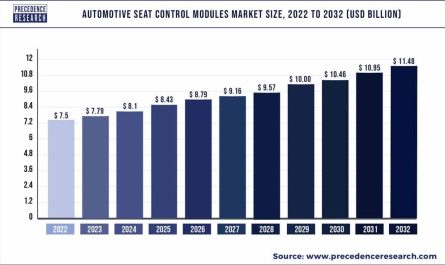

The global electric vehicle battery swapping market size accounted for USD 1.80 billion in 2022 and it is expected to reach around USD 49.70 billion by 2032 with a CAGR of 39.40% from 2023 to 2032.

Key Takeaways

- Asia Pacific electric vehicle battery swapping market was valued at USD 72 million in 2022.

- By vehicle type, the two-wheeler segment garnered largest revenue share of 69% in 2022.

- In 2022, Asia pacific region accounted largest market share of around 44%.

- Europe will show good growth rate in near future.

- By service type, the subscription segment accounted 67% revenue share in 2022.

The electric vehicle battery swapping market mainly deals with exchange of the fully discharged batteries of the electric vehicles with fully charged new batteries. In the old and new vehicles undergo a service in this process. As a result of the occurrence of the pandemic the demand and supply of the new and old vehicles has seen a drastic decline.

Get the Free Sample Copy of Report@ https://www.precedenceresearch.com/sample/1872

The quick services which are provided by the back battery swapping techniques helps to save a lot of time and energy of the consumers. The lack of facility is which is created from the rapid demand of electric vehicles by the people will also be managed with the help of these services.

Report Highlights

- On the basis of vehicle type, the two-wheeler market has proved to be the leader as a result of its high demand among the common people in the developing nations. The three-wheeler electric vehicles have projected a higher return pertaining to the higher demand of public transports.

- On the basis of service type, the subscription facilities which are provided by the companies helps the consumer to enjoy the services without paying off a heavy amount from their own pockets. The pay per use segment has helped the people who are not frequent users of vehicles but wish to enjoy the services occasionally.

- On the basis of geography, the Asia Pacific region has topped the market.\

Regional Snapshots

The Asia Pacific region has seen a tremendous growth in the electric vehicles battery swapping market as a result of the huge demand of two wheelers and three wheelers which operate on electric power. The rapid increase in e-mobility in this region has also help to boost the market for the electric vehicle battery swapping market. The developing status of the countries belonging to this region has boosted the revenue return for the battery swapping market. European nations are the next market that have provided a boost to the economy as a result of the rapid growth in city vehicles which are being operated by the private owners in this region.

The North American market has made strict rules and guidelines regarding the carbon emissions which has helped to boost the market for the electric vehicles. This intern is providing great opportunity for the electric vehicle battery swapping market. The increasing awareness regarding climate change and environmental destruction has helped to boost the market size of the electric vehicle battery swapping market.

Report Scope of the Electric Vehicle Battery Swapping Market

| Report Coverage | Details |

| Market Size by 2032 | USD 49.70 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 39.40% |

| Asia Pacific Market Share in 2022 | 44% |

| Subscription Segment Market Share in 2022 | 68% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Vehicle Type, Service Type, Geography |

Electric Vehicle Battery Swapping Market Dynamics.

Drivers.

The facility of battery swapping for the electric vehicles has helped to reduce the total cost of the electric vehicles. This has enabled the private owner to opt for electric vehicles instead of petroleum operated machines. The increasing awareness regarding global warming and rapid climate change has also encourage the use of electric vehicles. The time required to charge a fully exhausted electric vehicle battery is far more as compared to the time which is required for swapping an old battery with a new full recharge battery unit. The space which is required to perform these functions is also very less as compared to the space which is required to set up a charging station. The facilities of battery swapping also helps the consumer to remain stress free when the question of maintenance of the vehicle arises. The maintenance and care of the battery depends on the manufacturer and the battery companies. The service provided by the battery swapping company is quicker and accurate which helps a consumer to enjoy their travel without any hassle.

Restraints.

The restraining factor which affects the market growth of the electric vehicle battery sweeping market is the high cost of the services. The total investment which has to be made in this business is the major factor which hampers the growth of the market. The factors of site leasing, workforce, equipment’s and batteries impose a huge amount on the company trying to set it up. The strict rules and regulations which are imposed by the government on the rotation of the batteries and their spare parts prove to be a restraining factor for the market. The means by which in the waste batteries and their components are disposed have been kept under close watch by the government which makes it a challenge for the market. Absence of proper skilled labor has also proved to be arrest training factor for the growth of the market without which a satisfactory service cannot be provided to the consumer.

Opportunities.

With the increasing awareness regarding global warming and rapid climate change the use of electric vehicles has been encouraged by the government of various countries. This inserts in the use of batteries for the electric operated vehicles. In the time which is required to charge a fully exhausted battery cannot be measured easily which depends upon the condition of the battery. This problem is solved by the battery swapping services which are provided for the electric vehicles. The total time which is required for swapping of fully exhausted electric vehicle battery with a fully charged battery unit is hardly around 10 minutes which is quite feasible as compared to the other alternatives. The space which is required to perform these functions is also quiet less as compared to the setting of the entire charging station. On the other hand, the maintenance of the battery is also taken care of by the company itself which makes the owner of the electric vehicle care free. The ownership of the batteries and the electric vehicle have been divided by this system which helps the owner to take care only of their electric vehicle and not of the battery. These multiple factors prove to be great opportunities for the market.

Challenges

The total cost of setting up the electric vehicle battery swapping services is very use which proves to be a challenge for the market. The state government rules and regulations which are laid regarding the maintenance of the battery has hampered the revenue return of the companies. Lack of skilled labor force has proved to be a challenge for the market. Minor manual mistakes made by the company might cost the electric vehicle owner heavily.

Read Also: On-Board charger Market Size to Hit USD 20.49 Billion by 2032

Recent Developments

- NIO and Sinopec together introduced the NIO Power Swap Station 2 which is located at Sinopec’s station. This project is situated in China. It is the first of its kind under this collaboration. It is also the second of its kind under this segment where battery swapping takes place. It mainly represents the introduction of NIO Power Swap Station 2. This event took place in April 2021.

- In June 2021, Ample and ENEOS landed into a collaboration in order to install the technology for battery swapping in Japan. The passenger companies and delivery services will be making use of them in the initial phase by the end of March 2022.

Key market players

- Numocity

- BAIC

- ChargeMyGaadi

- NIO

- KYMCO

- Amplify Mobility

- Gogoro

- Sun Mobility

- Lithion Power

- Ample

- ECHARGEUP

- Amara Raja

- Aulton New Energy Automotive Technology

- Others

Segments covered in the report

By Vehicle Type

- Two-Wheeler

- Three-Wheeler Passenger vehicle

- Three-Wheeler Light commercial vehicle

- Four Wheeler Light commercial vehicle

- Buses

- Others

By Service Type

- Subscription

- Pay Per Use

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/