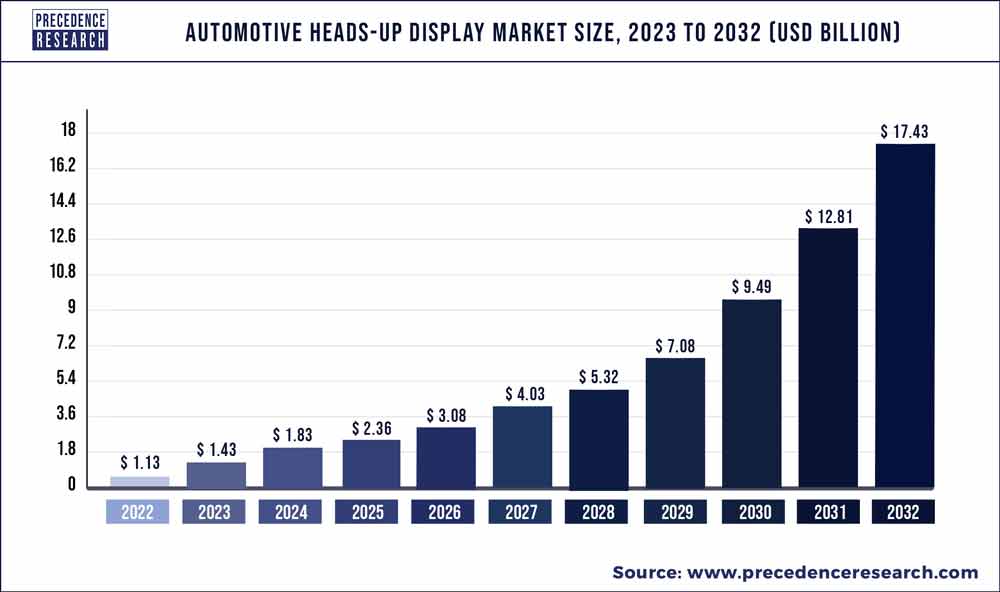

The global automotive heads-up display market size was estimated at USD 1.43 billion in 2023 and is projected to reach around USD 17.43 billion by 2032 with a CAGR of 31.97% from 2023 to 2032.

Key Points

- Asia Pacific led the global market with the highest market share in 2022.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By Technology, the augmented reality – heads-up display segment has held the largest market share in 2022.

- By Heads-up Display Type, the windshield segment captured the biggest revenue share in 2022.

- By Dimension, the 3D segment is estimated to hold the highest market share in 2022.

The automotive heads-up display (HUD) market has experienced remarkable growth in recent years, driven by advancements in automotive technology, increasing demand for advanced driver assistance systems (ADAS), and the growing emphasis on vehicle safety and convenience. Heads-up displays provide drivers with critical information such as vehicle speed, navigation directions, and warning alerts, projected onto the windshield, thereby enhancing situational awareness and minimizing driver distraction. As automotive manufacturers continue to integrate HUD technology into their vehicles, the market for automotive HUDs is expected to expand significantly, offering lucrative opportunities for stakeholders across the automotive industry.

Get a Sample: https://www.precedenceresearch.com/sample/1487

Growth Factors:

Several key factors have fueled the growth of the automotive HUD market. Firstly, the rising consumer demand for advanced safety features and driver assistance systems has driven automakers to incorporate HUD technology into their vehicles. Heads-up displays enable drivers to access vital information without taking their eyes off the road, thereby enhancing driving safety and reducing the risk of accidents.

Moreover, technological advancements in display technologies, optics, and augmented reality have enabled the development of more advanced and immersive HUD systems. High-resolution displays, augmented reality overlays, and customizable interfaces have enhanced the functionality and user experience of automotive HUDs, making them increasingly attractive to consumers.

Furthermore, stringent safety regulations and mandates aimed at improving road safety and reducing distracted driving have incentivized automakers to integrate HUD technology into their vehicles. Regulatory initiatives such as Euro NCAP’s safety ratings and the National Highway Traffic Safety Administration’s (NHTSA) guidelines on driver distraction have underscored the importance of HUDs in enhancing driver awareness and reducing cognitive workload.

Additionally, the growing adoption of connected and autonomous vehicles (CAVs) has spurred demand for HUD technology as a key component of next-generation automotive interfaces. Heads-up displays can provide real-time information on vehicle status, traffic conditions, and navigation instructions, enhancing the user experience and enabling seamless integration with autonomous driving systems.

Furthermore, the increasing penetration of electric vehicles (EVs) and hybrid vehicles has created opportunities for HUD technology to display information related to battery status, charging stations, and energy consumption, thereby catering to the specific needs of electric vehicle drivers.

Region Insights:

The adoption of automotive HUDs varies across regions, influenced by factors such as regulatory environment, consumer preferences, and technological infrastructure. In North America, the automotive HUD market has witnessed significant growth, driven by the presence of leading automotive manufacturers, favorable regulatory policies, and high consumer demand for advanced safety features. The United States, in particular, has emerged as a key market for automotive HUDs, with automakers such as General Motors, Ford, and Tesla incorporating HUD technology into their vehicles.

In Europe, stringent safety regulations and the presence of established automotive manufacturers have contributed to the widespread adoption of HUD technology. Countries such as Germany, France, and the United Kingdom have seen strong demand for automotive HUDs, driven by consumer preferences for premium vehicles equipped with advanced driver assistance systems and connectivity features.

In Asia Pacific, rapid urbanization, rising disposable incomes, and the growing adoption of electric vehicles have fueled demand for automotive HUDs. Countries such as China, Japan, and South Korea have emerged as major markets for automotive HUDs, with domestic automakers and international brands competing to offer advanced HUD solutions to tech-savvy consumers.

Scope of the Automotive Heads-Up Display Market

| Report Coverage | Details |

| Market Size in 2023 | USD 1.43 Billion |

| Revenue Projection by 2032 | USD 17.43 Billion |

| Growth Rate from 2023 to 2032 | 31.97% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

Drivers:

Several drivers are propelling the growth of the automotive HUD market. One of the primary drivers is the increasing focus on vehicle safety and the need to reduce driver distraction. Heads-up displays enable drivers to access critical information such as speed, navigation directions, and warning alerts without diverting their attention from the road, thereby enhancing situational awareness and reducing the risk of accidents.

Moreover, technological advancements in display technologies, optics, and augmented reality have expanded the capabilities of automotive HUDs, making them more attractive to consumers. High-resolution displays, augmented reality overlays, and customizable interfaces offer enhanced visibility and usability, improving the overall user experience and driving adoption of HUD technology.

Furthermore, the growing demand for connected and autonomous vehicles has spurred interest in HUD technology as a key interface for interacting with vehicle systems and accessing real-time information. Heads-up displays can provide drivers with essential data on vehicle status, traffic conditions, and navigation instructions, facilitating seamless integration with autonomous driving systems and enhancing the user experience.

Additionally, regulatory mandates and safety standards aimed at reducing distracted driving have incentivized automakers to incorporate HUD technology into their vehicles. By providing drivers with essential information directly in their line of sight, automotive HUDs help minimize cognitive workload and improve driver focus, thereby enhancing overall safety on the road.

Furthermore, the increasing adoption of electric vehicles and hybrid vehicles has created new opportunities for HUD technology to display information related to battery status, charging stations, and energy consumption, catering to the specific needs of electric vehicle drivers and enhancing the functionality of automotive HUDs.

Opportunities:

The automotive HUD market presents numerous opportunities for stakeholders across the automotive value chain. One of the most significant opportunities lies in the development of advanced HUD technologies that offer enhanced functionality, usability, and customization options. Features such as augmented reality overlays, gesture controls, and voice recognition capabilities can differentiate HUD systems and provide automakers with a competitive edge in the market.

Moreover, the integration of automotive HUDs into a wide range of vehicles, including passenger cars, commercial vehicles, and electric vehicles, presents opportunities for HUD manufacturers to expand their customer base and address diverse market segments. As consumer demand for advanced safety features and connectivity options continues to grow, automotive HUDs are likely to become standard features in many vehicles, creating a substantial market opportunity for suppliers and manufacturers.

Furthermore, partnerships and collaborations between automakers, technology companies, and HUD manufacturers can drive innovation and accelerate the development of next-generation HUD systems. By leveraging each other’s expertise and resources, stakeholders can collaborate on research and development initiatives, explore new use cases for HUD technology, and bring innovative products to market more quickly.

Additionally, the aftermarket segment offers opportunities for HUD manufacturers to tap into the growing demand for retrofit HUD solutions. As consumers seek to upgrade their existing vehicles with advanced safety features and connectivity options, aftermarket HUD systems provide a cost-effective and convenient solution for adding HUD technology to older vehicles, expanding the addressable market for HUD manufacturers.

Furthermore, the growing demand for electric vehicles and autonomous vehicles presents opportunities for HUD technology to play a more prominent role in the future of mobility. Heads-up displays can provide real-time information on battery status, charging stations, and autonomous driving modes, enhancing the user experience and enabling seamless integration with emerging automotive technologies.

Challenges:

Despite the promising growth prospects, the automotive HUD market faces several challenges that must be addressed to realize its full potential. One of the primary challenges is the high cost of HUD technology, which can limit adoption among budget-conscious consumers and manufacturers. The integration of advanced display technologies, optics, and augmented reality features can drive up the cost of HUD systems, making them less accessible to mass-market vehicles.

Moreover, concerns about driver distraction and information overload pose challenges to the widespread adoption of automotive HUDs. While heads-up displays offer the advantage of providing essential information without diverting the driver’s attention from the road, poorly designed HUD interfaces or excessive information display can overwhelm drivers and increase cognitive workload, potentially leading to safety risks.

Furthermore, interoperability and compatibility issues between HUD systems and vehicle platforms can hinder market growth and adoption. As automakers develop proprietary HUD solutions and software platforms, compatibility with third-party devices and aftermarket accessories may be limited, restricting consumer choice and hindering aftermarket adoption.

Read Also: Airless Tires Market Size, Share, Share, Report By 2032

Some of the prominent players in the global automotive heads-up display market include:

- Harman International

- Robert Bosch GmbH

- JVCKENWOOD Corporation

- Panasonic Corporation

- Continental AG

- Visteon Corporation

- Garmin Ltd.

- Hyundai Mobis

- LG Display Co. Ltd

- KYOCERA Corporation

Segments Covered in the Report

By Technology

- Augmented Reality – Heads-up Display

- Conventional Heads-up Display

By Heads-up Display Type

- Combiner

- Windshield

By Dimension

- 2D

- 3D

By Vehicle Class

- Economy

- Mid-segment

- Luxury car

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/