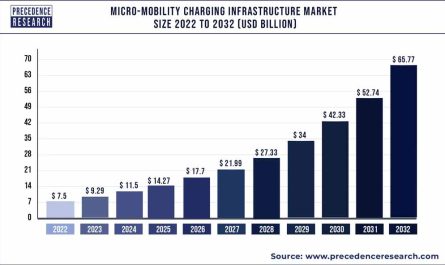

The automotive engineering services market size is predicted to surpass US$ 360.22 billion by 2030 from US$ 184.51 billion in 2022 with a growing CAGR of 8.7% from 2022 to 2030.

The automotive engineering services market is expected to be driven by the growing technological skills for engineering service providers to offer research and development and product innovation in their solutions for connected automobiles, vehicle positioning, and guidance systems. In addition, the automotive engineering services market’s overall growth is likely to benefit from original equipment manufacturers rapid shift in preference for digital solutions over mechanical and core assistance.

However, due to the depth and complexity of the powertrain, transmission, and engine designs, manufacturers prefer to design these components in-house rather than outsourcing them to engineering services providers.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1584

Furthermore, growing problems about the exposure of intellectual property and design are prompting original equipment manufacturers to establish their own manufacturing facilities. As a result, the automotive engineering services market’s growth is expected to be hampered by manufacturers’ increasing focus on producing in-house design.

Report Highlights

- Based on the service, the prototyping segment is the fastest growing segment in the global automotive engineering services market. The shorter manufacturing timeframes and reduced production costs are achieved by prototype approaches, as are easier product innovation and supply chain transformation as well as cleaner, safer, and lighter part designs.

- Europe is the largest segment for automotive engineering services market in terms of region. Europe is home to one of the world’s greatest automotive manufacturing centers, and automobile manufacturers are an important part of the European economy. The government is providing subsidies and pushing the availability of energy efficient automobiles, which has resulted in an increase in demand for electric vehicles.

- Asia-Pacific region is the fastest growing region in the automotive engineering services market. Many governments in the region intend to replace their present public fleets with electric vehicles. The rapid expansion of the logistics sector is also boosting demand for commercial electric automobiles, which in turn is driving up demand for automotive engineering services.

Report Scope of the Automotive Engineering Services Market

| Report Coverage | Details |

| Market Size by 2030 | USD 360.22 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 8.7% |

| Base Year | 2021 |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Location, Service, Application, Nature, Vehicle, Geography |

| Companies Mentioned | Tech Mahindra Limited, L&T Technology Services, IAV Automotive Engineering, HCL Technologies, Harman International Industries Inc., AltenCresttek Company, Akka Technologies, Fev Europe GmbH, Capgemini SE, Bertrandt AG |

Market Dynamics

Drivers: Standardization of safety features

Several governments around the world have mandated safety features in new vehicles to reduce over speeding and fatal accidents. The advanced safety features include advanced emergency braking, emergency lane-keeping systems, and enhanced crash tests. All of these requirements are critical to overall road safety. To improve passenger safety, automakers must comply with the new regulations. In the coming years, all of these mandates will have a significant impact on vehicle safety. The original equipment manufacturers’ initiatives to implement these features early will result in a high demand for engineering service providers to provide these solutions.

Restraints

Security threats

The automotive engineering services play a significant role in vehicle advanced driver-assistance system technologies. The majority of advanced driver-assistance systems safety features include sensors like radar, ultrasonic sensors, cameras, infrared, and various actuators. The precise of fail-safe techniques could put occupant safety at danger. Thus, the security is very important for the occupant. Hence, this factor could hamper the growth of the global automotive engineering services market during the forecast period.

Opportunities

Rising sales of electric vehicles

The global e-vehicle industry is rapidly expanding. Electric vehicles, like any transformative disruptive technology, activate lots of new influential economic development, challenges, and opportunities. The global electric vehicle sales are being driven by increasing vehicle range increased charging infrastructure availability and proactive participation by automotive original equipment manufacturers. Furthermore, the growing sensitivity of various governments toward a cleaner environment has increased demand for zero-emission vehicles, which is supporting the growth of the electric vehicle market. The developed countries are actively promoting the use of electric vehicles to reduce emissions, which has resulted in increased sales of electric vehicles. As a result, the rising sales of electric vehicles are creating lucrative opportunities for the growth of the automotive engineering services market.

Challenges

Intellectual property rights

The outsourcing is now widely used by original equipment manufacturers and system integrators in the automotive industry. A typical engineering service begins with research and progresses through design and testing phases before reaching the final stage of production. In some cases, the original equipment manufacturer owns the intellectual property of new technology or processes developed throughout the process. However, service providers may be working with multiple original equipment manufacturers for similar requirements or specifications, with the limitation of using existing technology patented by various original equipment manufacturers. As a result, service providers must exercise extreme caution when it comes to intellectual property infringement laws. Intellectual property laws prohibit service providers from repeatedly using the same technology, which may limit the use of their engineering service technology.

Some of the prominent players in the global automotive engineering services market include:

- Tech Mahindra Limited

- L&T Technology Services

- IAV Automotive Engineering

- HCL Technologies

- Harman International Industries Inc.

- AltenCresttek Company

- Akka Technologies

- Fev Europe GmbH

- Capgemini SE

- Bertrandt AG

Segments Covered in the Report

By Location

- In-House

- Outsource

By Service

- Designing

- Prototyping

- System Integration

- Testing

- Others

By Application

- Autonomous Driving

- Body & Chassis

- Powertrain & After-treatment

- Infotainment & Connectivity

- Simulation

- Battery Development & Management

- Charger Testing

- Motor Control

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Nature

- Body-Leasing

- Turn-Key

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Engineering Services Market

5.1. COVID-19 Landscape: Automotive Engineering Services Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Engineering Services Market, By Vehicle Type

8.1. Automotive Engineering Services Market, by Vehicle Type, 2022-2030

8.1.1. Passenger Cars

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Commercial Vehicles

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Engineering Services Market, By Location Type

9.1. Automotive Engineering Services Market, by Location Type, 2022-2030

9.1.1. On-shore

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Off-shore

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Engineering Services Market, By Service Type

10.1. Automotive Engineering Services Market, By Service Type, 2022-2030

10.1.1. Designing

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Prototyping

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. System Integration

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Testing

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Automotive Engineering Services Market, By Application Type

11.1. Automotive Engineering Services Market, by Application Type, 2022-2030

11.1.1. Autonomous Driving

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Body & Chassis

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Powertrain & After-treatment

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Infotainment & Connectivity

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Automotive Engineering Services Market, By Nature Type

12.1. Automotive Engineering Services Market, by Nature, 2022-2030

12.1.1. Body-Leasing

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Turn-Key

12.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Automotive Engineering Services Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.1.2. Market Revenue and Forecast, by Location (2017-2030)

13.1.3. Market Revenue and Forecast, by Service (2017-2030)

13.1.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.5. Market Revenue and Forecast, by Nature (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Location (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Service (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.7. Market Revenue and Forecast, by Nature (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Location (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Service (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Nature (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.2. Market Revenue and Forecast, by Location (2017-2030)

13.2.3. Market Revenue and Forecast, by Service (2017-2030)

13.2.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.5. Market Revenue and Forecast, by Nature (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Location (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Service (2017-2030)

13.2.7. Market Revenue and Forecast, by Application (2017-2030)

13.2.8. Market Revenue and Forecast, by Nature (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Location (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Service (2017-2030)

13.2.10. Market Revenue and Forecast, by Application (2017-2030)

13.2.11. Market Revenue and Forecast, by Nature (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Location (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Service (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.13. Market Revenue and Forecast, by Nature (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Location (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Service (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.15. Market Revenue and Forecast, by Nature (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.2. Market Revenue and Forecast, by Location (2017-2030)

13.3.3. Market Revenue and Forecast, by Service (2017-2030)

13.3.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.5. Market Revenue and Forecast, by Nature (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Location (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Service (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.7. Market Revenue and Forecast, by Nature (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Location (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Service (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.9. Market Revenue and Forecast, by Nature (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Location (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Service (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Nature (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Location (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Service (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Nature (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.2. Market Revenue and Forecast, by Location (2017-2030)

13.4.3. Market Revenue and Forecast, by Service (2017-2030)

13.4.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.5. Market Revenue and Forecast, by Nature (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Location (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Service (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.7. Market Revenue and Forecast, by Nature (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Location (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Service (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.9. Market Revenue and Forecast, by Nature (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Location (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Service (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Nature (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Location (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Service (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Nature (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.5.2. Market Revenue and Forecast, by Location (2017-2030)

13.5.3. Market Revenue and Forecast, by Service (2017-2030)

13.5.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.5. Market Revenue and Forecast, by Nature (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Location (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Service (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.7. Market Revenue and Forecast, by Nature (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Vehicle (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Location (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Service (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Nature (2017-2030)

Chapter 14. Company Profiles

14.1. Tech Mahindra Limited

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. L&T Technology Services

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. IAV Automotive Engineering

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. HCL Technologies

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Harman International Industries Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. AltenCresttek Company

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Akka Technologies

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Fev Europe GmbH

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Capgemini SE

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Bertrandt AG

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308