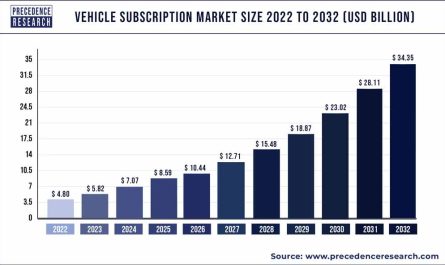

As the global automotive industry rapidly electrifies, a new and highly sustainable market is emerging: the second-life electric vehicle (EV) batteries sector. According to a recent report by Precedence Research, the global second-life electric vehicle batteries market, valued at USD 1.60 billion in 2025, is projected to skyrocket to USD 12.42 billion by 2034, exhibiting a robust Compound Annual Growth Rate (CAGR) of 25.61% from 2025 to 2034. This impressive growth underscores the growing recognition of retired EV batteries as valuable assets for various applications, contributing significantly to a circular economy.

The concept of “second life” for EV batteries addresses both environmental concerns and economic opportunities. Even after a decade of demanding use in an electric vehicle, these lithium-ion power packs often retain 70-80% of their original capacity, making them perfectly suitable for less strenuous, stationary applications. This extended utility delays the need for complete dismantling and recycling, significantly reducing waste and the environmental footprint.

Key Drivers Fueling the Market Expansion:

Precedence Research highlights several critical factors propelling this market forward:

- Explosive Growth in EV Sales and Battery Availability: The primary driver is the accelerating adoption of electric vehicles worldwide. As more EVs are sold, a larger volume of batteries will eventually reach their “end-of-first-life,” creating a consistent and growing supply stream for repurposing. Countries with early and significant EV adoption, such as China, Japan, South Korea, and increasingly India, are becoming major sources of these retired batteries. The sheer scale of anticipated battery retirement, with projections indicating hundreds of millions of tonnes of EV batteries reaching end-of-life in the coming decade, underscores the immense potential.

- Increasing Demand for Cost-Effective Energy Storage Solutions: The global shift towards renewable energy sources like solar and wind necessitates efficient and affordable energy storage to balance intermittent power generation. Second-life EV batteries offer a compelling economic alternative to new battery storage systems (BESS), making them ideal for grid stabilization, microgrids, and backup power, particularly for commercial and industrial (C&I) applications. Their lower upfront cost compared to new batteries significantly reduces the capital expenditure for energy storage projects.

- Environmental Sustainability and Circular Economy Principles: Repurposing EV batteries significantly reduces waste and the demand for new raw materials like lithium, cobalt, and nickel, which are often sourced through environmentally intensive mining. This aligns with global efforts to minimize environmental impact and fosters a circular economy where resources are kept in use for as long as possible. Regulatory measures, such as India’s Battery Waste Management Rules, 2022, which enforce Extended Producer Responsibility (EPR), are further incentivizing second-life solutions from EV OEMs and battery manufacturers by making them responsible for the entire lifecycle of their batteries.

- Technological Advancements in Battery Management and Diagnostics: Innovations in artificial intelligence (AI) and machine learning (ML)-based energy management systems are enhancing the efficiency and sustainability of second-life batteries. These sophisticated systems can accurately assess a battery’s State-of-Health (SOH) and State-of-Charge (SOC), predict its remaining useful life, and optimize energy distribution for second-life applications. The integration of smart grid infrastructure and IoT-based battery monitoring further improves performance, safety, and cost-effectiveness, helping to overcome challenges related to varying degradation levels across battery packs.

Get a Sample: https://www.precedenceresearch.com/sample/5793

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.42 Billion |

| Market Size in 2025 | USD 1.60 Billion |

| Market Size in 2024 | USD 1.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.61% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. |

Diverse Applications and Regional Dynamics:

The applications for second-life EV batteries are diverse and expanding, moving beyond traditional power backup into integrated energy solutions:

- Stationary Energy Storage Systems (ESS) for C&I: This remains the dominant application, providing solutions for peak shaving, demand charge management, optimizing renewable energy self-consumption for businesses and industrial facilities, and ensuring grid stability.

- Residential Energy Storage: Growing interest from homeowners for home inverters, uninterruptible power supplies (UPS), and microgrids to enhance energy independence, reduce electricity bills, and provide resilience during power outages.

- EV Charging Infrastructure Integration: Repurposed batteries serve as local energy reservoirs at public and commercial EV charging stations, buffering grid demand during peak charging times, enabling faster charging, and providing power in areas with limited grid capacity. This also allows for energy arbitrage, charging the battery when electricity is cheap and discharging it for EV charging when rates are high.

- Lower-Power Electromobility: While not suitable for high-performance EVs, these batteries find new life in less demanding electric vehicles such as e-rickshaws, golf carts, electric scooters, and forklifts, contributing to sustainable urban mobility.

- Off-grid and Remote Applications: Their cost-effectiveness makes them viable for providing power in remote areas lacking reliable grid access, for temporary applications like festivals or construction sites, and crucial support during disaster relief efforts.

- Data Center and Telecom Tower Backup: Providing reliable, instantaneous backup power to critical infrastructure, reducing reliance on fossil-fuel generators and improving energy efficiency.

Geographically, Asia Pacific currently dominates the second-life EV batteries market, largely due to the region’s massive and rapidly expanding EV industry and existing infrastructure for battery production. Countries like China and India are particularly active in setting up repurposing facilities and fostering supporting policies. However, Europe is projected to witness the fastest growth between 2025 and 2034, driven by increasing environmental initiatives, stringent regulations like the upcoming EU Battery Regulation with its digital battery passport requirements (expected to be fully implemented by 2027), and proactive automaker involvement in developing second-life energy storage systems. The Lithium-ion battery type continues to hold the largest market share, though research into repurposing other chemistries like Sodium-ion is also gaining traction.

Navigating the Road Ahead: Challenges and Innovations

Despite the immense potential, the second-life EV battery market faces specific hurdles that require concerted effort and innovation:

- Performance and Safety Concerns: Ensuring consistent energy output, long-term reliability, and adherence to rigorous safety standards for degraded batteries remains paramount. This necessitates robust, standardized testing, detailed grading, and modular reassembly processes to guarantee performance and instill consumer confidence. Thermal management systems are also critical to prevent overheating in repurposed packs.

- Lack of Standardization and Traceability: The absence of uniform international standards for battery health assessment, module design, and quality certification significantly complicates scaling and widespread adoption. The impending EU Battery Passport is a crucial step towards improving data availability and traceability throughout a battery’s lifecycle, which will be vital for accurate SOH assessment and efficient repurposing.

- Logistics and Cost Bottlenecks: The efficient collection, transportation, and processing of retired batteries, often across long distances, can be logistically complex and costly. Challenges include hazardous material transport regulations, varying battery pack designs, and the need for specialized equipment for disassembly and reassembly. Automation in testing, sorting, and module integration is key to reducing manual intervention and driving down operational expenses.

- Competition from New Batteries and Price Parity: The continuous decline in the price of new lithium-ion BESS technologies creates a competitive landscape. Second-life solutions must be priced aggressively while offering a compelling value proposition in terms of performance and reliability to compete effectively. Innovative business models, such as “Battery as a Service (BaaS)” or rental models for second-life BESS, are emerging to enhance affordability and uptake.

- Diversity in Battery Chemistries and Designs: The growing variety of battery chemistries (e.g., NMC, LFP, potentially Sodium-ion) and diverse pack designs (e.g., cell-to-pack, module-to-pack) presents challenges for standardized repurposing processes, requiring adaptable technologies, skilled labor, and specialized expertise.

- Warranty and Insurance Challenges: Establishing clear warranty provisions and insurance models for second-life battery systems is a nascent area, crucial for market trust and broader acceptance. This requires collaboration between OEMs, repurposers, and financial institutions.

Collaborative Endeavors and Future Outlook:

The future of the second-life EV battery market hinges on strong collaboration among automotive OEMs, battery manufacturers, energy providers, technology developers, and policymakers. Leading players like Nissan (with its 4R Energy Corp.), Renault, Mercedes-Benz Energy, Connected Energy, B2U Storage Solutions, and India’s Lohum Cleantech (which recently partnered with MG Motor India) are at the forefront of developing and deploying these solutions. These partnerships are vital for creating efficient reverse logistics, ensuring battery quality, and establishing robust supply chains for retired packs.

As global EV adoption accelerates, the second-life battery market presents a unique opportunity to build a more sustainable, resilient, and circular energy ecosystem. By maximizing the value of these powerful assets, we can not only mitigate environmental impact but also unlock new economic opportunities, reduce reliance on virgin materials, and contribute to a greener, more energy-independent future. The industry’s evolution towards more automated diagnostics, standardized processes, strategic partnerships, and supportive regulatory frameworks will be key to realizing its multi-billion dollar potential and ensuring that EV batteries deliver sustainable value throughout their entire lifecycle.

Read Also: The Intelligent Cocoon: How In-Cabin Sensing is Revolutionizing the Automotive Experience

Second-life Electric Vehicle Batteries Market Companies

- Enel X

- Nissan Motors Corporation

- Fortum

- Renault Group

- Mercedes-Benz Group

- Hyundai Motor Company

- RWE

- Mitsubishi Motors Corporation

- BELECTRIC

- BeePlanet Factory SL

- B2U Storage Solutions, Inc.

- RePurpose Energy Inc.

- ReJoule

- Cactos Oy

- ECO STOR AS

- Connected Energy Ltd.

- Smartville Inc.

- Lohum Cleantech Private Limited

- DB Bahnbau Gruppe GmbH