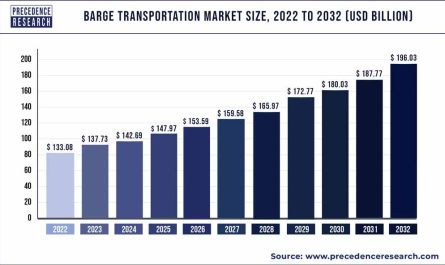

The global on-board diagnostics (OBD) aftermarket size was valued at USD 4.29 billion in 2023 and is projected to reach around USD 23.32 billion by 2032, at a CAGR of 20.71% from 2023 to 2032.

Key Points:

- North America contributed more than 47% of revenue share in 2022.

- By Vehicle Type, the passenger vehicle segment led the global market with the largest market share in 2022.

- By Application, the fleet management segment contributed more than 53% of revenue share in 2022.

- By Component, the hardware segment accounted the maximum market share in 2022.

On-Board Diagnostics (OBD) aftermarket refers to the market for devices and software that allow vehicle owners and professionals to access and interpret data from a car’s OBD system. This data can include information on engine performance, emissions, and other diagnostics. The OBD aftermarket includes handheld diagnostic scanners, smartphone apps, and computer-based software that can connect to a car’s OBD port. These tools help identify issues and enable timely maintenance and repair, improving vehicle performance and safety.

Get a Sample: https://www.precedenceresearch.com/sample/3278

Table of Contents

ToggleGrowth Factors:

The growth of the OBD aftermarket is driven by several factors. The increasing complexity of modern vehicles and the need for efficient maintenance solutions contribute to the demand for OBD devices. Additionally, rising awareness among vehicle owners about the importance of regular diagnostics for vehicle health and emissions control supports market growth. The integration of wireless technology and mobile apps with OBD devices has also fueled market expansion by offering convenience and advanced features to users.

Region Insights:

The OBD aftermarket varies across regions. In North America and Europe, the market is well-established due to strict emissions regulations and a high number of vehicles. These regions have a strong base of automotive professionals and a tech-savvy consumer base, driving the adoption of OBD devices. In Asia-Pacific, the market is growing rapidly due to increased vehicle ownership, rising disposable incomes, and growing awareness of the benefits of diagnostics. Emerging markets in Latin America and Africa are also showing potential for growth as vehicle penetration increases.

On-Board Diagnostics (OBD) Aftermarket Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 4.29 Billion |

| Market Size by 2032 | USD 23.32 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 20.71% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Components, By Application, By Platform, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

On-Board Diagnostics (OBD) Aftermarket Dynamics:

Drivers:

Key drivers for the OBD aftermarket include the need for regular vehicle maintenance, emissions control, and diagnostic capabilities. Advancements in vehicle technology and the proliferation of connected cars are also driving demand for sophisticated OBD solutions. Additionally, the increasing focus on fuel efficiency and environmental regulations is pushing for the use of OBD devices to monitor and optimize vehicle performance.

Opportunities:

Opportunities in the OBD aftermarket include the integration of advanced analytics and AI with OBD data to provide predictive maintenance solutions. This could revolutionize vehicle diagnostics by identifying potential issues before they become serious problems. Additionally, there is potential for growth in the market for fleet management solutions that use OBD data to monitor and optimize the performance of commercial vehicle fleets.

Challenges:

The OBD aftermarket faces challenges such as compatibility issues between different vehicles and diagnostic tools. Ensuring data security and privacy is another concern, especially as OBD devices become more connected to the internet. There is also competition from original equipment manufacturers (OEMs) who may offer integrated diagnostic solutions with their vehicles. Addressing these challenges will be important for the sustained growth of the OBD aftermarket.

Read Also: Amphibious Vehicle Market Size To Rise USD 10.28 Bn By 2032

Recent Developments:

- Innova Electronics Corporation, an esteemed provider of diagnostic reporting and testing equipment for the automotive aftermarket, has recently unveiled its newest software and firmware update for its OBD2 scanner tools and dongles in the present generation.

- Bartec USA recently unveiled a new software update for its TPMS tool, boasting more extensive coverage of Rite-Sensor and a greater range of model year tools. This update also showcased Bartec’s enhanced OBD II capabilities.

On-Board Diagnostics (OBD) Aftermarket Companies

- Magneti Marelli S.p.A.

- Intel Corporation

- Innova Electronics Corporation

- Hella GmbH & Co. KGaA

- Geotab Inc.

- Electronic System LTD

- ERM

- Continental AG

- CalAmp Corporation

- Danlaw Inc.

- Bosch Diagnostic (Robert Bosch GmbH)

- Azuga Inc.

- AVL DiTEST GmbH

- Autel Intelligent Technology Corp., Ltd.

Segments Covered in the Report:

By Components

- Empennage

- Wings

- Fuselage

- Nacelle & Pylon

- Nose

- Others

By Application

- Fleet Management

- Consumer Telematics

- Car Sharing

- Used-based Insurance

By Platform

- Fixed-Wing Aircraft

- Military

- Commercial

- General Aviation Aircraft

- Business Jet

- Rotary-Wing Aircraft

- Military Helicopters

- Commercial Helicopters

- UAVs

By End-User

- OEM

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/