The Advanced Driver Assistance Systems (ADAS) market has experienced significant growth in recent years, driven by advancements in automotive technology, increasing demand for safety features, and regulatory mandates. ADAS encompasses a range of systems designed to enhance vehicle safety by providing assistance and automation for driving tasks. These systems utilize sensors, cameras, radar, and other technologies to detect and respond to potential hazards, helping to prevent accidents and mitigate their severity. As the automotive industry continues to evolve towards autonomous driving, ADAS plays a crucial role in bridging the gap between traditional vehicles and fully autonomous ones.

Get a Sample: https://www.precedenceresearch.com/sample/1007

Growth Factors

Several factors contribute to the growth of the ADAS market. Firstly, rising concerns about road safety and the increasing number of accidents worldwide have led to greater adoption of safety technologies by both consumers and regulatory bodies. Additionally, advancements in sensor technology, artificial intelligence, and connectivity have enabled the development of more sophisticated ADAS functionalities, enhancing their effectiveness and reliability. Moreover, the growing popularity of electric vehicles (EVs) and the integration of ADAS as a standard feature in many new vehicle models further drive market expansion.

Trends:

Several trends are shaping the ADAS market. One prominent trend is the integration of ADAS with other vehicle systems, such as infotainment and navigation, to provide a seamless user experience. Another trend is the emergence of augmented reality (AR) and heads-up display (HUD) technologies, which enhance driver awareness by overlaying relevant information onto the windshield. Furthermore, there is a growing focus on developing ADAS specifically for commercial vehicles, such as trucks and buses, to improve fleet safety and efficiency. Additionally, the rise of connected and autonomous vehicles is driving the development of more advanced ADAS features, including autonomous emergency braking, adaptive cruise control, and lane-keeping assistance.

Advanced Driver Assistance Systems (ADAS) Market Scope

| Report Highlights | Details |

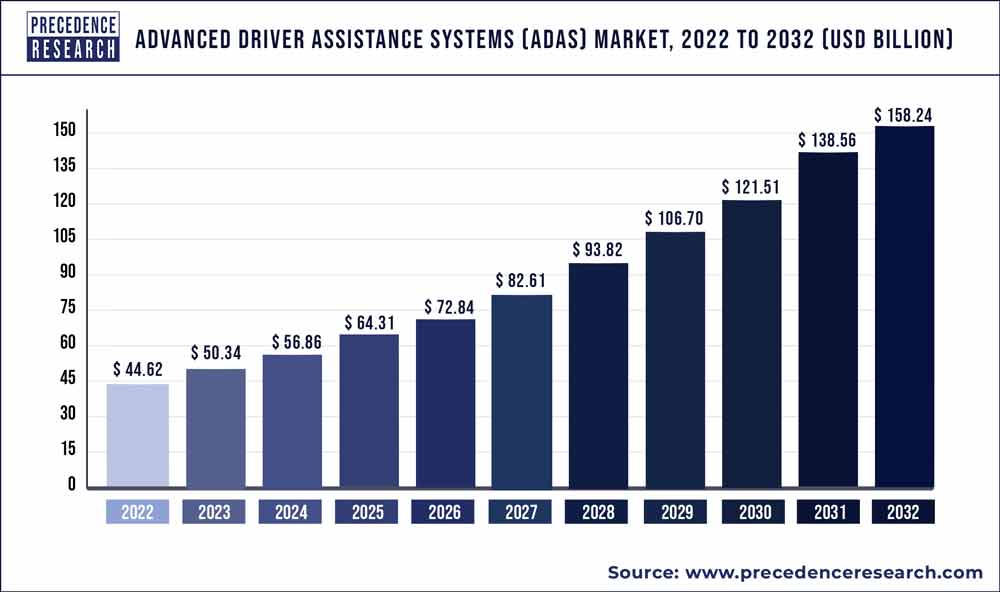

| Market Size by 2032 | USD 158.24 Billion |

| Growth Rate | CAGR of 13.8% from 2023 to 2032 |

| Largest Market | Europe and North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | System Type, Vehicle Type, Sensor Type, Electric Vehicle, Level of Autonomy, Region Type |

SWOT Analysis

- Strengths: The ADAS market benefits from technological advancements, increasing safety regulations, and growing consumer awareness about the importance of safety features in vehicles. Additionally, the integration of ADAS into new vehicle models by automotive manufacturers strengthens market penetration.

- Weaknesses: Despite technological advancements, certain ADAS systems may still face limitations in certain driving conditions, such as adverse weather or complex urban environments. Moreover, high initial costs and potential compatibility issues with existing vehicle platforms can hinder widespread adoption.

- Opportunities: There is significant opportunity for market expansion, driven by the increasing demand for autonomous vehicles, the development of advanced sensor technologies, and the growing emphasis on connected car ecosystems. Moreover, partnerships and collaborations between automotive OEMs and technology companies can accelerate innovation and market growth.

- Threats: The ADAS market faces threats from cybersecurity risks, potential regulatory challenges, and competition from alternative safety technologies. Additionally, economic downturns and supply chain disruptions can impact market dynamics and growth prospects.

Read Also: Automotive Wiring Harness Market Size To Hit USD 88.36 Bn by 2033

Some of the recent activities by market players are as follows:

- In July, 2021, Magna International Inc. acquired Veoneer, a leader in automotive safety technology to strengthen and broaden its ADAS portfolio and industry position.

- In April, 2021, Denso Corporation developed advanced driver assistance products for new Lexus LS, and Toyota Mirai.

- ZF released ZF co ASSIST, a Level 2 + automated driving system, in January 2020, which is the first venture into the Level 2 + modular hardware and software suite and highlights the capabilities of ZF as a complete system supplier. From 2020 ZF will be equipping production vehicles for a major Asian manufacturer with this new ZF system.

- Veoneer was chosen to have active safety services based on next-generation vision and radar systems in February 2020. Veoneers versatile system has been developed to achieve Euro NCAP 5-star safety ratings and include many driver assistance features such as highway assistance, adaptive cruise control stop and go, traffic sign recognition, lane centering control, automatic emergency braking and automated high beam control.

- In July 2020, Arbor unveiled an Advanced Driver Assistance System (ADAS) and fleet management Rockchip PX30-based telematics device with an 8-inch touchscreen that aims primarily to improve bus safety.

- July 2020, Canadian ADAS (advanced driver assistance systems) company LeddarTech announced that it is acquiring Israeli company VayaVision, the maker of an autonomous vehicle vision sensor based platform.

- July 2020, for its advanced ADAS calibration frame systems, the Regular Calibration System and the MA600 Mobile Calibration System, Autel US has launched three calibration enhancement packages that extend vehicle and application coverage of these calibration solutions.

- In February 2020, Continental AG built a new plant for the manufacturing of radar sensors in Texas, US.

Competitive Landscape:

The ADAS market is highly competitive, with numerous players vying for market share. Major automotive OEMs, such as BMW, Toyota, and General Motors, are investing heavily in ADAS research and development to differentiate their offerings and enhance vehicle safety. Additionally, technology companies like Nvidia, Intel, and Qualcomm are providing advanced hardware and software solutions for ADAS applications. Moreover, startups and specialized firms, such as Mobileye (an Intel company) and Waymo (a subsidiary of Alphabet Inc.), are driving innovation in autonomous driving technology and ADAS algorithms. Overall, intense competition within the market is fueling rapid technological advancements and product innovation.

Advanced Driver Assistance Systems (ADAS)Companies:

- Denso

- Aptiv

- Robert Bosch GmbH

- Continental AG

- Magna International

- Veoneer

- Hyundai Mobis

- ZF Friedrichshafen

- Valeo

- NVIDIA

- Intel

- Microsemi Corporation

- Nidec Corporation

- Hella

- Texas Instruments

- Infineon Technologies AG

- Hitachi Automotive

- Renesas Electronics Corporation

Segments Covered in the Report

This research report analyzes and predicts growth of market size at global, regional, and country levels. It also offers comprehensive study of the up-to-date industry developments in all of the sub-segments from 2020 to 2032. In order to study thoroughly this research study categorizes market depending upon different aspects such astype, sensor type, vehicle type, and region:

By System Type

- Intelligent Park Assist (IPA)

- Lane Departure Warning (LDW)

- Road Sign Recognition (RSR)

- Tire Pressure Monitoring System (TPMS)

- Night Vision System (NVS)

- Automatic Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Adaptive Front Light (AFL)

- Blind Spot Detection (BSD)

- Cross Traffic Alert (CTA)

- Driver Monitoring System (DMS)

- Forward Collision Warning (FCW)

- Others

By Sensor Type

- Image Sensors

- Ultrasonic Sensors

- LiDAR

- Radar Sensors

- Infrared (IR) Sensors

- Laser Sensors

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

By Level of Autonomy

- L1

- L2

- L3

- L4

- L5

By Electric Vehicle

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/