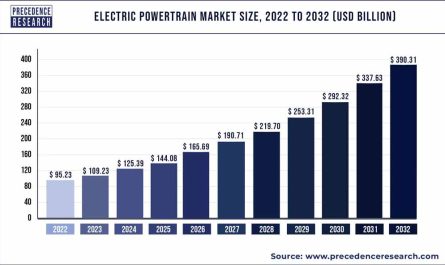

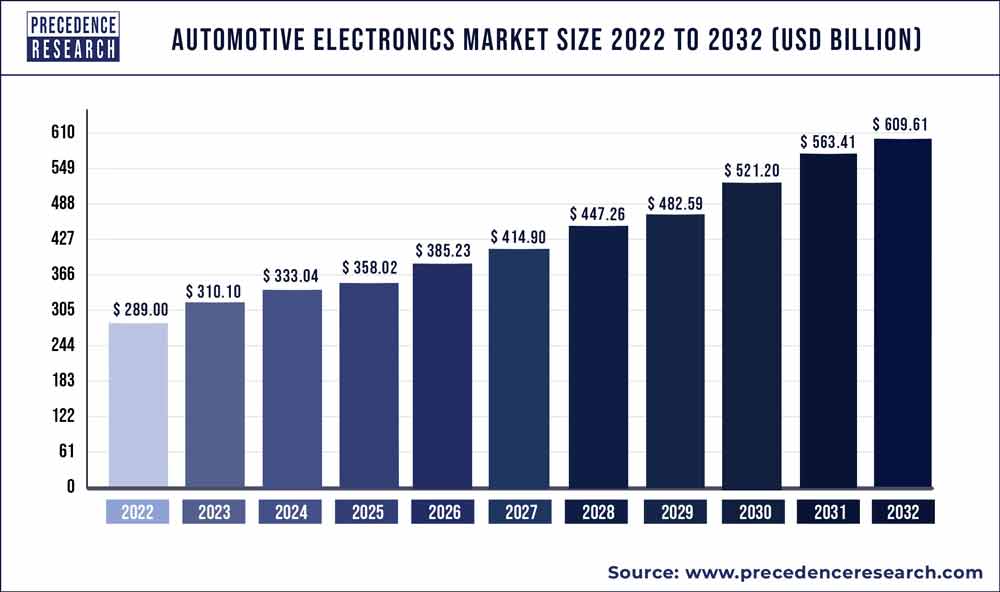

The automotive electronics market size surpassed USD 289 billion in 2022 and is projected to be worth over USD 609.61 billion by 2032, growing at a CAGR of 7.80% between 2023 and 2032.

Key Takeaways

- By component, the current carrying devices segment has generated a market share of 41% in 2022.

- The sensors segment is expected to grow at a CAGR of 9.7% from 2023 to 2032.

- By application, the safety systems segment has captured market share of 29% in 2022.

- The ADAS segment is registering growth at a CAGR of 11.1% from 2023 to 2032

- By sales channel, the OEM segment has accounted market share of around 69% in 2022.

- The aftermarket segment is expected to grow at a CAGR of 7.4% from 2023 to 2032.

- Asia Pacific automotive electronics market has held market share of around 41.2% in 2022.

Automotive electronics are designed electronics dedicated to utilize in automobiles. Automotive electronics are systems employed in vehicles such as ignition, engine management, radio, carputers, in-car entertainment systems, and telematics among others. Engine, transmission and ignition electronics are also found in motorcycles, trucks, off-road vehicles, and other internal combustion powered machinery including tractors, excavators and forklifts. Associated elements for control of pertinent electrical systems are also observed in electric cars and on hybrid vehicles.

There are diverse electronic systems are utilized in automobiles for operations such as enhancing the driving act, well-being of the drivers and rider and fuel effectiveness. Automotive electronics can be subjected to more extensive temperature ranges in comparison with commercial electronics. Majority of the electrical devices are produced in numerous temperature grades and individual manufacturer define its particular temperature rating. Snowballing speed of revolution in electronics for the automotive sector will offer path for users to better exploit their time in transit to relish novel services. As a result, consumers will have more time to capitalize in personal activities and thus an electronically smart car will always demand for improved features.

Get the Sample @ https://www.precedenceresearch.com/sample/1240

Growth Factors

Automotive electronics technologies like all-electric cars, autonomous driving, and in-car infotainment are the new-fangled trends in the automotive sector. Automotive vehicles are renovating into the definitive electronic devices. Automotive electronics are foretold to occupy near a 3rd of the total price of the whole car. The automotive renovations offer escalation to new features and encounters such as all-electric cars and autonomous driving with extreme high power, and secure communications, high-speed and infotainment among others.

The future of cars is about sharing, autonomous driving, electric power, and links to external networks (i.e. vehicle-to-everything/ V2X) and automotive electronics will be leveraged for all 4 of these segments. Rising automotive electronics acceptance to offer safety features like emergency call systems, alcohol ignition interlocks, and calamity data recorder systems are anticipated to boost growth of the market. Cumulative acceptance by OEMs on high-volume traditional executions is also expected to amend the governing framework.

However, on account of COVID-19, most of the nations obeyed a complete lockdown that has impacted vehicle production across the world. Manufacturing units have been closed; thus, sales of vehicles have dropped and impacted production on a global level. Though few OEMs have restarted production; the drive by wire market may perceive noteworthy decline in 2020. Though, the COVID-19 outbreak disturbed the ICE vehicle production, numerous automakers are still concentrating on expansions in numerous drives by wire systems.

Scope of the Automotive Electronics Market

| Report Highlights | Details |

| Market Size | US$ 609.61 Billion by 2032 |

| Growth Rate | CAGR of 7.80% from 2023 to 2032 |

| Base Year | 2022 |

| Historic Data | 2020 to 2021 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Sales Channel, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Report Highlights

- Asia Pacific anticipated constituting prime share in the global automotive electronics market in terms of revenue throughout the assessment period

- Accident data recorder system, alcohol ignition interlock, and emergency call system are achieving attention that drives the demand for advanced electronic in the automotive sector

- Advanced driver-assistance systems or ADAS application segment of the market is predicted to grow at the fastest rate during years to come due to numerous steps undertaken by the governments to augment the security and safety of drivers along with the vehicles

Read Also: Automotive Seat Control Modules Market Size to Worth Around US$ 11.48 Bn by 2032

Regional Snapshots

Rapidly rising automotive sector in the region due to varying living standards and cumulative purchasing power of users is expected flourish revenue growth of automotive electronics market in Asia Pacific during forecast period. Furthermore, increasing automotive aftermarket is anticipated to subsidize revenue development of automotive electronics market in APAC. China occupied for over 28% of global motor production. It was the front-runner in passenger car sales and production with 23.7 million and 23.5 million correspondingly, in 2018.

North America is predictable to develop at the considerable CAGR of throughout the estimate period. The U.S. is expected to govern the regional market due to the occurrence of crucial manufacturers including ZF Friedrichshafen AG, Continental AG, Autoliv, Inc, and Robert Bosch GmbH and others.

Key Players & Strategies

Competitive pressure and consumer demand have forced manufacturers to manufacture better intelligence in trucks, automobiles and other highway vehicles. For instance, the Chevy Volt employs around 100 microprocessors running around 10 million lines of code in whole, that places the Chevy Volt’s software content over head the present generation of jet fighters and original space shuttle i.e., Boeing 787 Dreamliner.

- HELLA GmbH & Co. KGaA

- Altera

- Broadcom Ltd

- Infineon Technologies AG

- Panasonic Corporation

- Hitachi Automotive Systems, Ltd

- Microchip Technology, Inc

- NXP Semiconductors N.V

- Texas Instruments Incorporated

Recent Developments

- In January 2021, Renesas Electronics Corporation announced its partnership with Microsoft to fast-track the development of connected automobiles. The R-Car Starter Kit of Renesas, created on R-Car Automotive SoC, is now accessible as a development environment for the MCVP (Microsoft Connected Vehicle Platform).

Major Market Segments Covered:

By Type

- Sensors

- Electronic Control Unit

- Current Carrying Devices

By Sales Channel

- OEM

- Aftermarket

By Application

- Body Electronics

- ADAS

- Infotainment

- Safety Systems

- Powertrain Electronics

By Geography

- North America

-

- U.S.

- Canada

-

- Europe

-

- Germany

- France

- United Kingdom

- Rest of Europe

-

- Asia Pacific

-

-

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

-

- Latin America

-

- Brazil

- Rest of Latin America

-

- Middle East & Africa (MEA)

-

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

-

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/