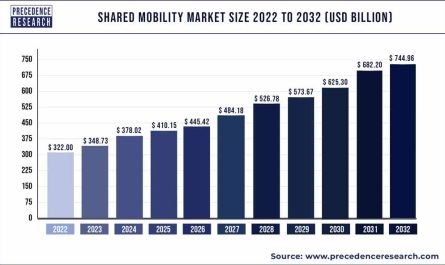

The global electric vehicle charging station market size was valued at USD 34.59 billion in 2023 and it is projected to reach around USD 344.61 billion by 2032 with a remarkable CAGR of 29.1% from 2023 to 2032.

Key Points

- As per a report published by International Energy Agency (IEA) in 2020, China own total 52% of slow chargers and 82% of fast chargers globally.

- By charging Level, the Level 2 segment has captured 70% revenue share in 2022.

- By mode of charging, the plug-in charging segment has accounted revenue share of around 86% in 2022.

- By end user, the residential segment has held revenue share of around 65% in 2022.

- In 2022, the public chargers application segment accounted market share of around 85%

- DC charging station segment garnered revenue share of around 75% in 2022.

The electric vehicle (EV) charging station market has witnessed remarkable growth in recent years, driven by the increasing adoption of electric vehicles globally. Electric vehicles have emerged as a sustainable solution to combat environmental concerns and reduce carbon emissions. As the automotive industry shifts towards electrification, the demand for reliable and efficient charging infrastructure has surged, leading to significant opportunities for the EV charging station market. This market encompasses various types of charging stations, including Level 1, Level 2, and DC fast chargers, catering to the diverse needs of electric vehicle owners.

Electric Vehicle Charging Stations Market Data and Statistics:

- In July 2023, the Confederation of Indian Industry stated that India requires approximately 1.32 million electric vehicle charging stations by 2030. The nation is aiming to set up at least one charging station for 40 electric vehicles.

- By 2025, Beijing, China alone will have 7,00,000 electric vehicle chargers. The policy, Urban Management Development Plan for Beijing is expected to promote the installation of electric vehicle charging stations in the city.

- ABB, one of the largest manufacturers of EV chargers expanded its manufacturing capacity in 2022 with a $30 million production facility in Italy. The new production facility aims to produce 10,000 EV chargers annually.

- In February 2023, the United States government invested $7.5 billion for electric vehicle charging infrastructure while aiming net-zero emissions by 2050.

- The United States installed 6,300 fast chargers in 2022, about three-quarters of these fast chargers were of Tesla Superchargers.

- The Tokyo Metropolitan Government exceeded the subsidy for apartment EV charging station installation up to $12,600. Tokyo plans to offer EV charging stations at every construction of building with 20% of parking space.

- EVgo, a leading manufacturer of EV charging stations in the United States stated that its revenue increased to $25.3 million in the first quarter of 2023, which showed a 229% year on year growth.

- The Federal government, Canada partnered with the United States in May 2023, in order to establish a binational charging station corridor connecting Michigan to the Quebec City.

- In March 2023, the Government of India announced a grant of Rs.800 crore to Hindustan Petroleum, Bharat Petroleum and Indian Oil in order to establish 7,432 public fast EV charging stations in the country.

- The United Kingdom government introduced a grant in 2023 under which, people can receive up to 75% cost of purchase and installation of electric vehicle charging station at home. Along with this, 18 companies in the UK aim to invest $7.5 billion in EV infrastructure by 2030.

- The Motor Fuel Group in the United Kingdom announced a plan to invest $50 million in EV hubs in 2023, the hubs will offer 360 ultra-rapid chargers.

Growth Factors:

Several factors contribute to the rapid growth of the electric vehicle charging station market. Government initiatives and policies aimed at promoting clean energy and reducing dependence on fossil fuels play a pivotal role in driving market growth. Substantial investments in charging infrastructure development, coupled with incentives and subsidies for EV buyers, have spurred the deployment of charging stations worldwide. Additionally, technological advancements, such as wireless charging and smart charging solutions, enhance user convenience and further propel market expansion. Moreover, collaborations between automakers, energy companies, and charging infrastructure providers facilitate the establishment of an extensive charging network, fostering market growth.

Region Insights:

The electric vehicle charging station market exhibits significant regional variation due to differences in infrastructure development, government regulations, and consumer preferences. North America, with its strong emphasis on sustainability and environmental stewardship, has emerged as a key market for EV charging stations. The presence of major automakers and supportive government policies, such as tax incentives and grants for charging infrastructure installation, has accelerated market growth in the region. Europe, known for its ambitious climate targets and stringent emission regulations, has witnessed widespread adoption of electric vehicles, driving the demand for charging infrastructure. Countries like Norway and the Netherlands have achieved remarkable penetration of EVs, fueling the deployment of charging stations. In Asia Pacific, rapid urbanization, growing concerns over air quality, and government initiatives to promote electric mobility are driving market expansion. China, as the world’s largest EV market, represents a significant growth opportunity for charging station providers.

Electric Vehicle Charging Station Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 34.59 Billion |

| Market Size by 2032 | USD 344.61 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 29.1% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe and North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Charging Station Type, Power Output, Supplier Type, End User, Geography |

Drivers:

Several factors drive the demand for electric vehicle charging stations globally. The increasing awareness of environmental issues and the need to mitigate climate change have led consumers and businesses to embrace electric vehicles as a cleaner alternative to internal combustion engine vehicles. Government incentives, such as tax credits, rebates, and grants, reduce the upfront cost of EV ownership and incentivize the installation of charging infrastructure. Moreover, advancements in battery technology have extended the driving range of electric vehicles, alleviating range anxiety and boosting consumer confidence in EV adoption. The proliferation of electric vehicle models across different segments, including passenger cars, commercial vehicles, and public transportation, further drives the need for charging infrastructure development.

Opportunities:

The electric vehicle charging station market presents lucrative opportunities for stakeholders across the value chain. Expansion of charging infrastructure in urban areas, highways, and commercial establishments is critical to support the growing fleet of electric vehicles. Innovative business models, such as subscription-based charging services and integrated energy management solutions, enable monetization of charging infrastructure and enhance user experience. Collaborations between charging station operators, utilities, and real estate developers facilitate the integration of charging infrastructure into smart city initiatives and sustainable urban planning. Furthermore, investments in renewable energy sources, such as solar and wind, offer synergies with EV charging infrastructure, enabling greener and more sustainable transportation solutions.

Challenges:

Despite the promising growth prospects, the electric vehicle charging station market faces several challenges. One of the primary concerns is the lack of interoperability and standardization among charging protocols, which hampers the seamless integration of charging infrastructure and limits user convenience. Additionally, the high upfront cost of deploying charging stations, coupled with uncertainties regarding revenue streams and utilization rates, poses financial challenges for infrastructure investors and operators. Grid constraints and the need for grid upgrades to accommodate the increasing demand for electricity from charging stations present technical challenges to infrastructure deployment. Furthermore, the uneven distribution of charging infrastructure in rural and underserved areas exacerbates range anxiety and limits the adoption of electric vehicles among certain demographics.

Read Also: Automotive Suspension Market Size, Share, Report By 2032

Recent Developments

- Chargemaster PLC declared the acquisition of infrastructure supplier Elektromotive Limited, as well as its subsidiary, in 2017. The former intended to enhance its existing portfolio and client offerings with this acquisition. Chargemaster PLC, the UK’s top provider of electric vehicle chargers and operator of the country’s largest electric vehicle charging network, was bought by BP PLC in 2018. Chargemaster PLC was renamed BP Chargemaster after the acquisition. BP PLC was able to construct a fast and ultra-fast charging network on its forecourts in the UK as a result of the acquisition.

- In October 2022, The CP6000, ChargePoint’s most adaptable and reliable global AC EV charging solution, has been launched by ChargePoint Holdings, Inc. a leading provider of electric vehicle (EV) charging networks. It is now accessible for vehicles of all shapes and sizes.

- In October 2022, Wall Connector, a home charging station compatible with other electric vehicles, is introduced by Tesla.

- In September 2022, Shell unveiled its first EV charger for India’s two- and four-wheeled vehicle markets. The initial market for Shell’s two-wheeler chargers in India. The firm wants to provide its clients with safe, environmentally friendly, and integrated mobility solutions through the Shell Recharge Stations, therefore it expects to install more than 10,000 charging stations across India by 2030. All of the energy used by the Shell Recharge chargers is renewable.

- In February 2022, With the Ford Charge Station Pro, a specially designed electric vehicle (EV) charger for the Ford F-150 Lightning, Siemens eMobility announced that it has collaborated with Ford. The newly enlarged Underwriters Laboratories (UL) 9741, a significant industry standard that assures goods fulfill safety criteria, has certified this cutting-edge charger as the first bidirectional-ready EV solution that is slated for delivery at the retail customer scale. The new charging station also has a 19.2 kW peak power, which is the highest power rating currently offered for a Level 2 charging station.

Electric Vehicle Charging Station Market Companies

- ABB Ltd.

- ChargePoint, Inc.

- EVgo Services LLC.

- Allego

- Scheinder Electric

- Blink Charging Co.

- Wi Tricity Corporation

- Toshiba Corporation

- AeroViroment, Inc.

- Mojo Mobility, Inc.

- General Electric

- Robert Bosch GmbH

- Chargemaster plc.

- Evatran Group

- HellaKGaAHueck& Co.

- Siemens AG

- Leviton Manufacturing Co., Inc.

- Efacec

- Alfen N.V.

- Denso Corporation

- Elix Wireless

- Tesla Inc.

- ClipperCreek

- Engie

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

Segments Covered in the Report

By Level of Charging

- Level 1

- Level 2

- Level 3

By Charging Station Type

- AC Charging

- DC Charging

- Wireless Charging

By Power Output

- <11KW

- 11KW-50KW

- >50KW

By Supplier Type

- OE Charging Station

- Private Charging Station

By Vehicle Type

- Passenger Cars

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Vehicle(PHEV)

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Two-wheelers & Scooters

By Installation Type

- Fixed

- Portable

- Residential

- Commercial

By Connector Type

- Normal Charging

- Type 2

- CCS

- CHAdeMO

- Tesla SC

- GB/T

By Application

- Private

- Public

By Mounting Type

- Wall Mount

- Pedestal Mount

- Ceiling Mount

By Charging Service

- EV Charging Service

- Battery Swapping Service

By End User

- Commercial EV Charging Stations

- Commercial Public EV Charging Stations

- On-Road Charging

- Parking Spaces

- Destination Chargers

- Commercial Private EV Charging Stations

- Fleet Charging

- Captive Charging

- Commercial Public EV Charging Stations

- Residential EV Charging Stations

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- MEA

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/