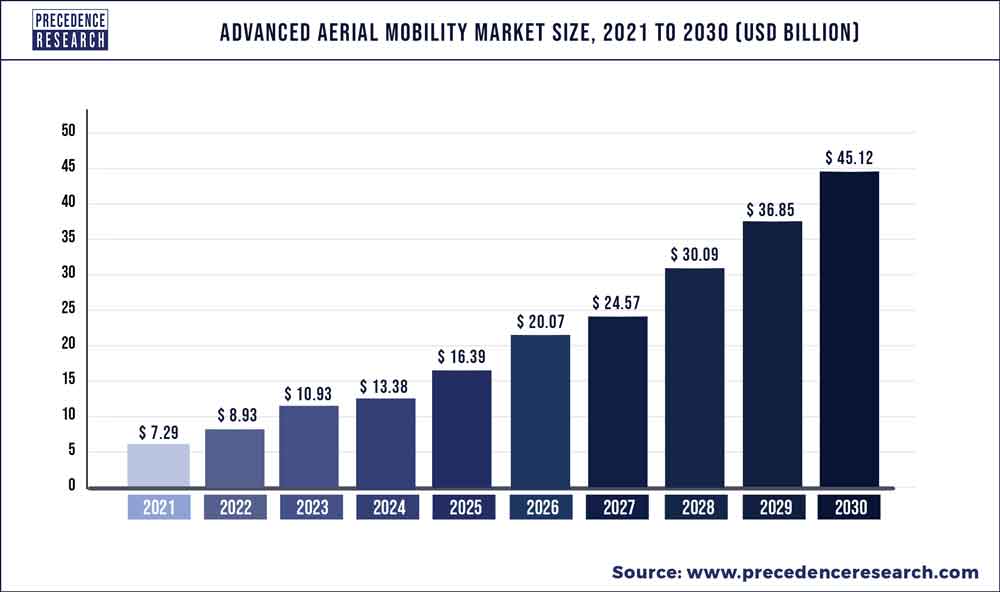

The global advanced aerial mobility market size was valued at USD 8.93 billion in 2022 and is projected to hit around USD 45.12 billion by 2030, at a CAGR of 22.45% during the forecast period 2022 to 2030.

Key Takeaway:

- By end user, the cargo segment has captured 58% revenue share in 2022.

- The passenger segment has accounted 42% revenue share in 2022.

- By propulsion type, the electric segment has held for 49% revenue share in 2022.

- The North America has contributed 39% revenue share in 2022.

The next-generation commuting option is the hovering automobile, which can serve as a personal vehicle and a means of air travel. In addition, because of operational and infrastructural demands in urban commuting systems, the preponderance of self-driving cars is anticipated to include horizontal takeoff and landing technologies. Self-driving cars are anticipated to be employed on both a personal and professional scale to accommodate shifting commuting needs, particularly in urban regions. Compared to other types of transport, flying vehicles and cargo drones have higher testing and development expenses since they call for the fusion of numerous advanced technologies.

Get the sample pages of report @ https://www.precedenceresearch.com/sample/2110

Regional snapshots:

The nation that builds its internal resources and is among the first to produce cutting-edge AAM goods that are safe, secure, and widely accessible may become the world’s leading nation. The Us will build and scale its local AAM industry to be the first in the marketplace to attain and maintain the position of global dominance and effectively realize national security and economic objectives. Even with proper planning, it should be ready to enter and dominate a sizable international export industry. North America stays foreseen to hold the largest market share for sophisticated aerial transportation globally during the projection timeframe. The market is growing in this sector due to the acceptability of expensive aviation in both urban and rural environments as well as the development of disruptive aviation technology.

On the other hand, it is projected that the Asia-Pacific area will expand more swiftly and offer a wide range of opportunities for market growth. The market is expanding in this sector due to factors including the development of drone technology and an increase in the use of commercial air travel.

| Report Coverage | Details |

| Market Size in 2022 | USD 8.93 Billion |

| Market Size by 2030 | USD 45.12 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 22.45% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Mode of Operation, End-Use, Propulsion Type, and Geography |

Market dynamics

Drivers:

The International Air Transportation Association (IATA) estimates that 8.4 billion people will fly globally by the year 2036. Conferring in the direction of the UN, 69% of people will live in cities by 2050. The claim for substitute methods of carriage is rising as a result of the numerous accessibility and congestion issues that the growing number of vehicles in cities is causing. In this esteem, VTOL, eVTOL, and STOL aircraft had shown themselves to be formidable rivals. Some VTOL aircraft was best suited for short-haul flights over densely populated areas to evade road traffic. These benefits suggest that the need for AAM in advanced mobility applications will upsurge in the future years.

Restraints:

The reactions of individuals to the advanced aerial mobility proposal range from neutral to enthusiastic, conferring to a NASA Appropriate application market Analysis Possible Institutional Challenges of Air Speed report. Men, older responders, and responses received from affluent backgrounds exhibited greater enthusiasm for the idea. However, in the wiliness scenario, neither of the municipal zones showed any relevance. Another emotional obstacle is the widespread belief that widespread job losses will follow from the increased usage of new airplanes for purposes such as commercial flights, freight delivery, air ambulance, and the last delivery. In addition, passengers are worried about security checkpoints and only choose UAM for lengthier journeys. Airlines and governmental agencies are working to raise public knowledge of these obstacles and encourage people to accept airplanes as a novel transportation option.

Opportunities:

The second-most polluting industry is the energy-intensive transportation sector. The noteworthy greenhouse productions from such industries hurt the environment. The use of autonomous unmanned landing and take-off aircraft in advanced aerial mobility may provide a practical solution to these problems. Unmanned aircraft systems’ adoption by cities as the next mode of transportation is projected to create enticing growth possibilities for this sector. One of the IATA’s objectives is for the aviation industry to have zero carbon emissions by 2050. Such power and hydrogen would be produced using cutting-edge new combustion technology and sustainable alternative biofuels. Rendering to the TATA, novel engine technology, which includes hydrogen, may account for 13% of the sector, with efficient developments accounting for the remaining 3%.

Challenges:

Due to the requirement of enhanced aerial mobility on technology, security may be a severe drawback. A few of the cybersecurity challenges that improved aerial transportation faces include threats to board systems and software, intrusions into vehicles controlling traffic satellite uplinks, and insertion of hostile or improper information used for protection judgments and/or computer vision. The vulnerability of enhanced aerial mobility would depend on the maneuver of additional composite working organization technologies like GPS, ATC, and various common communication networks. Network security strategies that take modeling and engineering security into account are required for urban air transportation to thrive. To advance novel strategies to defend autonomous aircraft against hacking attempts, R&D is necessary. The same mindset shifts that have pushed for safety assurance also apply to computer security.

Read Also: Automotive Exhaust Systems Market Size is Reach USD 123.43 Bn by 2032

Recent developments

- To produce sides for City Airbus, NextGen, Spirit Aero-Systems, and Airbus Acubed, a division of Boeing, signed a contract in March 2022. Airbus will be able to explore cutting-edge aerospace through this partnership while maintaining the highest standards.

- EHang and AEROTREE, the country’s premier aviation firm, entered into a strategic agreement in March 2022 to co-develop Organizations willing in Malaysia. AEROTREE has ordered 60 units of commuter automated autonomous drones (AAVs).

- A Memorandum of Agreement was signed in March 2022 by Lilium N.V., NetJets Inc., and FlightSafety Worldwide, the industry leader in commercial aviation. More than 150 Lilium aircraft would be available for purchase through the partnership, providing NetJets stockholders more options to supplement their present flight schedules.

- In March 2022, Joby partnered with CAE, a global leader in commercial aviation, to develop and certify flight dynamics training equipment that would be used to instruct young pilots of the revolutionary all-electric airplane.

- In January 2022, Vertical and Leonardo started collaborating to build the VX4 electric and hybrid fuselage. The agreement is for an additional six certifying aircraft to complete Vertical’s business that existed before booking, but it may enhance the capacity to mass produce 2,000 VX4s annually.

Recent Developments

- Spirit Aero-Systems and Airbus Acubed, a division of Boeing, inked a contract in March 2022 to build the sides for City Airbus, NextGen. Through this relationship, Airbus will be able to explore innovative aerospace while still adhering to the strictest standards.

- To co-develop Organizations willing in Malaysia, EHang and AEROTREE, the nation’s top aviation corporation, engaged in a strategic agreement in March 2022. 60 units of commuter automated autonomous drones have been purchased by AEROTREE (AAVs).

- In Mar 2022, Lilium N.V. as well as NetJets Inc. entered into a Memorandum of Agreement alongside FlightSafety Worldwide, the industry pioneer in commercial aviation. Through the collaboration, NetJets would have the opportunity to buy more than 150 Lilium planes, giving NetJets shareholders more alternatives to supplement their current flying schedules.

- To create and certify flight dynamics training equipment that would be used to educate young captains of Joby’s ground-breaking all-electric airplane, the company joined with CAE, a world leader in commercial aviation, in March 2022.

- Vertical and Leonardo began working together in January 2022 to construct the fuselage of Vertical’s VX4 electric and hybrid. To fulfill Vertical’s business which was before booking, the agreement is for an additional six certifying aircraft, but it may increase capacity to mass manufacturing of 2,000 VX4s annually.

Advanced Aerial Mobility Market Players

- AeroMobil

- Airbus S.A.S.

- Flytrex

- Hyundai Motor Company

- Lilium

- Matternet

- PAL-V International B.V.

- The Boeing Company

- Volocopter GmbH

- Zipline

Segments covered in the report:

By Mode of Operation

- Piloted

- Autonomous

By End-Use

- Cargo

- Passenger

By Propulsion Type

- Parallel Hybrid

- Turboshaft

- Electric

- Turboelectric

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com