Is the World Rolling Toward a Greener Tire Future?

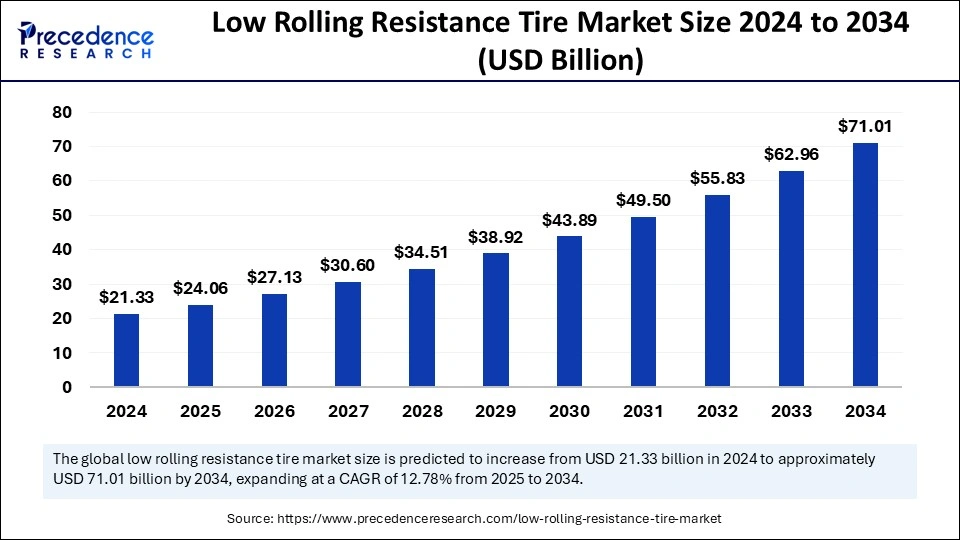

The global low rolling resistance (LRR) tire market is witnessing rapid expansion, driven by rising demand for energy-efficient and environmentally sustainable automotive solutions. In 2024, the market was valued at USD 21.33 billion. As we move into 2025, this figure is expected to reach USD 24.06 billion. With growing emphasis on vehicle performance and emission reduction, the market is projected to surge to approximately USD 71.01 billion by 2034. This represents a strong compound annual growth rate (CAGR) of 12.78% over the forecast period.

This growth trajectory reflects the increasing adoption of low rolling resistance tires by original equipment manufacturers (OEMs), particularly in the electric vehicle (EV) and hybrid vehicle segments. The ability of these tires to reduce friction and energy consumption during driving translates to improved fuel efficiency and extended battery range—factors highly desirable in modern automotive design. What Do the Numbers Reveal About the Market’s Momentum?

The LRR tire market is on a promising growth path, with several notable insights emerging from the latest data. The expected CAGR of 12.78% signifies sustained long-term momentum across various segments. North America led the market in 2024, securing a dominant share of 36%, largely due to high automotive production and stringent environmental regulations.

Meanwhile, Asia Pacific is projected to emerge as the fastest-growing regional market, boasting an estimated CAGR of 13.9%. This growth is fueled by rising vehicle ownership, infrastructure development, and environmental initiatives in countries like China, India, and Japan. In terms of vehicle types, the passenger car segment held the largest market share in 2024 at 42%, driven by consumer demand for fuel-efficient vehicles. However, the electric vehicle segment is anticipated to grow at the fastest pace due to increasing global electrification trends.

From a design perspective, wide band tires dominated in 2024, favored for their ability to distribute vehicle weight evenly, thereby enhancing durability and fuel efficiency. The dual-width segment is also expected to grow steadily, particularly in the light commercial vehicle space. In terms of distribution, OEMs held the majority market share at 61% in 2024, but the aftermarket segment is poised to expand quickly as consumer awareness of LRR benefits increases.

Get a Sample: https://www.precedenceresearch.com/sample/5871

Can Smart Cities and AI-Driven Tires Redefine Efficiency?

Urbanization and technological advancement are profoundly reshaping the tire manufacturing landscape. As cities become more congested and environmentally conscious, there is a growing push toward efficient, eco-friendly transport options. Low rolling resistance tires have become integral to this shift, especially in applications like last-mile delivery, shared mobility, and electric urban commuting.

Smart cities are emphasizing sustainable transportation infrastructure, and LRR tires support these efforts by improving vehicle range and reducing operational costs. Manufacturers are heavily investing in new battery systems that align with LRR technologies, allowing electric vehicles to travel longer distances with less energy consumption.

Additionally, lightweight materials and compact vehicle designs are contributing to the demand for advanced tire solutions. Innovations such as graphene-infused rubber, AI-based tread pattern optimization, and CAD-assisted prototyping are allowing manufacturers to enhance performance, minimize wear, and reduce carbon emissions. These technological leaps are also reducing production costs over time, making LRR tires more accessible.

Which Regions Are Steering the Tire Revolution?

Is the U.S. Leading with Policy or Performance?

The U.S. market alone accounted for USD 6.14 billion in 2024 and is projected to climb to USD 20.86 billion by 2034, with a CAGR of 13%. This robust growth is a result of stringent environmental regulations, high demand for electric vehicles, and a well-established automotive sector. Major tire manufacturers like Goodyear, Michelin, and Bridgestone have a strong footprint in the region, continuously innovating to meet evolving efficiency and safety standards.

American consumers and commercial fleet operators are increasingly opting for vehicles that offer better mileage and reduced emissions. Government tax incentives and programs promoting sustainable transport have also encouraged OEMs to integrate LRR tires into newer models, especially electric and hybrid variants.

Will Asia Pacific Dominate the Tire Transformation?

Asia Pacific is expected to experience the most significant growth, largely due to the automotive manufacturing boom in China and India. China alone, as per the China Association of Automobile Manufacturers, is forecast to achieve 32.4 million vehicle sales in 2025, with New Energy Vehicle (NEV) sales expected to grow by 24.4%. This massive output naturally translates into higher demand for advanced tire technologies.

India, too, is showing strong policy support for EVs through schemes like FAME II, which prioritize energy-efficient components such as LRR tires. Japan, a leader in automotive innovation, continues to pioneer tire efficiency and low-emission technologies, reinforcing the region’s overall leadership in the LRR space.

Can Europe Set the Sustainability Benchmark?

Europe is another important player, with a strong focus on environmental sustainability and carbon reduction. The EU has imposed strict fuel efficiency and emission standards, prompting automakers to use high-performance tires that reduce energy loss. European nations are also electrifying public transportation fleets and incentivizing private EV ownership, further boosting LRR tire adoption.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 71.01 Billion |

| Market Size in 2025 | USD 24.06 Billion |

| Market Size in 2024 | USD 21.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.78% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Width, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

What Makes LRR Tires Essential for the Future of Mobility?

Low rolling resistance tires are engineered to minimize energy loss caused by tire deformation as the vehicle moves. This results in improved fuel economy and reduced greenhouse gas emissions. These tires are especially important in the context of global climate targets and sustainable mobility initiatives.

In today’s transportation landscape, where electric and hybrid vehicles are gaining rapid popularity, LRR tires play a vital role in optimizing performance and energy use. Their adoption supports key trends such as urban electrification, shared vehicle fleets, and cleaner logistics. As cities grow smarter and greener, LRR tires are emerging as an essential component of the modern vehicle ecosystem.

What’s Powering and Slowing Down the Market?

What’s Driving the Market Forward?

Several forces are propelling the market forward. The most prominent driver is the increasing demand for fuel-efficient and eco-friendly vehicles. With growing awareness of environmental issues and rising fuel prices, consumers and businesses alike are seeking solutions that lower operational costs and carbon footprints.

Moreover, the booming electric vehicle sector is directly driving the adoption of LRR tires. These tires help EVs extend their battery range, which is a top concern among consumers. Automakers are increasingly equipping their EVs with LRR tires to enhance overall efficiency and customer satisfaction.

Are High Costs Putting the Brakes on Adoption?

Despite their advantages, high initial costs remain a significant barrier to wider adoption. LRR tires typically cost more than conventional options, which can deter cost-sensitive consumers. The limited availability of these specialized tires in some markets also hampers their growth. Furthermore, certain models may underperform in areas like traction or durability, which can influence buyer decisions.

Read Also: Micro Electric Vehicles: Powering the Future of Compact, Clean Urban Mobility

What Opportunities Could Reshape the Market?

Advancements in materials science and tire design present promising opportunities. The use of nanomaterials, intelligent sensors, and 3D printing is enabling the development of more efficient and cost-effective LRR tires. Emerging markets, particularly in Latin America and Africa, represent untapped potential, as infrastructure investments and EV penetration increase. Public transit electrification projects worldwide also present a lucrative opportunity for tire manufacturers. Are Vehicle Types Steering Market Demand?

The low rolling resistance tire market is categorized by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles. Among these, passenger vehicles held the largest market share in recent years due to the widespread demand for personal transportation and rising consumer awareness about fuel economy and environmental responsibility. On the other hand, electric vehicles (EVs) represent the fastest-growing segment. These vehicles benefit significantly from LRR tires, which help extend battery range, one of the most critical performance aspects of EVs. Commercial vehicles are also adopting LRR tires to reduce operational fuel costs and align with fleet sustainability mandates.

Is Power Source the Deciding Factor for Tire Performance?

When segmented by power source, the market includes Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs). BEVs lead the pack due to their total reliance on electric propulsion, making tire efficiency critical for range extension. HEVs and PHEVs also see performance gains from LRR tires, particularly in urban environments where they often run on electric power alone. As consumers look for a balance between eco-friendliness and flexibility, these vehicle types are expanding the market for energy-efficient tires.

How Do Different Batteries Impact Tire Needs?

The battery type plays a major role in determining compatibility and performance. Lithium-ion batteries dominate due to their high energy density and compatibility with range-boosting technologies like LRR tires. Lead-acid batteries, while still used in older or low-cost vehicles, are declining due to lower efficiency. Emerging technologies like solid-state and nickel-metal hydride batteries offer exciting prospects for next-generation electric mobility, potentially unlocking new tire design requirements and opportunities for innovation.

Which Applications Are Pushing the Market Ahead?

The application spectrum for LRR tires is broadening quickly. Urban transport leads the segment, as cities adopt electric public transit and car-sharing platforms that benefit from energy-efficient components. Last-mile delivery is also driving rapid growth, with logistics companies using LRR tires in electric vans and cargo bikes to reduce fuel/energy costs during frequent short trips. Recreational vehicles, including e-scooters and compact electric cars, are a growing niche as consumers seek fun, low-impact transportation alternatives.

Who’s Racing Ahead in the Tire Tech Arena?

The global LRR tire market is highly competitive, with major players such as Bridgestone, Michelin, Goodyear, Continental, Pirelli, Hankook, and Yokohama leading innovation. These companies are investing in AI-based design, sustainable materials, and tire sensors to deliver performance with purpose.

Recent launches like Michelin’s X LINE ENERGY 3 and Continental’s Eco Gen 5 are setting benchmarks. Hankook’s AI-driven Ventus evo tire is also a glimpse into the future of smart, adaptable tire technology that optimizes itself based on road and vehicle conditions.

Low Rolling Resistance Tire Market Key Players

- Bridgestone Corporation

- Michelin

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Hankook Tire

- Yokohama Rubber Co. Ltd.

- Apollo Tyres Ltd.

- Cheng Shin Rubber Industry Co. (Maxxis)

- Kumho Tire

- Zhongce Rubber Group Co., Ltd. (ZC-Rubber)

- Nokian Tyres plc

- MRF Tyres

- Sumitomo Rubber Industries, Ltd.

- Firestone Tire and Rubber Company

- Cooper Tire & Rubber Company

- Toyo Tire & Rubber Company

Are 2024–2025 Developments the Tipping Point?

From AI-designed tread patterns to regulatory shifts encouraging energy labeling, the LRR tire landscape is rapidly evolving. Governments are pushing policies that favor low-emission transportation, while commercial partnerships are enabling smarter fleet management. These developments are accelerating both consumer awareness and product availability, setting the stage for widespread adoption of low rolling resistance tires in the years ahead.