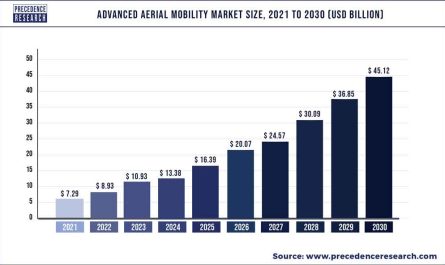

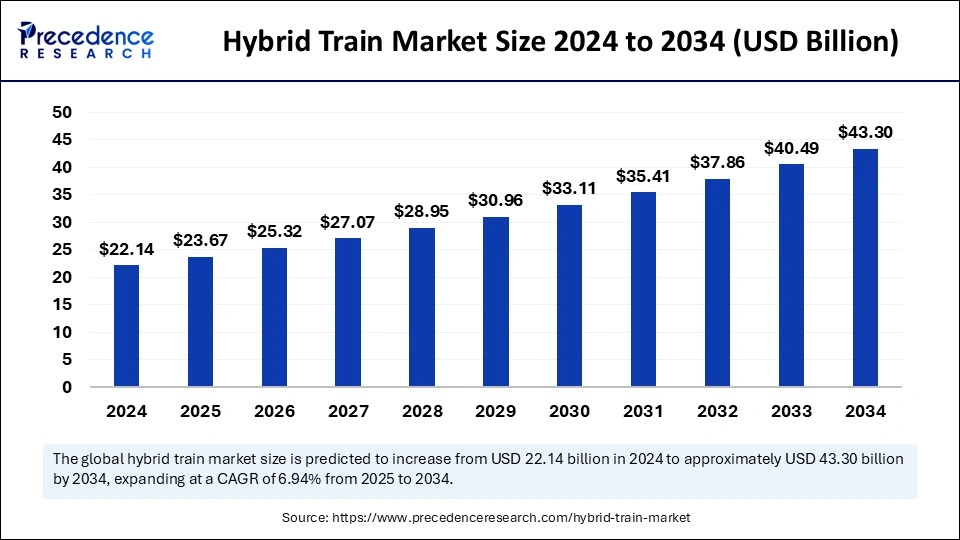

The global hybrid train market size accounted for USD 23.67 billion in 2025 and is predicted to surpass around USD 43.3 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034. Demand for energy-efficient solutions in both freight and passenger transport is escalating in response to fuel price volatility, decarbonization targets, and increasing investment in smart transportation infrastructure.

The hybrid train market is emerging as a critical component of the global transition toward sustainable transportation. Hybrid trains operate using a combination of propulsion technologies most commonly diesel-electric, battery-electric, and hydrogen-diesel systems that offer the dual benefits of reduced carbon emissions and improved fuel efficiency. Unlike traditional diesel-powered locomotives, hybrid trains can switch between energy sources depending on operational requirements and route electrification status. This ability provides operational flexibility, cost savings, and environmental benefits, making hybrid rail systems increasingly attractive to governments, transportation authorities, and private rail operators worldwide.

Hybrid Train Market Size and Key Takeaways

- Europe dominated the hybrid train market with the largest share of 33% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By propulsion type, the electro-diesel segment contributed the biggest market share of 39% in 2024.

- By propulsion type, the battery electric segment is expected to witness significant growth between 2025 and 2034.

- By speed, the above 200 km/h segment led the market in 2024.

- By speed, the 100-200 Km/h segment is expected to grow at a rapid pace in the coming years.

- By application, the passenger segment dominated the market in 2024.

- By application, the freight segment is anticipated to expand at a significant growth rate over the studied period.

Get a Sample: https://www.precedenceresearch.com/sample/5937

Market Drivers and Opportunities

One of the major drivers of the hybrid train market is the global shift toward cleaner transportation systems. Countries across Europe, North America, and Asia are implementing ambitious climate policies and sustainability goals that aim to significantly reduce greenhouse gas (GHG) emissions in the transportation sector. Hybrid trains, with their reduced dependence on fossil fuels, are increasingly seen as a practical solution for decarbonizing the railways—particularly in regions where full electrification is cost-prohibitive or logistically complex.

Government-backed initiatives and subsidies are also playing a crucial role. Policies like the European Green Deal, India’s electrification roadmap under its National Rail Plan, and the U.S. Bipartisan Infrastructure Law include funding for clean energy projects, including hybrid and electric train systems. This policy momentum creates substantial opportunities for market participants to expand product offerings, invest in R&D, and participate in public-private partnerships.

Technological innovations in lithium-ion battery technology, regenerative braking systems, and advanced power electronics have enhanced the performance and commercial viability of hybrid trains. Improvements in battery energy density and durability have made it feasible for hybrid trains to operate on longer routes without the need for frequent charging. Furthermore, innovations in regenerative braking help capture energy during deceleration, which is then reused during acceleration—improving energy efficiency and reducing operating costs.

In addition to mainline and high-speed railways, hybrid technology is also penetrating urban transit systems, regional passenger routes, and remote freight corridors, opening new avenues for growth. The versatility of hybrid propulsion systems makes them ideally suited for these diverse applications, particularly where environmental constraints and infrastructure limitations coexist.

Market Restraints and Challenges

Despite its potential, the hybrid train market faces several barriers. Chief among them is the high initial capital investment associated with hybrid propulsion systems. These trains require specialized components such as dual-mode engines, sophisticated battery management systems, and customized software platforms. This significantly increases the upfront cost compared to conventional diesel locomotives, making ROI a critical consideration for many railway operators.

Another key limitation is the lack of standardized infrastructure, especially for battery-electric and hydrogen-diesel hybrids. The absence of a well-established refueling or charging infrastructure in remote and semi-urban regions hinders widespread deployment. Limited range for battery-electric trains and the high cost of green hydrogen production remain technical and logistical constraints.

Additionally, regulatory complexity poses a challenge. Certification standards vary significantly by region, and ensuring compliance across markets can delay product launches and add to development costs. Integrating hybrid systems into legacy infrastructure—without disrupting existing service or exceeding regulatory noise and safety thresholds—requires significant technical expertise and coordination.

Hybrid Train Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 43.3 Billion |

| Market Size by 2025 | USD 23.67 Billion |

| Market Size by 2024 | USD 22.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.94% |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion Type, Speed, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Regional Analysis

Asia Pacific

The Asia Pacific region is poised to register the highest growth rate during the forecast period. Countries such as Japan, China, and India are investing heavily in hybrid rail solutions to support their smart mobility and environmental sustainability agendas. Japan continues to lead in technological development, with a focus on battery-electric and hydrogen train prototypes. China is rolling out hybrid trains in regions where electrification is not yet feasible, while India is converting existing diesel trains into hybrid variants for regional and intercity routes. With extensive government support, expanding urban transit systems, and rapidly growing populations, Asia Pacific is expected to be a key growth engine for the hybrid train market.

North America

North America’s hybrid train market is gradually expanding, particularly driven by increasing interest in reducing transportation-related carbon emissions. Rail operators like Amtrak and Canadian Pacific are testing hybrid systems for intercity and freight services. Federal and state governments are allocating significant funds for rail infrastructure modernization under clean energy mandates. The U.S. Environmental Protection Agency (EPA) and the Department of Transportation (DOT) are working to introduce low-emission standards that promote hybrid adoption. As North America emphasizes freight decarbonization and sustainable logistics, hybrid rail solutions will gain momentum in the coming decade.

Europe

Europe continues to lead the global hybrid train market due to its stringent emission control regulations, mature rail infrastructure, and strong political support for green transportation. Countries like Germany, France, and the United Kingdom have deployed various hybrid train pilot projects. Germany’s Alstom launched hydrogen-powered trains in several regional networks, while France’s SNCF and UK’s Hitachi Rail are exploring tri-mode propulsion systems. European operators are also focusing on retrofitting legacy diesel trains with hybrid modules to extend their operational life and reduce emissions.

Read Also: Automotive Ancillaries’ Products Market Size to Hit USD 33.79 Bn by 2034

Technology and Propulsion Innovations

Hybrid propulsion systems are evolving rapidly to meet the diverse needs of rail operators. Battery-diesel hybrids dominate the market due to their ability to switch between low-emission electric mode and diesel backup. They are widely used in metropolitan regions, regional networks, and tourist routes. Hydrogen-diesel hybrids, although in the early stages of commercial deployment, are gaining momentum in Europe due to their potential for zero-emission operation.

Emerging technologies such as AI-powered energy management systems, intelligent battery sensors, and digital twin simulations are being integrated into hybrid trains to optimize performance, reduce downtime, and enable predictive maintenance. These innovations contribute to a shift from reactive to predictive maintenance models, helping operators minimize disruptions and reduce long-term operational costs.

Application-Based Insights

In terms of application, passenger transport remains the dominant segment, accounting for over 65% of the market in 2024. As cities invest in modern, efficient, and sustainable public transport, hybrid trains are becoming the preferred choice for urban and regional mobility. Their low noise and emissions make them ideal for densely populated areas and environmentally sensitive zones.

The freight transport segment is expected to witness robust growth between 2025 and 2034. With growing demand for low-emission, high-efficiency logistics, hybrid trains are emerging as a viable alternative to road freight, especially in mining, forestry, and industrial zones. Green logistics strategies by major corporations and government incentives for rail freight are fueling this growth.

Configuration and Mode Insights

Hybrid trains are configured either as multiple units (MUs) or single-locomotive systems. MUs, often used in passenger transit, feature distributed propulsion systems for better acceleration and flexibility. Single-locomotive hybrids, on the other hand, are used in long-haul freight and intercity services where centralized propulsion offers superior efficiency.

In terms of propulsion mode:

-

Electro-diesel hybrids dominate today due to operational maturity.

-

Battery-electric trains are rapidly expanding, especially in regions with established charging infrastructure.

-

Hydrogen-powered systems are being tested for future scalability, supported by national hydrogen roadmaps.

Sales Channel Insights

The market is segmented into OEM (original equipment manufacturer) sales and retrofit/aftermarket solutions. OEMs like Alstom, Hitachi Rail, and Siemens Mobility are designing new hybrid fleets from the ground up. However, retrofitting is emerging as a significant trend, especially in Europe and North America, where operators are converting existing diesel units into hybrid variants to reduce costs and accelerate compliance with emission regulations.

Major Players and Strategic Moves

- CRRC Corporation Limited

- Alstom SA

- Siemens AG

- Hitachi Rail STS

- Wabtec Corporation

- Construcciones y Auxiliar de Ferrocarriles

- Hyundai Rotem Company

- Talgo

- The Kinki Sharyo Co., Ltd.

Recent Developments

In early 2024, Stadler Rail upgraded its FLIRT Akku battery trains with longer-range lithium-ion batteries, reducing the need for frequent charging. In late 2023, Hitachi Rail introduced the Masaccio fleet—capable of running on electric, diesel, and battery power, across UK regional routes. In Germany, Siemens Mobility began collaboration with regional rail operators to roll out hybrid trains in non-electrified corridors.