The passenger vehicle Advanced Driver Assistance Systems (ADAS) market is undergoing a remarkable transformation. As of 2024, the market is valued at approximately USD 36.7 billion and is forecasted to reach around USD 147.3 billion by 2034, growing at a CAGR of 14.8%. This growth is fueled by increasing regulatory mandates, heightened consumer demand for safety, and the ongoing evolution of semi- and fully-autonomous vehicles.

Government agencies across North America, Europe, and Asia are introducing stringent laws to make safety features such as automatic emergency braking, blind-spot detection, and lane-keeping assist mandatory in all new vehicles. Additionally, as OEMs shift toward electrification, ADAS is emerging as a core enabler of future autonomous mobility. The integration of these systems is not only becoming a differentiating factor but a regulatory and consumer necessity.

Get a Sample: https://www.precedenceresearch.com/sample/6024

What Are the Most Important Highlights Shaping the ADAS Market?

A few defining takeaways paint a clear picture of where the ADAS market is heading:

-

Asia Pacific is emerging as the fastest-growing region, with China and India aggressively pushing for safer, smarter vehicles through subsidies, mandates, and innovation.

-

In terms of systems, adaptive cruise control (ACC) and automatic emergency braking (AEB) lead due to regulatory backing and strong consumer adoption.

-

Radar sensors dominate the market, offering affordability and versatility. However, LiDAR is carving out space in premium segments due to its high accuracy.

-

SUVs account for the largest ADAS integration rate, thanks to ample space and higher pricing, while hatchbacks and sedans are gaining traction as costs fall.

-

The OEM channel remains the primary distribution path for ADAS, but the aftermarket is experiencing notable growth with retrofitting kits.

How Are Emerging Technologies Redefining ADAS Capabilities?

Technological innovation is reshaping the landscape of vehicle safety. At the core of this transformation is Artificial Intelligence (AI), which enables predictive analytics, pattern recognition, and object detection. AI is making ADAS more context-aware, capable of responding to complex road scenarios, and reducing false positives in driver alerts.

Radar and LiDAR sensors are evolving to offer greater accuracy and range. Radar remains the mainstream choice for mid-range vehicles, while LiDAR is being adopted in Level 3 autonomous systems for its precise environmental mapping. In parallel, high-resolution cameras, often combined with machine vision, are now capable of reading traffic signs, monitoring driver fatigue, and identifying road lane boundaries.

Connectivity also plays a vital role. Vehicle-to-Everything (V2X) communication and 5G networks enable ADAS to interact not just with nearby vehicles but also with infrastructure, pedestrians, and traffic systems. These technologies are paving the way for predictive driving experiences and smoother traffic flow.

Why Are Different Regions Accelerating ADAS Adoption Differently?

North America: What Makes This Region a Regulatory and Innovation Powerhouse?

North America continues to lead in ADAS mandates and innovation. The NHTSA and IIHS are setting benchmarks for mandatory systems like automatic braking and forward collision warnings. Automakers such as Tesla, Ford, and GM are incorporating advanced driver-assist features like lane centering and hands-free highway driving, setting a precedent for the industry. U.S.-based tech firms are also contributing to breakthroughs in edge computing and ADAS simulation platforms.

Asia Pacific: How Is China Fueling the World’s Fastest ADAS Growth?

Asia Pacific is experiencing the most rapid ADAS growth, driven largely by China’s push for intelligent transportation and electric mobility. Automakers like BYD, Nio, and XPeng are leading the way by incorporating advanced ADAS into budget and mid-range electric cars. In India, regulatory initiatives such as Bharat NCAP are promoting safety feature adoption. South Korea and Japan contribute with sensor innovations and tight integration of ADAS with vehicle design.

Europe: Can EU Mandates and German OEMs Keep Europe at the Forefront?

Europe remains a stronghold of ADAS regulation and premium vehicle innovation. The EU’s General Safety Regulation enforces mandatory inclusion of numerous ADAS features in all new vehicles, accelerating deployment across the board. Germany leads in OEM sophistication with BMW, Mercedes-Benz, and Volkswagen offering Level 2+ systems as standard in luxury segments. The continent also benefits from strong public-private R&D collaborations.

Passenger Vehicle ADAS Market Scope

| Report Coverage | Details |

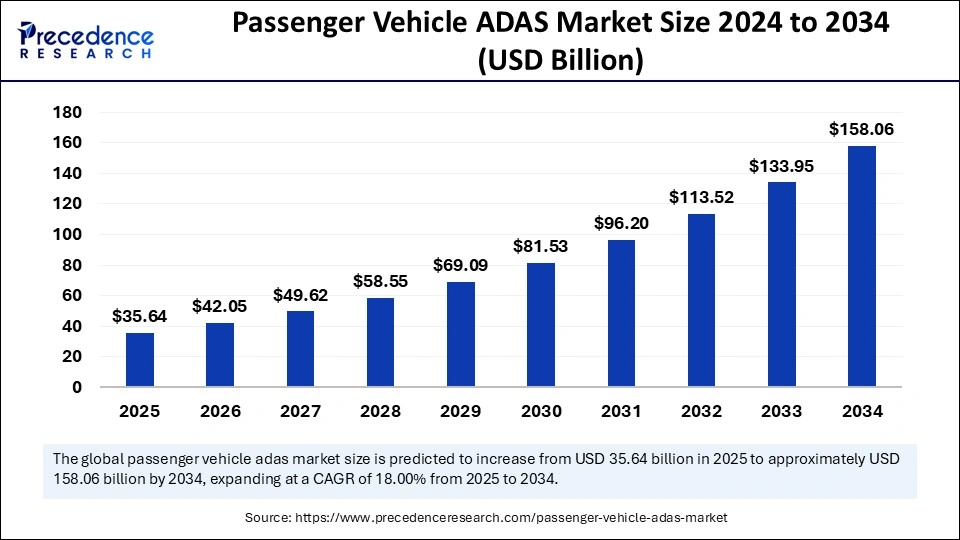

| Market Size by 2034 | USD 158.06 Billion |

| Market Size in 2025 | USD 35.64 Billion |

| Market Size in 2024 | USD 30.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System, Sensors, Vehicle, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

What Forces Are Fueling or Hindering the ADAS Market?

What’s Powering the Momentum?

Several key drivers are catalyzing market expansion. The transition toward autonomous driving is a major force, with ADAS forming the building blocks of Level 1–3 automation. Consumer awareness about road safety is also climbing, especially in emerging markets where traffic-related fatalities are high. In response, OEMs are increasingly branding their vehicles around safety features, creating product differentiation.

What’s Slowing Down Adoption?

On the flip side, high integration costs are a major challenge. Premium sensors like LiDAR remain expensive, and software calibration adds additional complexity. Maintenance and servicing of ADAS components post-installation or post-accident can be difficult and costly, especially in areas lacking qualified technicians.

Where Are the Emerging Opportunities?

Opportunities lie in the growth of 5G and V2X infrastructure, which will significantly improve real-time data exchange and system responsiveness. Additionally, the aftermarket segment is emerging as a lucrative space, especially in developing countries. Retrofit ADAS kits are gaining popularity among users who want enhanced safety without buying new vehicles.

Read Also: Smart Oil Dipstick Market Size to Worth USD 15.41 Billion by 2034

Which Segments Are Driving the ADAS Ecosystem?

What Are the Key Systems Steering This Market?

Lane Departure Warning (LDW) and Adaptive Cruise Control (ACC) are among the most widely implemented systems due to their immediate safety benefits and cost efficiency. Blind Spot Monitoring, Park Assist, and Traffic Sign Recognition are also becoming commonplace, especially in urban-focused models. High-end vehicles now offer semi-autonomous features like highway pilot and automated lane changing.

Which Sensors Are Dominating and Why?

Radar sensors dominate due to affordability, reliability in poor weather, and easy integration. However, LiDAR is gaining ground for its superior spatial awareness and object detection. Camera systems are increasingly advanced, supporting a range of functionalities from facial recognition to pedestrian detection.

How Do Vehicle Types Influence ADAS Adoption?

SUVs have the highest rate of ADAS deployment due to their design and price point. Larger vehicles can more easily accommodate multiple sensors and control units. Hatchbacks and compact sedans are now entering the ADAS landscape as component prices fall. Electric vehicles (EVs) naturally support ADAS features due to their software-defined nature, making them ideal testbeds for innovation.

Are OEMs Still Dominating Distribution?

Yes, OEMs continue to dominate the ADAS distribution chain. They integrate systems during manufacturing, ensuring compatibility and efficiency. However, aftermarket options are gaining visibility. Companies are offering plug-and-play ADAS kits tailored for older vehicles or those from price-sensitive segments.

Who Are the Key Players Leading the Charge in ADAS Innovation?

The global ADAS market is fiercely competitive, with major players investing in new technologies, partnerships, and acquisitions. Bosch offers a full-stack ADAS solution including radar, ultrasonic sensors, and software integration. Aptiv leads in connected architecture and software-defined systems. Continental AG and Valeo are focusing on cost-effective radar and camera units.

Mobileye, backed by Intel, is making waves in AI-driven vision systems and autonomous vehicle platforms. Meanwhile, partnerships such as Volkswagen and Mobileye, and Hyundai and Aptiv (Motional) are pushing the envelope in shared R&D for scalable ADAS platforms.

- Aisin

- Ambarella

- Aptiv

- Autoliv

- Bosch

- Continental

- Denso

- Mobileye

- Valeo

What’s New in the ADAS Market Between 2024 and 2025?

Recent years have been pivotal for ADAS development. In 2024, the EU GSR2 regulations came into effect, mandating multiple ADAS features. Tesla’s Navigate on Autopilot received an upgrade for city navigation. In 2025, Nissan announced collaboration with Valeo to embed solid-state LiDAR in its 2026 vehicle lineup. India’s Ministry of Road Transport and Highways (MoRTH) declared its intention to mandate AEB by 2026. These regulatory and technological milestones reinforce the forward momentum of the industry.

What Strategic Moves Should Stakeholders Consider for the Next Decade?

To maintain competitive advantage and ensure mass adoption, OEMs should invest in scalable, modular ADAS platforms that can cater to both budget and luxury vehicles. Tech firms must focus on software integration, AI algorithms, and cybersecurity, which are essential for real-time and secure operations. Governments and regulatory bodies must support 5G infrastructure and issue clear guidelines on V2X communication standards.

For aftermarket providers, offering low-cost, easy-to-install kits will help penetrate untapped markets, especially in Southeast Asia, Latin America, and Africa. Additionally, public awareness campaigns highlighting the safety benefits of ADAS could accelerate adoption in regions where education around vehicle technology is limited.