Key Takeaways:

- By end user, the non-automotive segment accounted largest revenue share 63% in 2022 and is projected to grow at a CAGR of 39.5%.

- In 2022, the electronics segment generated a revenue share of about 68%.

- The hydrometallurgical process segment has garnered a market share of 65% in 2022.

- The electric vehicle segment is growing at a registered CAGR of 45% over the forecast period.

- Asia-Pacific region is registering growth at a CAGR of 41% during the forecast period.

- In 2022, Europe dominated the market with 36.2% of revenue share.

Lithium-ion battery regeneration refers to the gathering of fuel cells from a diverse range of sources, such as automobiles, heavy machinery, consumer items, and digital equipment, as well as the extraction of metal or other materials via recycling procedures. The world market estimate covers the income generated from the sale of such reclaimed minerals or components, regardless of how they are used in additional battery recycling or other uses that necessitate a secondary use. It is said that the majority of metal collected is simply used to make batteries. Government restrictions, environment protection, and awareness campaigns will all play a big part in how the market develops.

Get the Free Sample Copy of Report@ https://www.precedenceresearch.com/sample/2039

The expansion of the lithium-ion recovery industry is anticipated to be constrained by poor separation of hazardous elements from cells, faulty disassembly, and inappropriate shredder. Uses for lithium-ion energy storage are widely used and thus are expected to continue to grow, which will put pressure upon recycling obligations and drive the development of the equipment and necessary infrastructure for recovering battery cells.

The introduction of new features, including cell placement that is approachable, and the inclusion of coating materials to reduce the probability of flame and relatively brief, among others, are expected to open up new growth prospects in the world market.

Regional Snapshots

The United States predominates in the lithium-ion North American market. Of the other countries, the U.S. does have the biggest market share. And over the projection timeframe, the U.S. is predicted to expand just at a high Rate. The primary drivers for the market include declining lithium-ion battery costs, fast adoption of electric cars, increasing application within the aviation industry, expanding the energy sector, and increasing consumer device usage.

The auto sector is seen as being one of the most important of different sectors for lithium-ion batteries. The increasing development of electric cars is anticipated to offer the lithium-ion battery sector a considerable boost. It is anticipated that increasing urbanization and private consumption would further drive up the need for such devices.

Among the main causes which have propelled the lithium-ion industry in Europe include the rising usage of electric cars, intelligent enables users to make, and also the expanding power storage business, in addition to government assistance for renewable power and electric car construction projects. The industry is additionally anticipated to expand as a result of the sizeable expenditures made on lithium-ion battery production facilities and initiatives, with an emphasis on electric cars & storage systems for lithium energy.

Report Scope of the Lithium-ion Battery Recycling Market

| Report Coverage | Details |

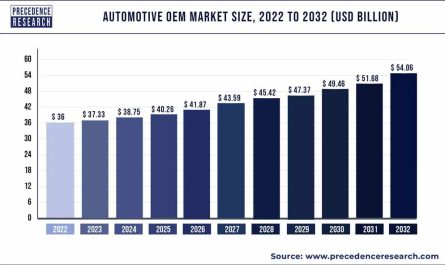

| Market Size in 2023 | USD 6.4 Billion |

| Market Size by 2032 | USD 66.36 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 26.4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | End User, Battery Components, Battery Chemistry, Recycling Process, Source, Geography |

Lithium-ion Battery Recycling Market

Drivers

The use of renewable biofuels is spreading throughout the automotive industry. Because of how strongly the transportation system depends on oil, both the economy and the environment are concerned. The popularity of electric vehicles is rising with environmental sustainability. Fuel cells, are required for a continuous energy source but are becoming more and more in demand as EDVs are utilized more regularly. The market for EVs is expected to grow as a consequence of factors like fuel economy, lower emissions, and customer preference. The market for electric vehicles is expanding as a result of advances in battery technology and the low maintenance requirements of these fuel cells. The transportation industry is expected to help the recycling industry grow quickly. Fuel cells are becoming more and more common in portable devices and electric cars because of their high efficiency, long lifespan, and little maintenance needs; this is expected to positively impact the market for goods created.

Restraints

Hazardous compounds found in used cells include acid and toxic substances like lead or mercury. Used cells retain some of their energy, thus increasing the risk of an unintentional explosion that could harm or damage both property and individuals. Larger lithium-based cells, like those employed in vehicle industries, may be mislabelled as batteries by some regional cell producers. State or federal authorities restrict the shipment and storage of expended cells as a result of these problems.

Opportunities

Several parts that are available at low rates make up modern lithium-ion batteries. Recent developments and claims made by automakers and lithium-ion battery producers suggest that the costs of these cells may drop dramatically. As a result of developments like mass production, falling unit costs, and the usage of technology to improve storage capacity, costs are declining. The business for storage of renewable energy is anticipated to expand as a result of lowering lithium battery prices, and this industry is predicted to favor battery cells above all other rechargeables. Therefore, it is projected that there would be a greater need for recovering spent lithium-based batteries.

Challenges

Chemicals and poisonous materials like lead and zinc are among the hazardous substances that can be detected in old cells. Used cells retain some energy, which raises the possibility of an unintended release that could endanger people or damage both people and property. Larger lithium-based cells, such as those used in the automotive industry, could be mistakenly marketed as storage batteries by local battery manufacturers.

State or federal authorities impose restrictions on the transportation and storage of used cells as a result of these issues. The high cost of recycling, the absence of adequate storage options for the collection of spent batteries, and the shortage of recyclable materials are other issues that have been recognized as industrial barriers.

Read Also: Artificial Intelligence (AI) in Transportation Market Size to Surpass USD 23.11 Bn by 2030

Key market players:

- Accurec-Recycling GmbH (Germany)

- AkkuSer (Finland)

- American Manganese Inc. (Canada)

- American Zinc Recycling Corp (U.S.)

- Batrec Industrie AG (Switzerland)

- Battery Recycling Made Easy (BRME) (US)

- Contemporary Amperex Technology Co. Ltd (CATL) (China),

- DOWA ECO-SYSTEM Co., Ltd. (Japan)

- Duesenfeld GmbH (Germany)

- Ecobat (UK)

- Envirostream Australia Pty Ltd (Australia)

- Euro Dieuze Industrie (E.D.I.) (France)

- Fortum (Finland)

- GEM Co., Ltd (China)

- Glencore International AG (Switzerland)

- Lithion Recycling Inc. (Canada)

- Metal Conversion Technologies (MCT) (US)

- Neometals Ltd (Australia)

- OnTo Technology LLC (US)

- Raw Materials Company Inc. (RMC) (Canada)

- Redux GmbH (Germany)

- Redwood Materials, Inc. (US)

- Retriev Technologies Inc. (Canada)

- San Lan Technologies Co., Ltd (China)

- SITRASA (Mexico)

- SMC Recycling (US)

- SNAM (France)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Tata Chemicals Limited (India)

- TES (Singapore)

- Umicore (Belgium)

- uRecycle Group Oy (Finland)

Segments covered in the report:

By End User

- Automotive

- Non-automotive

- Industrial

- Power

- Marine

- Others

By Battery Components

- Active Material

- Non-active Material

By Battery Chemistry

- Lithium-nickel Manganese Cobalt (Li-NMC)

- Lithium-iron Phosphate (LFP)

- Lithium-manganese Oxide (LMO)

- Lithium-titanate Oxide (LTO)

- Lithium-nickel Cobalt Aluminum Oxide (NCA)

By Recycling Process

- Hydrometallurgical Process

- Pyrometallurgy Process

- Physical/ Mechanical Process

By Source

- Electric Vehicles

- Electronics

- Power Tools

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/