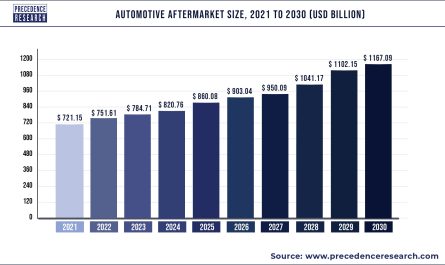

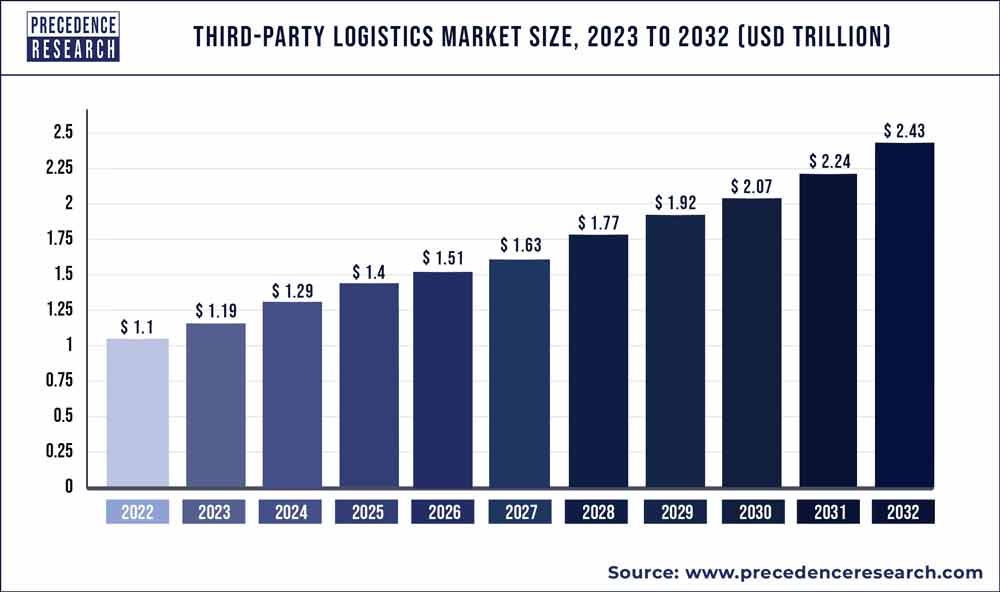

The global third-party logistics market size reached USD 1.10 trillion in 2022 and it is expected to expand at USD 2.43 trillion by 2032, poised to grow at a CAGR of 8.25% from 2023 to 2032.

Third-party logistics is a method by which manufacturers outsource their logistics and distribution services. A third-party logistics companies provide various services to its customers that include cross-docking, inventory management, packaging of products, and door-to-door delivery. These companies provide fast supply chain services in cost-effective way. In addition, the outsourcing of supply chain services by the manufacturing companies reduces their shipping & delivery cost, inventory cost, as well as meet the technical requirement that increases their capability to focus more towards the product development and other growth strategies.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1256

Third-party Logistics Market Growth Factors

Rising e-commerce and retail businesses are significantly escalating the demand for third-party logistics. Main factors contributing towards the growth of e-commerce business are changing consumer purchasing behavior, easy availability of the products over internet, no need to go out for shopping in the digital world, and many others. Additionally, growing demand for fast and cost-effective logistics services also aid in the growth of the third-party logistics market. Hence, the market anticipated to witness profound growth over the forecast period.

Apart from this, increasing tilt of manufacturing businesses to outsource their supply chain also provides significant escalation to the third-party logistics market. Earlier, these businesses invest largely on maintaining their supply chain and inventory as they need to manage their logistics from raw material procurement to finished product distribution process. By outsourcing supply chain process, manufacturers are now free from warehouse management, inventory management, and focus more towards their market growth strategies.

However, COVID-19 outbreak in the early 2020 has significantly impacted the global supply chain. The logistics network has also been disrupted due to stringent regulations imposed by the government in order to prevent the rapid spread of virus. Several third-party logistics companies are facing uncertainty for the movement of their goods. In addition, lack of human resource and less working hour have also impacted badly on the third-party logistics market.

Read More: Intelligent Transportation System Market Size To Attain USD 47.89 Billion By 2030

Report Highlights

- North America dominated the global third-party logistics market in 2020 and expected to grow at a steady rate owing to rising demand for cold storage in the region

- The Asia Pacific anticipated to witness the highest growth rate over the forecast period due to increasing industrialization and manufacturing businesses in the region

- By service, Domestic Transportation Management (DTM) led the global third-party logistics market in 2020 with a revenue share of around 30.3%

- Roadways segment captured major revenue share of the global market because of rapid development in the logistics infrastructure

- Airways expected to be the fastest growing transportation segment owing to need for fast and cost-effective delivery services

- In terms of end-use, manufacturing segment captured major revenue share of nearly 25.5% owing to shifting of companies to supply chain outsourcing rather than maintaining in-house supply chain

- Retail segment anticipated flourishing growth over the upcoming years because of rapid growth of retail businesses

Regional Snapshots

North America led the global third-party logistics market and hold significant share nearly 25.4% in the year 2020. Rise in the domestic and international trade has significantly impacted the third-party logistics market growth in North America region. United States is the front-runner in the North America region and captured nearly 70% of the market revenue. As per World Trade Organization (WTO), merchandise exports to the United States have significantly increased from the year 2017 to 2018. Because of growing trade activities customers are also demanding timely delivery of product and efficient operations of the process.

On the other side, the Asia Pacific exhibits the fastest growth rate over the upcoming years owing several policies for trade liberalization coupled with rapid growth in the manufacturing sector in developing as well as under-developed countries. China, India, South Korea, Japan, and Taiwan are some of the rapidly developing countries in terms of manufacturing, transportation, and industrialization that account to propel the market growth in the region. For instance, the Government of India has set the Logistics Efficiency Enhancement Program (LEEP) for the development of multi-model logistics park.

Key Players & Strategies

The prominent players in the market are more focused to include technological advancements to their services that include route optimization, real time tracking of shipments, and advanced driver assistance systems. These technologies help companies to maintain complete visibility during the entire supply chain.

Moreover, some market players are also highly focused towards inorganic strategies of growth such as merger & acquisition, partnership, regional expansion, and many others. For instance, in August 2019, Panalpina Welt transport Holding AG, a logistics company based at Switzerland was acquired by DSV. This increases the competitive value of the company in the market.

Some of the key players of the market are Burris Logistics, CEVA Logistics, C.H. Robinson Worldwide (CHRW) Inc., DB Schenker Logistics, FedEx Corporation, BDP International, UPS Supply Chain Solutions, Inc., Kuehne + Nagel International AG, J.B. Hunt Transport Services, Inc., Nippon Express Co., Ltd., and XPO Logistics, Inc among others.

Service Outlook

- Domestic Transportation Management (DTM)

- International Transportation Management (ITM)

- Dedicated Contract Carriage (DCC)/ Freight forwarding

- Value-Added Logistics Services (VALs)

- Warehousing & Distribution (W&D)

Transport Outlook

- Railways

- Roadways

- Airways

- Waterways

End-use Outlook

- Retail

- Manufacturing

- Automotive

- Healthcare

- Others

Regional Outlook

-

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

- North America

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333