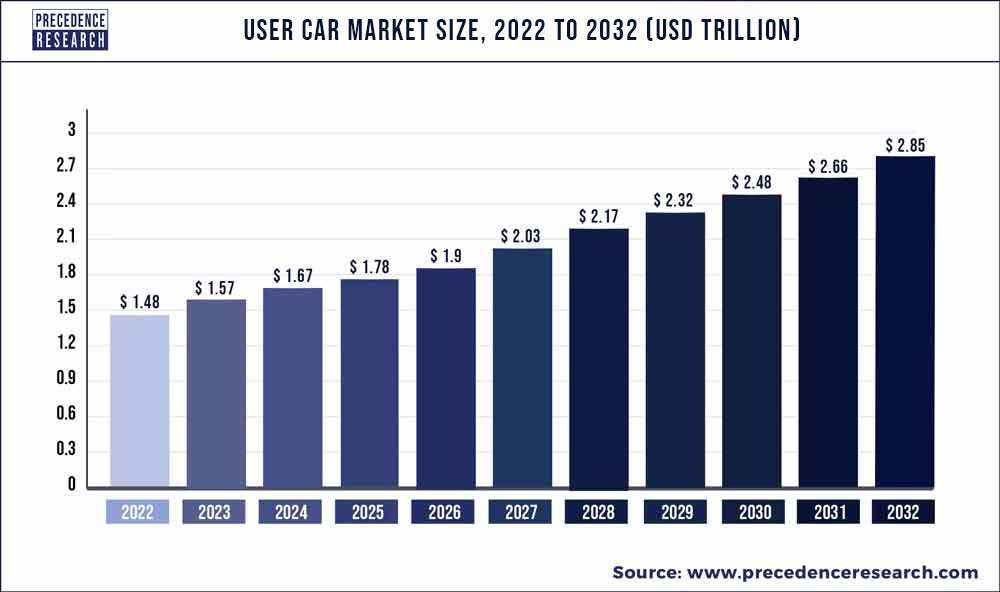

The global used car market size is expected to be worth around USD 2.85 trillion by 2032 from USD 1.48 trillion in 2022, growing at a CAGR of 6.80% during the forecast period from 2022 to 2032.

The market for used car witnessed prominent growth over the past few years and anticipated to grow at the same rate during the coming year. This is mainly attributed to the rising investment from automotive manufacturers for expanding their dealership network. Until recently, automotive dealers and manufacturers have focused primarily on the new vehicle production and sale business; however, they have also started focusing on used car and observe it as an important byproduct for their business growth. This has prominently boosted the market growth for used cars over the upcoming years.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1279

Used Car Market Report Scope

| Report Scope | Details |

| Market Size In 2023 | USD 1.57 Trillion |

| Market Size | USD 2.85 Trillion by 2032 |

| Growth Rate | CAGR of 6.80% From 2023 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Vehicle Type, Vendor Type, Fuel Type, Size, Sales Channel |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

| Companies Mentioned | CarMax Business Service LLC, Alibaba.com, Asbury Automotive Group, Hendrick Automotive Group, Scout24 AG, TrueCar Inc., Lithia Motor Inc., Group 1 Automotive Inc., AutoNation Inc., and eBay Inc. |

Read More: Ride Sharing Market Size is Expanding Around USD 436 Billion by 2032

Moreover, significant advancement in the technology for example development of internet along with the introduction of electric and hybrid vehicles have transformed the buyer’s perspective towards used cars. Further, the quality and reliability of the used cars have also attracted significant number of customers that positively favors the market growth. Presently, increased customer knowledge about the vehicle, quality finance charges, residual value of vehicle, and availability also propels the market growth during the forthcoming years.

Nonetheless, the corona virus outbreak has disrupted the automotive industry to a greater extent and brought its sales significantly down from its prior value. However, as per the analysis, the post pandemic era expected to witness an upsurge in the vehicle sales as people prefer self-owned vehicles rather than shared vehicles. Further, the financial disparities anticipated to hamper the market growth for used car in the coming years.

By vehicle type, electric vehicle witnessed the fastest growth rate over the forthcoming years because of shifting customer preference from conventional vehicles to electric-powered vehicles. In addition, the market growth for electric vehicles is also favored by the increasing number of government policies to promote the adoption of electric cars in order to curb the rate of pollution in the region. In accordance to the same, government of various regions are offering incentives and other tax benefits to promote the adoption of electric vehicles. Hence, the aforementioned factors propel the demand for electric vehicles in the coming years.

Based on fuel type, other segment expected to register prominent growth over the upcoming years due to large number of customers switching from conventional fuels to environment-friendly fuels such as CNG gas and electric-powered cars. This is mainly because of alarming rate of rise in the global pollution. In developing nations CNG gas powered vehicles have shown significant demand over the past few years and estimated to rise at the same rate in the near future.

On the basis of size, the global used car market has been classified into mid-size, compact, and SUVs. Compact sized vehicles are the most-preferred choice of customers in today’s era owing to scarcity of space. Hence, the compact size segment witnessed significant growth over the forecast period and also capture prominent revenue share in the present time.

Based on region, the Asia Pacific held the largest revenue share in the global used car market of approximately 36% in the year 2020. This is primarily because of large number of developing nations present in the region. In addition, the region accounted to hold the major share of middle-class population that also favors the significant demand of used cars in the region. China is the front-runner in the Asia region with the highest demand for used passenger cars.

The used car market experiences intense competition owing to huge surge in the new market entrants. The market for used car is a niche market and thus requires less investment that favors the entry of new market players in the global market. In addition, as new market players focus significantly in the technology integration and expanding their business using internet, they grow faster compared to older ones.

Some of the magnificent industry participants listed in the global used car market include CarMax Business Service LLC, Alibaba.com, Asbury Automotive Group, Hendrick Automotive Group, Scout24 AG, TrueCar Inc., Lithia Motor Inc., Group 1 Automotive Inc., AutoNation Inc., and eBay Inc. among others.

Market Segments:

By Vehicle Type

- Conventional

- Hybrid

- Electric

By Vendor Type

- Unorganized

- Organized

By Fuel Type

- Diesel

- Petrol

- Others

By Size

- Mid-Size

- Compact

- SUVs

By Sales Channel

- Offline

- Online

By Regional Outlook

- North America

- US

- Rest of North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Used Car Market, By Vehicle Type

7.1. Used Car Market, by Vehicle Type, 2021-2030

7.1.1. Conventional

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Hybrid

7.1.2.1. Market Revenue and Forecast (2017-2030)

7.1.3. Electric

7.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Used Car Market, By Vendor Type

8.1. Used Car Market, by Vendor Type, 2021-2030

8.1.1. Unorganized

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Organized

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Used Car Market, By Fuel Type

9.1. Used Car Market, by Fuel Type, 2021-2030

9.1.1. Diesel

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Petrol

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Used Car Market, By Size

10.1. Used Car Market, by Size, 2021-2030

10.1.1. Mid-Size

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Compact

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. SUVs

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Used Car Market, By Sales Channel

11.1. Used Car Market, by Sales Channel, 2021-2030

11.1.1. Offline

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Online

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Used Car Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.1.4. Market Revenue and Forecast, by Size (2017-2030)

12.1.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.6. U.S.

12.1.6.1. Market Revenue and Forecast, by Vehicle Type(2017-2030)

12.1.6.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Size(2017-2030)

12.1.6.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.7. Rest of North America

12.1.7.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.1.7.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.1.7.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.1.7.4. Market Revenue and Forecast, by Size (2017-2030)

12.1.7.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.2.4. Market Revenue and Forecast, by Size (2017-2030)

12.2.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.6. UK

12.2.6.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Size (2017-2030)

12.2.6.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.7. Germany

12.2.7.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Size (2017-2030)

12.2.7.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.8. France

12.2.8.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Size (2017-2030)

12.2.8.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.9. Rest of Europe

12.2.9.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.2.9.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.2.9.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.2.9.4. Market Revenue and Forecast, by Size (2017-2030)

12.2.9.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.3.4. Market Revenue and Forecast, by Size (2017-2030)

12.3.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.6. India

12.3.6.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Size (2017-2030)

12.3.6.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.7. China

12.3.7.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Size (2017-2030)

12.3.7.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.8. Japan

12.3.8.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Size (2017-2030)

12.3.8.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.9. Rest of APAC

12.3.9.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.3.9.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.3.9.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.3.9.4. Market Revenue and Forecast, by Size (2017-2030)

12.3.9.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.4.4. Market Revenue and Forecast, by Size (2017-2030)

12.4.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.6. GCC

12.4.6.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Size (2017-2030)

12.4.6.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.7. North Africa

12.4.7.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Size (2017-2030)

12.4.7.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.8. South Africa

12.4.8.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Size (2017-2030)

12.4.8.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.9. Rest of MEA

12.4.9.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.4.9.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.4.9.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.4.9.4. Market Revenue and Forecast, by Size (2017-2030)

12.4.9.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.5.4. Market Revenue and Forecast, by Size (2017-2030)

12.5.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5.6. Brazil

12.5.6.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Size (2017-2030)

12.5.6.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5.7. Rest of LATAM

12.5.7.1. Market Revenue and Forecast, by Vehicle Type (2017-2030)

12.5.7.2. Market Revenue and Forecast, by Vendor Type (2017-2030)

12.5.7.3. Market Revenue and Forecast, by Fuel Type (2017-2030)

12.5.7.4. Market Revenue and Forecast, by Size (2017-2030)

12.5.7.5. Market Revenue and Forecast, by Sales Channel (2017-2030)

Chapter 13. Company Profiles

13.1. CarMax Business Service, LLC

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Alibaba.com

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Asbury Automotive Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Hendrick Automotive Group

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Scout24 AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. TrueCar, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Lithia Motor Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Group 1 Automoitve Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. AutoNation Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. eBay Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333