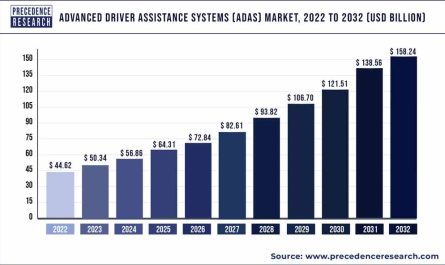

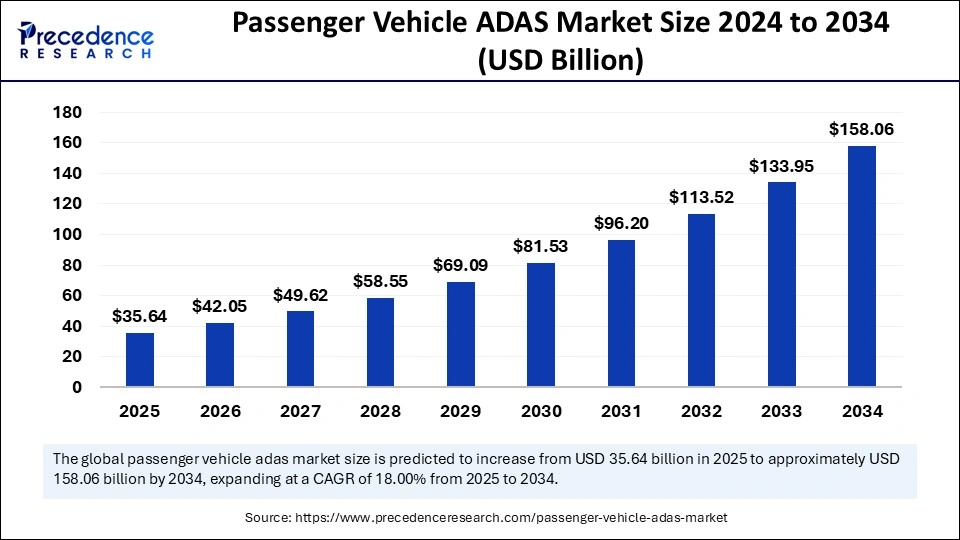

The global passenger vehicle ADAS market size is estimated at USD 35.64 billion in 2025 and is anticipated to be worth around USD 158.06 billion by 2034, growing at a CAGR of 18% from 2025 to 2034.

The global market for Advanced Driver Assistance Systems (ADAS) in electric passenger vehicles is witnessing significant growth, driven by the convergence of electrification and automation in the automotive industry. ADAS encompasses a range of technologies, such as adaptive cruise control, lane keeping assist, blind spot detection, and automatic emergency braking, designed to enhance vehicle safety, improve driving comfort, and pave the way toward autonomous mobility. The electric vehicle (EV) sector, in particular, is becoming a major platform for the deployment of advanced ADAS features. This is largely due to EVs’ digital architecture, which is more compatible with sensors, high-performance computing, and over-the-air (OTA) software updates than traditional internal combustion engine (ICE) vehicles.

In recent years, electric vehicle manufacturers such as Tesla, BYD, NIO, and Xpeng have integrated ADAS as a core component of their offerings, using it not only to enhance safety but also to differentiate their vehicles in an increasingly competitive market. As regulatory mandates for vehicle safety intensify worldwide, ADAS is evolving from a luxury add-on to a standard feature—especially in EVs, where consumer expectations for technological innovation are higher. The global ADAS market for passenger vehicles is expected to grow at a compound annual growth rate (CAGR) exceeding 15% over the next decade, with EVs representing the most rapidly expanding subsegment.

Get a Sample: https://www.precedenceresearch.com/sample/6024

The Role of Artificial Intelligence in ADAS

Artificial Intelligence (AI) plays a critical role in the development and performance of ADAS technologies. AI enables real-time data processing from multiple sensors, such as cameras, radar, ultrasonic sensors, and LiDAR, through advanced machine learning and deep learning algorithms. These algorithms allow ADAS systems to perceive the environment more accurately and make decisions such as lane changes, obstacle avoidance, and collision mitigation. AI-driven sensor fusion enhances object detection and classification, enabling the system to operate reliably in a variety of traffic and weather conditions.

Moreover, AI supports continuous improvement of ADAS through data aggregation from millions of vehicles. This enables manufacturers to refine their systems with real-world driving data. Over-the-air (OTA) updates, which are increasingly common in electric vehicles, allow for rapid deployment of AI-driven enhancements. Tesla’s Full Self-Driving (FSD) beta program is a prime example of this feedback loop, where AI software is continuously trained and pushed to vehicles via the cloud. AI also enables predictive analytics for driver behavior monitoring and adaptive features that tailor assistance levels based on user preferences, further improving the user experience.

Key Growth Factors Driving the Market

The growth of ADAS in electric passenger vehicles is propelled by a combination of regulatory, technological, and consumer trends. Firstly, governments across the globe are mandating safety features like automatic emergency braking, lane departure warning, and pedestrian detection in all new vehicles. In Europe, the EU has enacted the General Safety Regulation, which mandates several ADAS features by default from 2024 onward. Similarly, the United States is pushing for wider deployment of safety systems through the National Highway Traffic Safety Administration (NHTSA), while China’s New Car Assessment Program (C-NCAP) rewards vehicles with advanced safety ratings for implementing ADAS.

Secondly, the rise of connected and autonomous vehicle platforms is reshaping how manufacturers view vehicle development. Electric vehicles offer a digital-first architecture with centralized computing and domain control units (DCUs), which simplify the integration of ADAS. The proliferation of high-speed 5G and vehicle-to-everything (V2X) communication further enhances the utility of ADAS by allowing real-time traffic updates, hazard warnings, and remote diagnostics. Thirdly, consumer awareness of safety and convenience is growing. Buyers increasingly prefer vehicles with smart safety features, and many are willing to pay a premium for enhanced automation.

Regional Insights and Trends

Regionally, the ADAS market in electric passenger vehicles shows diverse patterns. North America, particularly the United States, has a well-established market with high ADAS penetration in both premium and mid-range EVs. Tesla leads the way with its Autopilot and Full Self-Driving (FSD) systems, while legacy automakers like Ford and GM are investing in hands-free systems such as BlueCruise and Super Cruise. Despite regulatory fragmentation across U.S. states, a strong consumer appetite for innovation sustains momentum in this region.

Europe represents a mature and regulatory-driven market for ADAS. Germany, the UK, and France have implemented strict safety norms and provide subsidies for ADAS-equipped EVs. European automakers like Audi, BMW, and Volvo are integrating Level 2+ ADAS systems in their EV models and preparing for Level 3 deployment in select urban corridors. In contrast, the Asia-Pacific region—especially China—has emerged as the fastest-growing ADAS market. Backed by government subsidies, favorable policies, and rapid EV adoption, Chinese companies like BYD and NIO are pushing boundaries with proprietary ADAS stacks such as DiPilot and NIO Pilot.

In emerging markets such as India, Southeast Asia, Latin America, and Africa, ADAS adoption is still in early stages. Challenges include high vehicle costs, limited awareness, lack of infrastructure, and fragmented regulations. However, rising demand for safety, increasing urbanization, and regulatory reforms are opening up future opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 158.06 Billion |

| Market Size in 2025 | USD 35.64 Billion |

| Market Size in 2024 | USD 30.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System, Sensors, Vehicle, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Major Market Drivers

There are several primary drivers behind the expansion of the electric passenger vehicle ADAS market. One of the foremost drivers is regulatory pressure. Governments are enforcing stringent vehicle safety standards, particularly for new energy vehicles (NEVs). This regulatory environment makes ADAS not just a differentiator but a necessity. Another major driver is technological feasibility. EVs are inherently more adaptable to ADAS because of their electronic control systems, digital interfaces, and real-time connectivity. Moreover, consumer expectations are changing rapidly—people expect their vehicles to provide a safer, semi-autonomous driving experience, particularly in urban areas.

Industry competition is another key factor. Automakers are racing to showcase their ADAS capabilities to secure market share in the EV space. This has led to increased R&D investments, partnerships with tech firms, and faster deployment of ADAS across vehicle lineups. Cost reductions in critical components like radar sensors, cameras, and computing modules have also made ADAS more affordable, allowing deployment in mass-market EVs and not just premium vehicles.

Read Also: Electric Vehicle Sound Generator Market Size to Worth USD 4.28 Bn by 2034

Opportunities in the Market

The growing demand for higher levels of autonomy (Level 3 and Level 4) presents immense opportunities for OEMs and Tier 1 suppliers. Automakers are testing pilot projects for Level 4 capabilities in controlled environments, such as urban centers with geo-fenced mapping and dedicated lanes. These initiatives are especially promising in China and the U.S., where infrastructure and technology readiness are accelerating.

There is also a massive opportunity in software development and AI services. Companies that specialize in perception algorithms, sensor fusion, and vehicle control logic stand to gain by licensing their solutions to multiple OEMs. Additionally, aftermarket ADAS solutions are emerging, providing upgrades to older EVs that lack built-in advanced features. Furthermore, mobility services—such as robotaxis and autonomous shuttles, can leverage ADAS as a foundational technology to enable safer shared transportation.

Challenges and Limitations

Despite its growth, the electric vehicle ADAS market faces numerous challenges. Safety and liability are significant concerns. As automation increases, determining legal responsibility in case of a crash becomes more complex, especially for Level 3 and above. Public trust also remains a hurdle. Surveys show that a significant portion of consumers are skeptical of autonomous driving technologies due to fears of malfunction or system hacking.

Another challenge lies in infrastructure readiness. ADAS systems rely on clear road markings, high-definition maps, and reliable communication networks, all of which are lacking in many regions. Cybersecurity risks are also rising as vehicles become more connected. Protecting ADAS systems from hacking and ensuring secure OTA updates are critical tasks for automakers. Cost remains a barrier, especially in developing countries where vehicle affordability is low. Integrating ADAS into budget EVs without compromising reliability or safety is a technological and economic challenge.

Passenger Vehicle ADAS Market Key Players

- Aisin

- Ambarella

- Aptiv

- Autoliv

- Bosch

- Continental

- Denso

- Mobileye

- Valeo

Leaders Announcements

- In January 2025, Tata Technologies and Telechips announced a partnership to develop innovative solutions for next-gen software-defined vehicles (SDVs). Their collaboration will focus on ADAS platforms, automotive cockpit controllers, and gateway systems, helping OEMs tackle software-hardware integration challenges and speed up time-to-market.

- In September 2024, Valeo announced a new production facility in Pune for power electronics, boosting its presence in India’s growing passenger vehicle ADAS market. The facility will supply key components for advanced safety and electric vehicle technologies.

Recent Developments

- In March 2025, Elitek Vehicle Services launched ADAS MAP, a tool to help shops diagnose, calibrate, and repair ADAS systems, supporting the growing passenger vehicle ADAS market and enhancing vehicle safety and performance.

- In January 2025, Garmin unveiled its latest innovation, Unified Cabin 2025, at the Consumer Electronics Show in Las Vegas. The solution includes features like Ultra-Wide Band (UWB) technology for Child Presence Detection (CPD), enhanced blind spot detection, improved computer vision, and augmented reality capabilities.

- In August 2024, Mercedes-Benz announced that it had received a Level 4 autonomous driving test license. The automaker plans to upgrade its current Level 3 autonomous driving system to Level 4 for the Chinese market, with the upgrade scheduled for September.