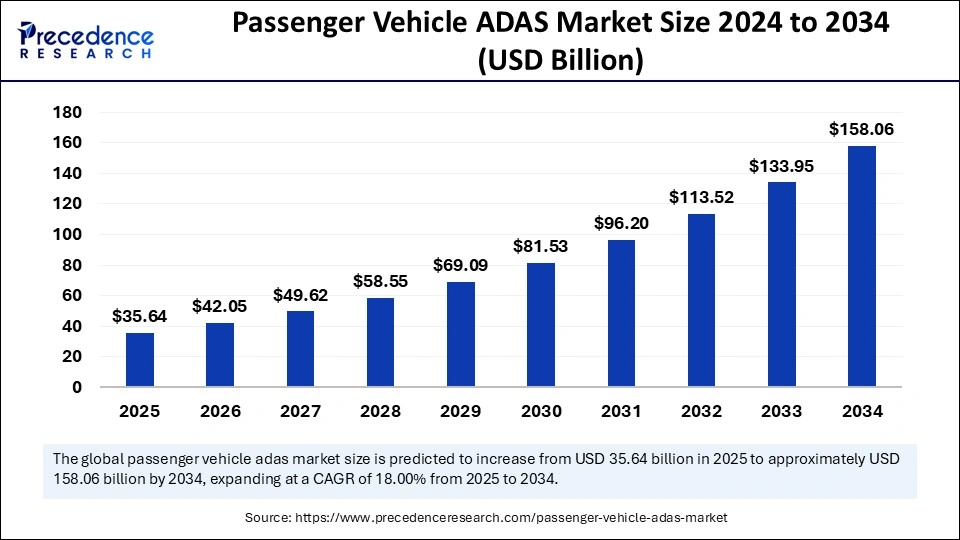

The global passenger vehicle ADAS market size was estimated at USD 30.20 billion in 2024 and is expected to surpass around USD 158.06 billion by 2034, growing at a CAGR of 18% from 2025 to 2034.

Passenger Vehicle ADAS Market Key Insights

-

North America led the global market with the highest share of 36% in 2024.

-

The Asia Pacific market is estimated to expand at the fastest CAGR between 2025 and 2034.

-

Europe has been expanding at a significant pace in the global market.

-

By system, the lane departure warning system segment held the largest market share of 16% in 2024.

-

The adaptive cruise control segment is anticipated to grow remarkably between 2025 and 2034.

-

By sensor, the radar segment captured the biggest market share in 2024.

-

The LiDAR segment is expected to expand at a notable CAGR over the projected period.

-

By vehicle, the SUV segment captured the biggest market share in 2024.

-

The hatchback segment is expected to grow at a notable CAGR over the projected period.

-

By distribution channel, the OEM segment captured the biggest market share in 2024.

-

The after-market segment is expected to grow rapidly over the projected period.

Role of AI in Passenger Vehicle ADAS Market

Artificial Intelligence (AI) is at the core of advancements in the Passenger Vehicle Advanced Driver Assistance Systems (ADAS) market. AI enables ADAS to process vast amounts of data from various sensors—including cameras, radar, and LiDAR—in real time to make precise decisions. It enhances the accuracy of object detection, lane-keeping, pedestrian recognition, and adaptive cruise control, making driving safer and more efficient.

Furthermore, AI allows ADAS systems to learn from driving behaviors and environmental patterns through deep learning algorithms. This continuous learning process improves system responsiveness and decision-making in complex driving scenarios such as urban traffic, adverse weather, or unpredictable pedestrian movement. AI also plays a crucial role in enabling semi-autonomous and autonomous driving capabilities, positioning it as a fundamental driver of innovation in the passenger vehicle ADAS landscape.

Market Overview: Enhancing Safety and Driving Experience

The Passenger Vehicle Advanced Driver Assistance Systems (ADAS) market has emerged as a pivotal segment in the evolution of automotive safety and autonomous technologies. ADAS includes a suite of electronic systems that assist drivers in driving and parking functions using sensors, cameras, radar, LiDAR, and control units. These systems enhance vehicle safety by reducing human error, which is a leading cause of road accidents globally. From basic features like rear-view cameras and parking sensors to more sophisticated systems like lane-keeping assist, adaptive cruise control, and automated emergency braking, ADAS is becoming increasingly standard in modern passenger vehicles. With automotive OEMs focusing on electrification, connectivity, and autonomy, ADAS technologies serve as a foundational layer for future self-driving capabilities, thereby driving market growth significantly.

Get the Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6024

Passenger Vehicle ADAS Market Growth Factors

The rapid advancement in sensor technologies, AI-based perception systems, and vehicle-to-everything (V2X) communication is fueling the growth of the ADAS market in the passenger vehicle segment. Consumers are increasingly prioritizing vehicle safety features, pushing OEMs to integrate ADAS even in mid-range and economy vehicles. Additionally, regulatory mandates across major economies requiring specific ADAS functions in new vehicles—such as automatic emergency braking and lane departure warning—are accelerating adoption. The growing demand for semi-autonomous driving features, along with rising investments in autonomous driving R&D, is further expanding the scope of ADAS. Moreover, developments in 5G connectivity and edge computing enhance real-time data processing, making ADAS systems more reliable and efficient.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 158.06 Billion |

| Market Size in 2025 | USD 35.64 Billion |

| Market Size in 2024 | USD 30.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System, Sensors, Vehicle, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers: Rising Safety Awareness and OEM Initiatives

One of the primary drivers of the passenger vehicle ADAS market is the increasing consumer awareness around road safety and the benefits of driver-assist features. Governments and insurance companies are also incentivizing vehicles with advanced safety systems, further encouraging buyers to choose ADAS-equipped models. Automotive manufacturers are responding by integrating ADAS technologies as standard or optional features across various segments, including compact and budget vehicles. Additionally, the competitive push among OEMs to differentiate their offerings with premium features is leading to greater adoption of high-level ADAS functionalities. The development of electric vehicles (EVs), which often include modern digital platforms, provides an ideal base for ADAS integration, amplifying its reach in the passenger car segment.

Opportunities: AI-Powered Systems and Autonomous Vehicle Transition

Significant opportunities lie in the convergence of ADAS with artificial intelligence (AI), which enables real-time object recognition, behavioral prediction, and autonomous decision-making. AI-powered ADAS systems are expected to enhance the accuracy and responsiveness of functions like pedestrian detection, traffic sign recognition, and lane change assist. Another major opportunity is the integration of ADAS with cloud-based platforms, allowing over-the-air (OTA) updates and predictive diagnostics. As Level 2 and Level 3 automation becomes more mainstream in passenger vehicles, the demand for robust ADAS platforms will grow, offering scope for innovation and partnership among automotive OEMs, tier-1 suppliers, and tech firms. Additionally, the growth of mobility services and autonomous ride-sharing fleets will necessitate highly advanced driver assistance technologies to ensure safety and efficiency.

Challenges: Cost, Infrastructure, and Standardization Issues

Despite its promise, the ADAS market faces a range of challenges. High system costs, especially for features using radar and LiDAR, make it difficult for full-scale integration in low-cost passenger vehicles, particularly in emerging economies. The lack of uniform safety regulations and technical standards across regions also hampers widespread deployment. Furthermore, ADAS performance can be significantly impacted by weather conditions, poor road infrastructure, or inaccurate map data, limiting its effectiveness in real-world scenarios. Driver over-reliance on these systems, without proper understanding of their limitations, can also result in misuse or complacency. Addressing cybersecurity vulnerabilities and ensuring data privacy in ADAS-enabled, connected cars is another growing concern among regulators and consumers alike.

Regional Outlook

Geographically, Europe and North America dominate the passenger vehicle ADAS market, thanks to stringent safety regulations, high consumer awareness, and mature automotive ecosystems. The European Union’s General Safety Regulation mandates the inclusion of several ADAS features in all new cars starting in 2024, providing a significant regulatory boost. In North America, the presence of major OEMs and tech providers, along with favorable regulatory developments by the NHTSA, supports widespread ADAS deployment.

The Asia-Pacific region, particularly China, Japan, and South Korea, is poised for rapid growth over the next decade. China, with its aggressive push toward intelligent and connected vehicles, is investing heavily in ADAS and autonomous driving infrastructure. Japan’s strong automotive sector and technology leadership in sensing and imaging solutions also contribute to market momentum. Meanwhile, India and Southeast Asian markets are gradually catching up, driven by improving road safety standards and increasing vehicle electrification. Latin America and the Middle East are emerging markets, where cost sensitivity and infrastructure limitations pose barriers, but rising automotive demand creates long-term growth potential.

Passenger Vehicle ADAS Market Companies

- Aisin

- Ambarella

- Aptiv

- Autoliv

- Bosch

- Continental

- Denso

- Mobileye

- Valeo

Segments Covered in the Report

By System

- Adaptive cruise control

- Blind spot detection

- Lane departure warning system

- Automatic emergency braking (AEB)

- Forward collision warning

- Night vision system

- Driver monitoring

- Tire pressure monitoring system

- Head-up display

- Park assist system

- Others

By Sensor

- Radar

- Lidar

- Camera

- Others

By Vehicle

- Sedan

- SUV

- Hatchback

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Read More: Industrial Noise Control Market

Source: https://www.precedenceresearch.com/passenger-vehicle-adas-market