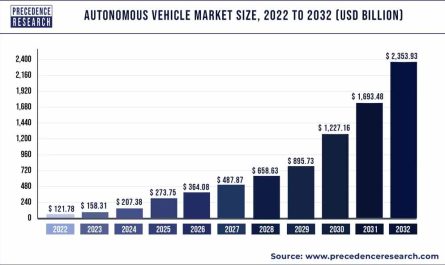

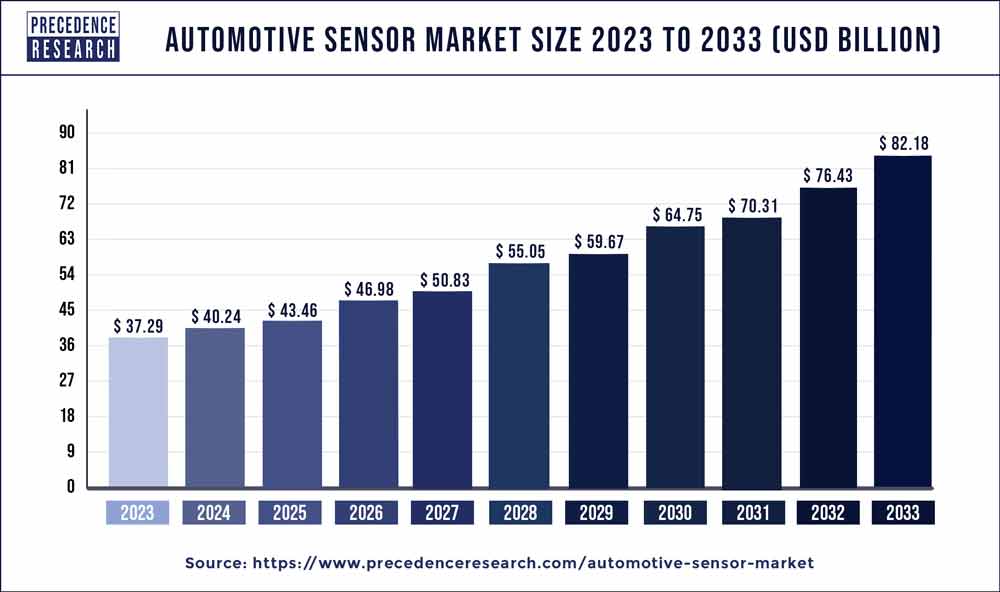

The automotive sensor market which was USD 34.59 billion in 2022, would rocket up to USD 76.43 billion by 2032and is expected to undergo a CAGR of 8.30% between 2023 to 2032.

Automotive sensors measure, detect, and transmit information that helps to analyze vehicle performance. Sensors are the electronic component that analyzes the changes in environment and provide an output correspondingly. They used to sense physical parameters such as heat, light, pressure, moisture, motion, and other entity, and transmit a response in electronic form for further process. Sensors are designed using Integrated Circuit (IC) fabrication technology on silicon wafers. It controls and monitors chemical, process, and physical changes of an automotive vehicle.

Sensors are very useful in reducing fuel consumption along with onboard weight of the vehicle. Sensors used in automobile are smart and used to process and control the coolant level, pressure, and oil pressure in vehicles. There are various types of automotive sensors such as coolant sensors, speed sensors, pressure sensors, temperature sensors, voltage sensors, magnetic sensors, and oxygen sensors. Automotive sensors experience the fastest growth among other automotive technologies as they are one of the prime equipment used for safety and security of the vehicle and driver.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1030

Automotive Sensor Market Growth Factors

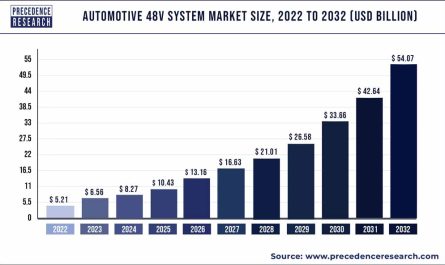

Increased sales of electric and hybrid vehicles drive the market growth. Furthermore, charging stations and other related technology to electric and hybrid vehicles propel the growth of automotive sensors in the coming years. Moreover, increased application of pressure and gas sensors to enhance the vehicle safety significantly propels the growth of sensor technology in the automotive sector. The pressure and gas sensors are largely applicable to control and monitor the gas emission and fuel efficiency of the vehicle.

Report Highlights

- The Asia Pacific is the most promising region for the global automotive sensor market growth. Large consumer base, increased disposable income and purchasing capacity of the public are some of the prime factors that drive the market growth in the region.

- North America and Europe are the significant revenue contributors in the global automotive sensor market. They are the prior adopters of sensor technology in various fields of application. In addition, their growth is also governed by the flourishing demand for advanced driver assistance system (ADAS) and other advanced sensor equipped automotive electronics.

- Speed sensor dominated the global automotive sensor market in 2019. Prime factor driving the growth of the segment is increased application in monitoring and controlling the speed of the vehicles. Speed sensor continuously monitors the speed of the vehicle and passes on information to the controlling device if it exceeds the maximum speed limit. This prevents the vehicle from collision.

- By application, powertrain led the global automotive sensor market with significant revenue share in 2019. This is mainly attributed to large number of sensors used in powertrain to monitor speed, position, gas, temperature, and pressure for safe and efficient operation.

Read More: Automotive Paints and Coatings Market Size To Grow USD 36.05 Billion by 2030

Regional Snapshots

The Asia Pacific held prominent market value share in 2019 and experience stupendous growth opportunity during the forecast period. Increasing sales of passenger vehicles in the region along with rising demand for advanced safety systems installed in the vehicle are some of the prime factors contributing for the accelerating growth of the region. Other than this, increased purchasing capacity and large consumer base makes the region more attractive for the further growth of the market. China and India are the most prominent countries in the Asia Pacific that attract the attention of market players as they provide low labor cost and significant sales opportunity in the region. In addition, the countries offer favorable regulation for the foreign manufacturers to set up their plant.

Europe and North America are the other prominent revenue shareholders in the global automotive sensor market. Government regulations favorable for the adoption of automotive sensor technology drive the market growth in the regions. Furthermore, significant demand for Advanced Driver Assistance System (ADAS) and other automotive electronic devices equipped with sensor system are propelling the market growth.

Key Players & Strategies

The global automotive sensor market experience high competition due to continuous product development and enhancement. Several players are significantly investing in the product development to retain their market position and enhancing the security in vehicle. In addition, stringent government norms for vehicle and driver safety have forced automobile manufacturers to implement sensor technology in their vehicles. Robert Bosch and Denso Corporation have emerged as the market leaders by capturing more than 25% of the revenue share collectively in the global market.

Some of the key players operating in the market are Robert Bosch, AUTOLIV INC, DENSO Corporation, Valeo, Continental AG, Sensata Technologies, Delphi Automotive Company, STMicroelectronics N.V, NXP Semiconductor, and Infineon Technologies AG among others.

Automotive Sensor Market Segmentation

By Type Outlook

- Pressure Sensors

- Temperature Sensors

- Speed Sensors

- Motion Sensors

- Gas Sensors

By Application Outlook

- Chassis

- Powertrain

- Safety & Security

- Body Electronics

- Telematics

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Sensor Market, By Product

7.1. Automotive Sensor Market, by Product Type, 2022-2030

7.1.1. Pressure Sensors

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Temperature Sensors

7.1.2.1. Market Revenue and Forecast (2017-2030)

7.1.3. Speed Sensors

7.1.3.1. Market Revenue and Forecast (2017-2030)

7.1.4. Motion Sensors

7.1.4.1. Market Revenue and Forecast (2017-2030)

7.1.5. Gas Sensors

7.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Automotive Sensor Market, By Application

8.1. Automotive Sensor Market, by Application, 2022-2030

8.1.1. Chassis

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Powertrain

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Safety & Security

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Body Electronics

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Telematics

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Sensor Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2017-2030)

9.1.2. Market Revenue and Forecast, by Application (2017-2030)

9.1.3. U.S.

9.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.1.4. Rest of North America

9.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.3. UK

9.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.4. Germany

9.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.5. France

9.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.6. Rest of Europe

9.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.3. India

9.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.4. China

9.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.5. Japan

9.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.6. Rest of APAC

9.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.3. GCC

9.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.4. North Africa

9.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.5. South Africa

9.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.6. Rest of MEA

9.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

9.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2017-2030)

9.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.5.3. Brazil

9.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

9.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.5.4. Rest of LATAM

9.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

9.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 10. Company Profiles

10.1. Robert Bosch

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. AUTOLIV INC

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. DENSO Corporation

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Valeo

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Continental AG

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Sensata Technologies

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Delphi Automotive Company

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. STMicroelectronics N.V

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. NXP Semiconductor

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Infineon Technologies AG

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

About Us

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.