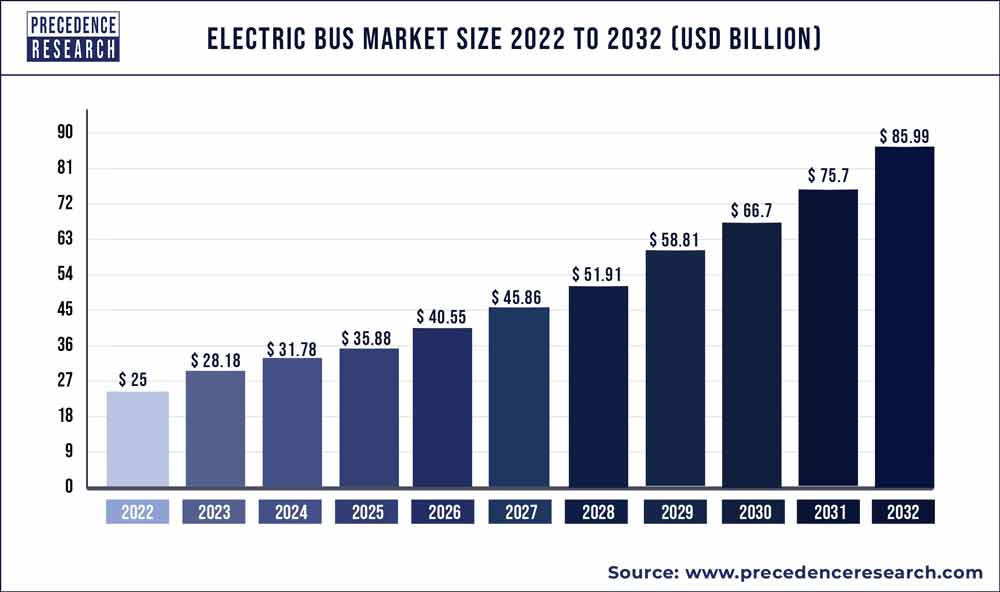

The global electric bus market size was estimated at US$ 25 billion in 2022 and is projected to hit over US$ 85.99 billion by 2032 with a CAGR of 13.20% from 2023 to 2032.

Key Takeaway

- By vehicle, the BEV segment has captured revenue share of 60.8% in 2022.

- The FCEV segment is expected to register a lucrative CAGR of 15.1% in terms of volume over the forecast period.

- By application, the intracity segment has held revenue share of 86% in 2022.

- The intercity segment is expanding at a CAGR of 15.6% between 2023 to 2032.

- By end-use, the public segment has held revenue share of around 81% in 2022.

- The private segment is growing at a CAGR of 11.8% from 2023 to 2032.

- By battery, the lithium iron phosphate battery segment has accounted revenue share of 90.5% in 2022.

- The lithium nickel manganese cobalt oxide segment is pooised to grow at a CAGR of 14.7% over the forecast period.

- Asia Pacific market has accounted Highest revenue share of 85.7% in 2022

The electric bus market is expected to witness remarkable growth in near future. The electrification of public transportation has increased significantly over the world. Because of this, electric buses have reduced maintenance costs. Furthermore, the government is spending heavily in the development of charging infrastructure across the board. In addition, the cost of battery research and development is rising. Throughout the world, the electric bus is regarded as a green transportation choice. There is a spike in demand for ecologically friendly transportation and mobility solutions in developing regions such as Latin America and the Asia-Pacific.

Get the Sample Pages of Report@ https://www.precedenceresearch.com/sample/1622

In addition, transportation corporations are refocusing their efforts on renewable energy sources. As a result, since a few years, there has been a high demand for electric buses. Thus, these factors are driving the growth of the global electric bus market.

Report Highlights

- The battery electric bus, hybrid electric bus, plug-in hybrid electric bus, and fuel cell electric bus are the different types of electric bus. Due to the factors such as growing need for sustainable public transportation solutions and increase in infrastructural development projects all over the globe, the battery electric bus segment held the highest share in 2020. This segment is also expected to expand and develop in the near future.

Report Scope of the Electric Bus Market

| Report Coverage | Details |

| Market Size by 2032 | USD 85.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.20% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Propulsion, Consumer Segment, Application, Length of Bus Type, Vehicle Range, Battery Capacity, Power Output, Battery Type, Component, Seating Capacity, Level of Autonomy, Geography |

| Companies Mentioned | Tata Motors, Daimler AG, Geely Automobiles Holdings Ltd., Man SE, Scania, AB Volvo, Workhorse, BYD Company Ltd., Dongfeng Motor Company, Paccar Inc. |

Read More: Electric Vehicle Battery Market Size to Worth Around US$ 559.87 Bn by 2030

Regional Snapshot

In the electric bus market, the Asia-Pacific is the largest. Factors such as rising disposable income, fast industrialization and urbanization rates, and new product introductions in the electric bus industry are driving the market in Asia-Pacific.

In terms of region, the electric bus market in North America area is the fastest expanding region. The electric bus market in North America is developing due to reasons and drivers such as increasing public acceptance of electric cars, strict government restrictions aimed at reducing the negative effects of fuel and gasoline-based vehicles, and rising demand for sustainable alternatives.

Key Players

The major players operating in the electric bus market are Tata Motors, Daimler AG, Geely Automobiles Holdings Ltd., Man SE, Scania, AB Volvo, Workhorse, BYD Company Ltd., Dongfeng Motor Company, and Paccar Inc.

Market Dynamics

Drivers: Growing government initiatives

The government all around the world is striving hard for the reduction of greenhouse gases and carbon emissions. For this, the government has enacted stringent regulations that need to be followed by all. The government has also started providing tax benefits to the electric bus manufacturers or original equipment manufacturers (OEMs). The countries with high population are largely adopting electric buses due to favorable government regulations. Thus, the growing government initiatives are driving the growth of the global electric bus market over the projected period.

Restraints: High cost of development

The process of manufacturing or designing electric buses require huge amount of capital investments. The cost of seats, batteries, equipment, machines, and advanced systems and technologies are involved in the cost of final product. The underdeveloped regions cannot afford high cost of buses. The major market players should strive for the development of economic friendly buses. Moreover, the battery electric bus also requires charging stations and good infrastructure for charging. This also increases the cost of vehicles on a large scale. Thus, high cost of development is restricting the growth of the global electric bus market.

Opportunities: Surge in demand for low or zero emission vehicles

Due to rise in pollution levels and emissions of carbon and greenhouse gases, the demand for zero emission vehicles has increased since a decade. The electric vehicles help in the reduction of pollution and help to save environment. The electric bus is considered as environmentally friendly solution by many nations. The electric bus also helps to save the fuel and gasoline. In every way, the electric bus is beneficial in nature. As a result, the surge in demand for low or zero emission vehicles is creating growth prospects for the electric bus market.

Challenges: Lack of awareness

The concept of electric bus is not so trending in underdeveloped regions. The key market players are also not launching new products in such regions. There is also lack of infrastructure to run electric buses for public. There are no government initiatives in underdeveloped regions for the promotion of electric bus. Thus, lack of awareness is a major challenge for the expansion of the global electric bus market over the forecast period.

Recent Developments

- Yutong demonstrated its 5G-enabled Intelligent mobility solution to global travelers in a live-show in China in September 2020. The event featured self-driving buses, intelligent bus stops, and unmanned intelligent bus terminals.

- VDL announced a contract to supply 32 electric buses to Hermes, a public transportation business in Eindhoven, in April 2021. These buses will begin service in Eindhoven cityscape in January 2022.

- Nova Bus, a Volvo Buses company, announced a supply contract from the Chicago Transit Authority in February 2021. Nova Bus has received an order for 600 new 40-foot electric buses.

- Switzerland authorized a project plan in January 2021 for the electrification of two lines in the country. The electric bus industry is likely to grow as the focus on fleet electrification continues.

Some of the prominent players in the global electric bus market include:

- Tata Motors

- Daimler AG

- Geely Automobiles Holdings Ltd.

- Man SE

- Scania

- AB Volvo

- Workhorse

- BYD Company Ltd.

- Dongfeng Motor Company

- Paccar Inc.

Segments Covered in the Report

By Propulsion

- Battery Electric bus

- Hybrid Electric bus

- Plug-in Hybrid Electric bus

- Fuel Cell Electric bus

By Consumer Segment

- Private

- Government

By Application

- Intercity

- Intracity

By Length of Bus Type

- less than 9 m

- 9−14 m

- Above 1 4m

By Vehicle Range

- Less than 200 miles

- Above 200 miles

By Battery Capacity

- Upto 400 kWh

- Above 400 kWh

By Power Output

- Upto 250 kW

- Above 250 kW

By Battery Type

- Lithium- Nickel- Manganese- Cobalt-Oxide

- Lithium- Iron- Phosphate

- Others

By Component

- Motor

- Battery

- Fuel Cell Stack

- Battery Management System

- Battery Cooling System

- EV Connectors

By Seating Capacity

- Up to 40 seats

- 40-70 seats

- Above 70 seats

By Level of Autonomy

- Semi-autonomous

- Autonomous

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308