market Size in 2023 | US$ 461.39 Billion |

| Growth Rate from 2023 to 2032 | 7.80% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Material, Tires Height, Vehicle, Region |

Drivers:

Several drivers contribute to the growth and expansion of the off-road tires market. Firstly, the increasing demand for off-road vehicles and equipment in sectors such as construction, agriculture, and mining fuels the need for specialized tires capable of operating in rugged terrains. Off-road tires play a crucial role in enhancing the performance, productivity, and safety of heavy-duty vehicles used in these industries, driving market growth.

Moreover, the growing popularity of outdoor recreational activities, including off-roading, camping, and adventure tourism, stimulates demand for off-road tires among outdoor enthusiasts. Off-road enthusiasts seek tires that offer superior traction, durability, and performance in diverse terrains, enabling them to explore off-road trails, remote wilderness areas, and challenging landscapes with confidence.

Additionally, advancements in tire technology, including the development of innovative tread designs, advanced rubber compounds, and durable construction materials, contribute to the performance and longevity of off-road tires. Manufacturers are continually innovating to meet the evolving needs of off-road vehicle owners, offering tires that deliver optimal traction, stability, and durability in various off-road conditions.

Furthermore, the expansion of distribution networks and aftermarket channels facilitates the availability and accessibility of off-road tires to consumers worldwide. Manufacturers leverage online platforms, retail outlets, and authorized dealerships to reach a broader customer base and cater to the diverse needs and preferences of off-road vehicle owners and enthusiasts.

Opportunities:

The off-road tires market presents numerous opportunities for manufacturers, retailers, and stakeholders across the automotive industry. Firstly, there is significant potential for product innovation and differentiation, with consumers increasingly seeking off-road tires that offer superior performance, durability, and value for money. Manufacturers can capitalize on this trend by investing in research and development to develop innovative tire solutions that meet the specific requirements of off-road vehicle owners and enthusiasts.

Moreover, the growing popularity of electric off-road vehicles, including electric ATVs, UTVs, and adventure motorcycles, presents new opportunities for tire manufacturers. Electric off-road vehicles offer several advantages, including reduced noise, emissions, and maintenance requirements, driving demand for specialized tires optimized for electric propulsion systems. Manufacturers can develop tires tailored to the unique characteristics and performance requirements of electric off-road vehicles, thereby expanding their product offerings and market reach.

Additionally, the aftermarket segment represents a lucrative opportunity for off-road tire manufacturers, with consumers seeking aftermarket upgrades and accessories to enhance the performance and aesthetics of their vehicles. Manufacturers can collaborate with aftermarket distributors, retailers, and service providers to offer a wide range of off-road tires, wheels, and accessories catering to the diverse needs and preferences of off-road enthusiasts.

Furthermore, there is growing interest in sustainable and eco-friendly tire solutions, driven by environmental concerns and regulatory pressures. Manufacturers can capitalize on this trend by developing eco-friendly tire materials, production processes, and recycling initiatives, thereby appealing to environmentally conscious consumers and fostering sustainable growth in the off-road tires market.

Challenges:

Despite the opportunities, the off-road tires market faces several challenges that could impact its growth and competitiveness. Firstly, the volatile nature of raw material prices, including rubber, oil, and steel, poses challenges for tire manufacturers in terms of production costs and pricing strategies. Fluctuations in commodity prices can affect profit margins and pricing flexibility, making it challenging to maintain competitiveness in the market.

Moreover, the increasing complexity and diversity of off-road vehicle designs and applications pose challenges for tire manufacturers in terms of product development and customization. Off-road vehicles come in various shapes, sizes, and configurations, each requiring specific tire specifications and performance characteristics. Manufacturers must invest in research and development to develop a wide range of off-road tire solutions that meet the diverse needs and preferences of off-road vehicle owners and enthusiasts.

Additionally, regulatory requirements and standards pertaining to tire safety, performance, and environmental impact impose compliance challenges for tire manufacturers. Adherence to stringent regulations and certification processes adds complexity and costs to the production and distribution of off-road tires, particularly in international markets with diverse regulatory frameworks.

Read Also: Automotive Heads-up Display Market Size To Reach USD 17.43 Bn By 2032

Off-road Tires Market Companies

- Hengfeng Rubber

- Continental AG

- GITI Tire

- Triangle Group

- Nokian Tires

- Toyo Tire

- Michelin

- Hankook

- Yokohama

- Maxxis

Segments Covered in the Report

By Material

- Synthetic Rubber

- Natural Rubber

- Fabrics & Wire

- Carbon Black

By Tire Height

- Below 31 inches

- 31-40 inches

- 41-45 inches

- Above 45 inches

By Vehicle

- 4WD

- HDT

- SUV

- UTV

- Dirt Bikes & Quad

- OTR

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Secondary/ Replacement

- Distributor/ Dealer Equipped

By Application

- Agriculture

- Construction

- Material Handling

- Mining

By Construction Type

- Solid

- Radial

- Belted Bias Tire

- Bias Tire

- Non-Pneumatic Tires

By Process

- Pre-Cure

- Mold Cure

By Industrial Equipment

- Forklifts

- Aisle Trucks

- Tow Tractors

- Container Handlers

By Agriculture Tractors

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/