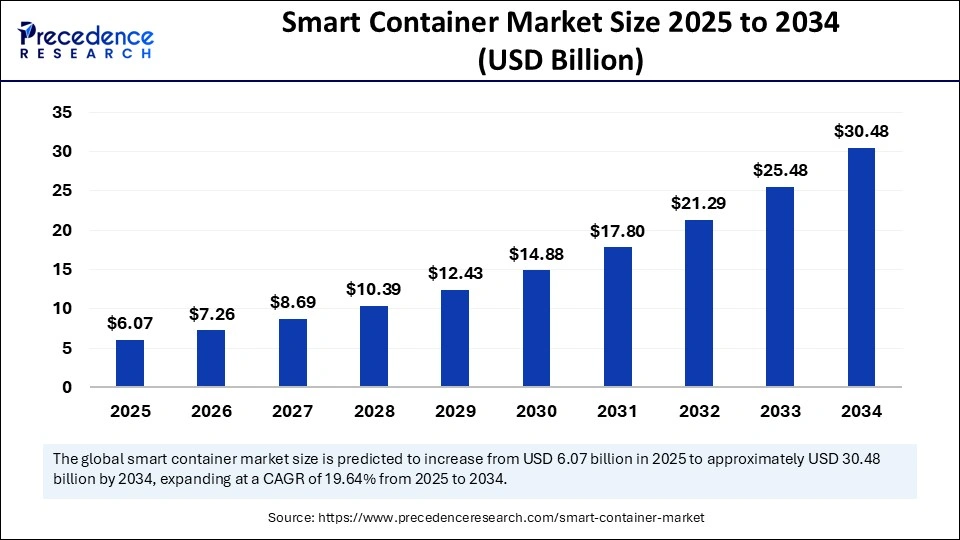

The global smart container market size is evaluated at USD 6.07 billion in 2025 and is anticipated to reach around USD 30.48 billion by 2034, growing at a CAGR of 19.64% from 2025 to 2034.

The global smart container market has experienced significant growth over the last decade and is poised for even greater expansion as global supply chains demand more intelligence, transparency, and efficiency. A smart container is essentially a shipping container equipped with embedded sensors and communication technology that allows real-time tracking, condition monitoring, and data sharing. These smart systems are capable of collecting and transmitting data about location, temperature, humidity, movement, and even container breaches. This innovation is transforming traditional container logistics into a more connected and responsive ecosystem, particularly in industries such as food and beverages, pharmaceuticals, chemicals, and high-value electronics where cargo sensitivity is a concern.

Globalization and the expansion of international trade are major catalysts behind the adoption of smart containers. Additionally, the rise of e-commerce has created an environment where consumers and businesses expect fast, traceable, and secure deliveries. The COVID-19 pandemic further revealed weaknesses in traditional logistics, increasing the urgency to digitize and modernize container shipping. By integrating digital intelligence, smart containers are helping logistics operators prevent losses, optimize routes, maintain compliance with regulatory standards, and ensure the quality of sensitive goods. These benefits are driving widespread adoption and investment across shipping lines, third-party logistics (3PL) providers, and multinational supply chain operations.

Impact of AI on Smart Containers

Artificial Intelligence (AI) plays a central role in shaping the future of the smart container market. While sensors and IoT devices form the foundation of smart containers, AI adds the analytical muscle required to interpret data in real-time and trigger intelligent actions. Predictive analytics enabled by AI allows logistics operators to anticipate delays, equipment failure, or cargo spoilage before it occurs. By learning from historical and real-time data, AI models can suggest optimal routes, proactively flag compliance issues, and predict the remaining useful life of container hardware, thus enabling predictive maintenance.

Moreover, AI is being used to manage vast fleets of containers across multiple geographies. For instance, algorithms can identify patterns in container dwell time or movement inefficiencies, recommending corrective actions that improve turnaround times. AI’s integration with blockchain technology further enhances transparency and traceability, creating immutable records of each container’s journey. This is particularly useful for industries with strict audit and documentation requirements, such as pharmaceuticals and food. AI’s role in decision automation is also growing. It allows logistics companies to automate container placement at ports, schedule maintenance, and even trigger alerts in the event of suspicious activity or deviations from planned routes.

Growth Factors and Market Drivers

A major growth factor in the smart container market is the demand for real-time visibility into shipping operations. In a globalized supply chain environment, the ability to track cargo in real time is no longer a luxury but a necessity. Companies want to know where their goods are, what condition they are in, and when they are expected to arrive. Smart containers provide all of this information through embedded sensors and cloud platforms, allowing shippers to take corrective actions when anomalies are detected. This reduces product loss, improves customer satisfaction, and increases operational efficiency.

Another significant driver is the proliferation of IoT technologies, which has made the deployment of smart devices more affordable and scalable. With advancements in low-power sensors, cloud computing, and satellite connectivity, it is now feasible to equip thousands of containers with tracking and monitoring capabilities. Furthermore, government regulations in sectors like healthcare and perishable goods are enforcing strict controls over shipment conditions, pushing companies to adopt smart containers to remain compliant. Sustainability is another motivator; smart containers help reduce carbon footprints by enabling optimized routing and better fuel usage, aligning with ESG (Environmental, Social, Governance) goals.

Security concerns also contribute to market growth. Cargo theft, tampering, and smuggling are persistent challenges in international logistics. Smart containers can deter these activities through geofencing and tamper alerts. When a container is opened at an unauthorized location or at the wrong time, the system notifies stakeholders immediately. This enhances cargo security and reduces insurance costs, making smart containers a valuable investment for high-value shipments.

Regional Insights

Regionally, North America currently leads the smart container market due to its advanced logistics infrastructure, early adoption of IoT technologies, and stringent regulations on shipping sensitive goods. The U.S. in particular has seen major investments from logistics providers and shipping companies in upgrading their fleets with smart systems. Additionally, the presence of leading tech companies and innovative startups in this region provides a conducive environment for integrating AI, cloud, and sensor-based technologies into logistics operations.

Europe follows closely, with countries like Germany, France, the Netherlands, and the UK investing heavily in sustainable logistics and smart infrastructure. Europe’s regulatory environment supports transparency and traceability in supply chains, especially in food and pharmaceutical sectors. Smart containers help European companies comply with regulations such as the EU Falsified Medicines Directive and Good Distribution Practices (GDP) for temperature-sensitive drugs. Europe is also seeing increased interest in port automation and smart shipping corridors, which align well with smart container capabilities.

Asia-Pacific, however, is the fastest-growing region for smart container adoption. Countries like China, India, Japan, and South Korea are rapidly modernizing their logistics and port infrastructure. China, in particular, is both a major manufacturer and consumer of smart containers. The Belt and Road Initiative and rising trade volumes are further fueling demand. India is investing in digital freight corridors, while Japan and South Korea focus on smart port technologies. The region’s booming e-commerce sector adds another layer of demand for fast, reliable, and trackable deliveries.

Latin America and the Middle East & Africa (MEA) regions are also showing promise. Latin American countries like Brazil and Mexico are expanding port capacities and adopting smart technologies to streamline exports, especially in agricultural and perishable goods. In MEA, ports in the UAE, Saudi Arabia, and South Africa are emerging as regional hubs where smart container technologies can optimize cargo handling and improve regional connectivity.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 30.48 Billion |

| Market Size in 2025 | USD 6.07 Billion |

| Market Size in 2024 | USD 5.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Technology, Application, End-Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Opportunities in the Smart Container Market

The smart container market presents multiple growth opportunities, particularly in the area of data monetization and platform-based services. As more containers get connected, a vast amount of data is being generated. Logistics companies can use this data not only for operational decisions but also to create new revenue streams. Data-driven services like risk prediction, route benchmarking, and real-time supply chain visibility dashboards are emerging as value-added offerings.

Another significant opportunity lies in the convergence of technologies. Integrating smart containers with blockchain, 5G, edge computing, and digital twins could provide unmatched levels of transparency, speed, and automation. 5G will enable high-bandwidth, low-latency communications between containers and control systems. Blockchain can secure data exchanges and improve trust between stakeholders. Digital twins of containers and supply chains could allow operators to simulate and optimize operations before executing them in the real world.

Additionally, sustainability goals provide a compelling use case for smart containers. As companies aim to reduce their environmental footprint, smart containers can support emissions tracking, fuel efficiency, and waste reduction. Governments and international bodies are also promoting the use of green logistics technologies through incentives and regulations, creating more favorable conditions for smart container adoption.

Read Also: Passenger Vehicle ADAS Market Size to Worth USD 158.06 Bn by 2034

Challenges Facing the Market

Despite the opportunities, several challenges could impede the rapid adoption of smart containers. First and foremost is the high initial cost. Equipping a container with sensors, connectivity modules, and software services can be expensive, especially for smaller logistics companies or developing regions. These capital expenditures may not be justifiable without immediate ROI, making it a hard sell for risk-averse operators.

Cybersecurity is another major concern. As containers become connected devices, they are vulnerable to cyber-attacks and data breaches. Logistics companies handle sensitive information such as shipping routes, cargo types, and customer data. A single breach can cause massive operational and reputational damage. Ensuring robust security protocols and compliance with international data regulations is critical for market success.

Lack of standardization and interoperability between different systems and networks is another roadblock. The industry currently operates with a variety of communication protocols (Bluetooth, LoRaWAN, LTE, 5G) and software platforms that are often not compatible with each other. This fragmentation makes it difficult for companies to scale or integrate smart container solutions across multi-vendor environments.

Coverage limitations in remote or oceanic regions also pose problems. Many smart containers rely on cellular networks, which are not available in the middle of oceans or in underdeveloped areas. While satellite communication is an alternative, it adds to the cost and complexity of the system. Finally, the integration of smart technologies into existing legacy systems can be time-consuming and disruptive, requiring retraining and workflow adjustments.

Recent Developments in the Market

- In March 2025, the Smart Container Alliance was launched to promote smart containers and enhance trade security. The Smart Container Alliance is dedicated to advancing industry standards, advocating for policy change, and fostering collaboration between technology providers, shipowners, customs authorities, and international government bodies, such as the European Union and the World Customs Organization.

- In February 2022, Traxens, the smart container service provider for the global supply-chain sector, announced that it had received a new financing round of €23 million, including participation of its historical shareholders, and acquired NEXT4, a fast-growing French supplier of removable and reusable shipping container trackers.

Smart Container Market Companies

- ORBCOMM

- Traxens

- Globe Tracker ApS

- Phillips Connect Technologies

- Emerson Electric Co.

- Hapag-Lloyd AG

- Seaco

- Savvy Telematics

- Sensitech Inc.

- Robert Bosch GmbH

- A.P. Moller – Maersk

- Roambee Corporation

- Nexxiot