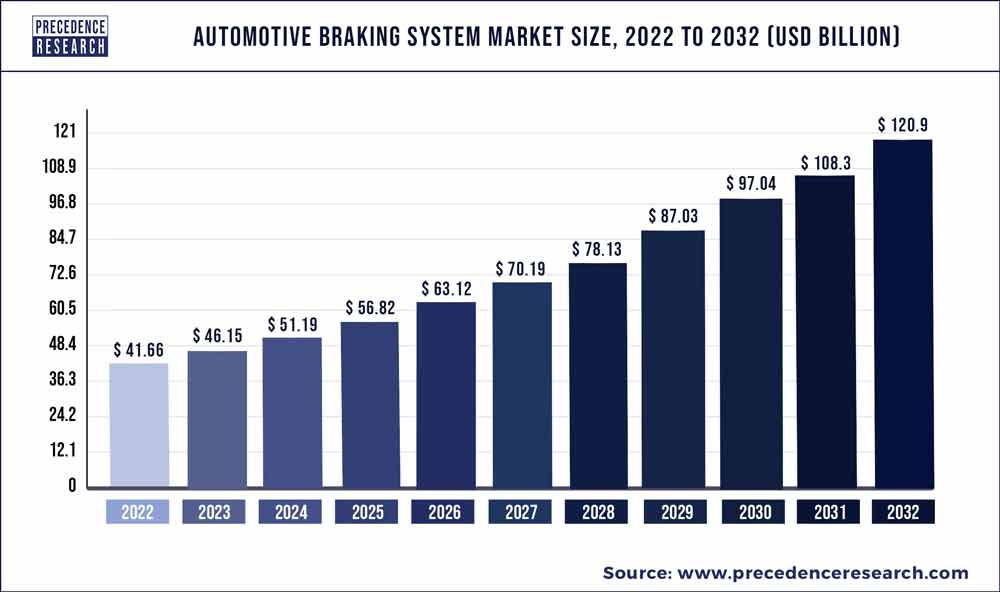

The global automotive braking system market size reached USD 41.66 Billion in 2022 and is predicted to touch USD 120.9 Billion by 2032 growing at a CAGR of 11.30% from 2023 to 2032.

Vehicle braking systems play a pivotal role in decelerating vehicles, ensuring safe speed reduction without abrupt halts. These systems are meticulously engineered to minimize adverse effects such as sudden stops.

In the automotive market, there are diverse brake variants, including drum and disc brakes. Disc brakes, composed of materials like iron cast, ceramic-matrix, and carbon-carbon composites, are affixed to rotating wheels. Friction is generated by brake pads pressing against the discs, effectively slowing or stopping the wheel. Conversely, drum brakes rely on friction between shoes or pads and a rotating drum-shaped component called a brake drum.

Get a Sample: https://www.precedenceresearch.com/sample/1086

Report Highlights

- The Asia Pacific led the global market attributed to the low production cost along with rising demand of transportation in countries such as China and India

- Europe and North America are other most prominent markets in the automotive braking system owing to strict safety regulations for transportation industry

- Passenger vehicles captured significant production share of nearly 75%per year that in turn boost the demand for advanced braking system in the passenger vehicle segment

- Demand for commercial vehicles expected to proliferate in the coming years because of accelerating growth of logistics and transportation industry

- Based on part type, disc brakes are expected to witness an escalating demand in the near future as it offers shorter stopping distance along with it is more efficient during emergency braking condition

- By system type, pneumatic braking system exhibits the fastest growth over the analysis period owing to advanced braking and stopping options

Read More: Automotive VVT System Market Size To Rise USD 102.39 Billion By 2032

Factors Driving Growth

The integration of electronic components is a key growth catalyst. This integration has given rise to technologies like Electronic Stability Control (ESC), Traction Control System (TCS), Antilock Braking System (ABS), and Electronic Brake-Force Distribution (EBD). The adoption of these innovations, coupled with growing consumer interest in vehicle safety tech, is expected to fuel market expansion. However, the higher costs associated with advanced braking systems might limit their widespread adoption, confining them mainly to luxury and premium vehicles.

Stringent vehicle safety regulations also bolster growth prospects. Global automotive associations actively pursue improved vehicle safety. For instance, the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety in the U.S., along with 20 major automakers, announced plans in 2016 to make Automatic Emergency Braking (AEB) systems a standard feature in all new passenger cars by September 2022. Similarly, India’s Ministry of Road Transport and Highway (MoRTH) mandated ABS integration in all commercial vehicles in 2015. This regulatory push is anticipated to sustain steady market growth.

Opportunities in the Automotive Braking System Market:

- Safety and Regulations: Increasing focus on vehicle safety and stringent government regulations worldwide create opportunities for advanced braking systems. Manufacturers can develop innovative technologies to meet or exceed safety standards.

- Advanced Driver Assistance Systems (ADAS): The integration of braking systems with ADAS, such as automatic emergency braking (AEB) and adaptive cruise control, presents opportunities for growth. These systems enhance vehicle safety by assisting drivers in avoiding collisions.

- Electric and Autonomous Vehicles: The rise of electric vehicles (EVs) and autonomous vehicles (AVs) requires specialized braking systems. Electric vehicles benefit from regenerative braking, while AVs demand highly reliable and responsive braking systems for various operational scenarios.

- Performance and Comfort: Consumer preferences for improved driving performance and comfort open opportunities for enhanced braking systems that provide better responsiveness, reduced noise, vibration, and harshness (NVH), and superior brake feel.

- Aftermarket and Maintenance: The aftermarket for brake components and systems is substantial. Opportunities exist for manufacturers to provide high-quality replacement parts, maintenance services, and upgrades to existing vehicles.

Challenges in the Automotive Braking System Market:

- Technological Complexity: Developing advanced braking systems with features like regenerative braking, autonomous emergency braking, and integration with vehicle networks requires substantial research, development, and engineering efforts.

- Cost Pressures: Implementing new technologies often comes with increased production costs, which can impact the overall vehicle cost. Striking a balance between safety, performance, and cost-effectiveness can be challenging.

- Global Market Variation: Different regions have varying road conditions, driving habits, and regulations. Brake systems must be adapted to meet these diverse requirements, adding complexity for manufacturers operating in multiple markets.

- Competition and Innovation: The automotive industry is highly competitive. Manufacturers must continually innovate to stay ahead, leading to rapid technological advancements that can be challenging to keep up with.

- Cybersecurity and Connectivity: As vehicles become more connected, there is a growing concern about cybersecurity. Ensuring the security of braking systems and preventing potential hacking or unauthorized access is crucial.

- Environmental Considerations: The shift towards environmentally friendly vehicles places pressure on reducing emissions and energy consumption, which may impact traditional braking systems. Manufacturers need to explore sustainable alternatives without compromising safety.

- Customer Acceptance and Education: Introducing new braking technologies requires consumer acceptance and understanding. Proper education is essential to ensure drivers use these systems correctly and trust their performance.

Regional Outlook

The Asia Pacific region dominates the global automotive braking system market and is poised to maintain this lead. China, a significant automotive market, is buoyed by a growing economy and rising disposable incomes. Favorable production costs have further propelled vehicle manufacturing, with China producing 27.8 million vehicles in 2018.

In Europe, a prominent automotive hub, technology-driven strategies are paramount for component manufacturers to stay competitive and boost revenue. The region’s robust automobile and component exports, including automotive braking systems, are expected to drive market growth.

Key Players and Strategies

The global automotive braking system market is competitive and fragmented due to numerous players. These entities prioritize product development and enhancement for a competitive edge. Additionally, inorganic growth strategies are embraced to fortify market presence.

Some of the key players operating in the market are ZF Friedrichshafen AG, Akebono Brake Industry Co., Ltd., Continental AG, Brembo S.p.A, Robert Bosch GmbH, AISIN SEIKI, Hyundai Mobis, WABCO, and Hitachi Ltd. among others.

Segments Covered in the Report

By Vehicle

- Commercial Vehicles

- Passenger Vehicles

By Part Type

- Disc

- Drum

By System Type

- Pneumatic

- Hydraulic

By Sales Channel

- Aftermarket

- Original Equipment Manufacturer (OEM)

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333