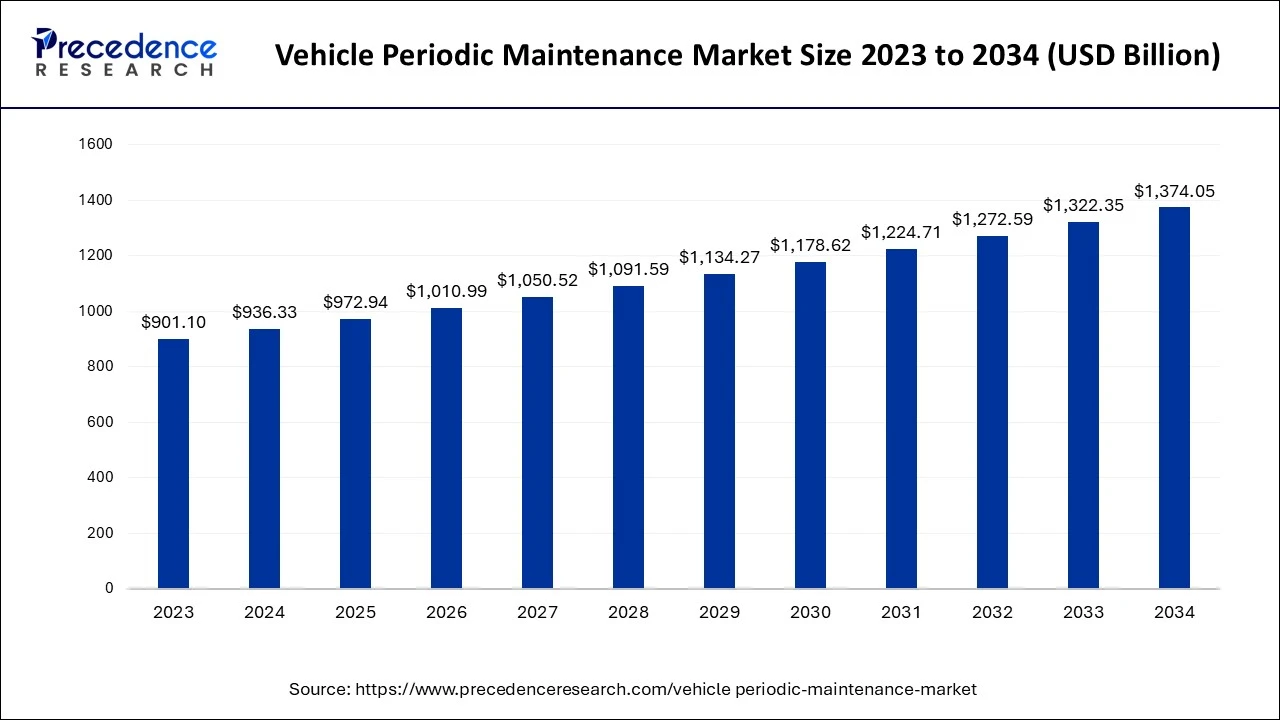

The global vehicle periodic maintenance market size was valued at USD 936.33 billion in 2024 and is expected to be worth around USD 1,374.05 billion by 2034, expanding at a CAGR of 3.91% from 2024 to 2034.

Is Regular Vehicle Maintenance Becoming the New Goldmine?

What once was a mundane checklist of oil changes and tire rotations has evolved into a multibillion-dollar global market. The vehicle periodic maintenance market is no longer just about keeping cars running—it’s about efficiency, safety, performance, and, increasingly, data. From small garages to dealership service networks and tech-enabled mobile service providers, the sector is expanding rapidly as more consumers recognize the long-term benefits of proactive maintenance. The growth is especially prominent in urban areas and emerging economies where car ownership is on the rise and safety regulations are tightening. This once-overlooked segment is now a pivotal force in the automotive ecosystem.

Get a sample: https://www.precedenceresearch.com/sample/5104

Why Are Aging Cars Suddenly So Valuable to the Market?

Surprisingly, the average age of vehicles on the road is one of the biggest boosters of this industry. As cars are built to last longer, owners are keeping them well beyond the traditional turnover period. But with age comes wear—and the need for more frequent and specialized maintenance. Older vehicles require periodic inspections, part replacements, and diagnostics to stay roadworthy and meet emission norms. This shift has created a consistent demand for maintenance services, particularly in regions where economic constraints make new vehicle purchases less feasible. Thus, aging vehicles are quietly fueling the engine of the maintenance market.

Can Artificial Intelligence Predict When Your Car Will Break Down?

Yesand it’s changing everything. Artificial Intelligence is revolutionizing how we maintain our vehicles. With real-time diagnostics, predictive analytics, and smart service scheduling, AI enables both consumers and fleet operators to anticipate problems before they lead to failure. Imagine a car that tells you it needs brake pad replacement two weeks before the wear becomes dangerous. That’s not science fiction anymore. AI is also streamlining backend operations for service providers, automating inventory, scheduling repairs, and improving customer engagement through chatbots and personalized notifications. This tech-forward shift is creating smarter, faster, and more cost-effective maintenance solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,347.05 Billion |

| Market Size in 2024 | USD 936.33 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.91% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service Type, Maintenance Part, Service Provider, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Are We Witnessing the Death of the Traditional Garage?

The days of flipping through a service manual in a greasy garage may be numbered. The rise of digital platforms, mobile service vans, and remote diagnostics is redefining how vehicle maintenance is delivered. Consumers today expect convenience, transparency, and efficiency. They want to schedule appointments through apps, receive instant service updates, and access service history digitally. These expectations are pushing traditional service centers to modernize or risk losing relevance. Subscription-based service packages, digital diagnostics, and even doorstep maintenance are fast becoming the norm. The garage isn’t gone—it’s just transforming into a tech hub.

Is Emission Regulation the Hidden Hand Behind Market Growth?

While it might not make headlines, government regulation is quietly one of the strongest drivers in this space. Stricter emission norms and road safety inspections in regions like Europe, North America, and parts of Asia are making periodic maintenance a legal obligation, not just a recommendation. Vehicles that fail to meet inspection standards face penalties or are barred from roads altogether. This has pushed both individuals and fleet operators to adopt stricter maintenance regimens. Regulatory compliance, in many ways, is becoming a growth catalyst—encouraging timely diagnostics, repairs, and even eco-friendly service practices.

Could Electric Vehicles Disrupt the Maintenance Ecosystem?

EVs may have fewer moving parts, but that doesn’t mean they’re maintenance-free. In fact, their rise is prompting a massive shift in service offerings. Traditional oil changes and engine diagnostics are being replaced by battery health monitoring, software updates, and electric drivetrain servicing. Many service centers are still unprepared for this transition, creating both a challenge and an opportunity. Providers that invest early in EV-specific tools, training, and diagnostics are likely to capture a growing market segment. As EV adoption accelerates, the industry will need to adapt quickly or risk obsolescence.

Why Are Fleets and Shared Mobility Services Game Changers?

Fleet operators and mobility platforms like ride-sharing services are becoming critical customers in this market. With high mileage and quick turnover, their vehicles demand frequent, efficient maintenance to avoid downtime and ensure passenger safety. These organizations are also early adopters of digital maintenance tools, predictive analytics, and AI-based platforms. For service providers, fleet contracts represent consistent revenue and long-term business relationships. As urban mobility continues to shift toward shared and subscription-based models, the need for scalable, tech-driven maintenance solutions will only grow.

Can Developing Countries Fuel the Next Wave of Growth?

While mature markets are refining service quality and integrating AI, developing regions are poised for explosive growth. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization, rising middle-class income, and increased vehicle ownership. However, the maintenance infrastructure in many of these regions remains fragmented. This creates a vast opportunity for new entrants, especially digital-first platforms and franchise service networks, to build scalable models. With the right investment and regulatory support, these markets could drive the next chapter in global maintenance industry expansion.

Read Also: Industrial Noise Control Market Size to Attain USD 8.55 Billion by 2034

Is Skilled Labor the Silent Crisis No One Talks About?

As vehicles become smarter and more complex, the skills required to maintain them are also evolving. Yet there’s a growing mismatch between the needs of modern service centers and the skill levels of available technicians. Many mechanics are still trained for internal combustion engine (ICE) vehicles and lack expertise in EVs, telematics, and AI-based diagnostics. Upskilling programs, vocational training, and partnerships between OEMs and technical institutes are urgently needed. Without a skilled workforce, even the most advanced service centers may struggle to meet rising demand.

What’s Standing in the Way of Full-Scale Transformation?

Despite its promising growth, the vehicle periodic maintenance market faces several roadblocks. Price competition, particularly from independent and unauthorized service providers, is intense. Data privacy and cybersecurity have become major concerns as vehicles become more connected and reliant on software. Additionally, the high cost of adopting cutting-edge AI and IoT solutions can deter smaller businesses from modernizing. Fragmentation in supply chains, inconsistency in service quality, and customer mistrust in some regions also continue to limit growth. Overcoming these challenges will require collaboration across OEMs, service networks, tech providers, and regulators.

Vehicle Periodic Maintenance Market Companies

- ADNOC

- Nippon Express Co.

- Car Parts.com Inc

- Belron International Ltd.

- EUROPART Holding GmbH

- Hance’s European

- Inter cars

- LKQ Corporations

- M& M Auto Repair

- Mekonomen Group

- Mobivia Groupe

- My TVS

- Sun Auto Service

- USA Automotive

- Wrench, Inc.

Recent Developments

- In June 2024, the Goodyear Tire and Rubber Company launched a new tires-as-a-service program that builds on its total mobility offering. Through this, participants will have access to Goodyear tires with monitoring software. Automatic tire inflation services through Opera technologies and tire service.

- In July 2023, Kiwi Fix Auto launched a mobile app to offer car owners in India a convenient and streamlined way to manage their vehicle maintenance, emergencies, and accessory purchases, all from their smartphones.

- In April 2022, Tesla, Inc. proposed constructing a 100,000-square-foot facility in St. Pete, Florida. The new Tesla center will handle sales, service, and deliveries in the area. The new Tesla facility will be built on a 4.21-acre plot that houses a 100,000-square-foot Kanes Furniture Liquidation Center.