What Is Driving the Surge in the Off-Highway Vehicle Lighting Market?

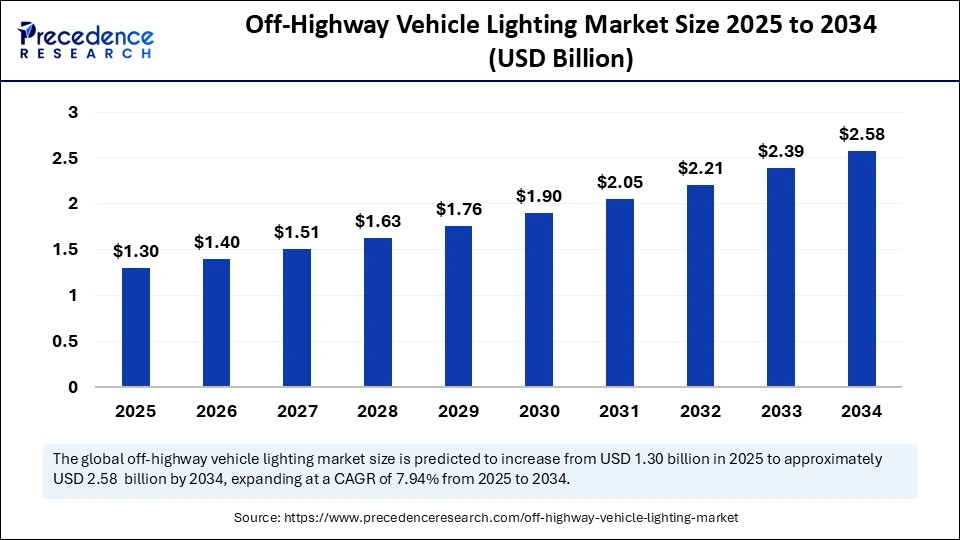

The global off-highway vehicle lighting market size reached USD 1.20 billion in 2024 and is predicted to increase from USD 1.30 billion in 2025 to approximately USD 2.58 billion by 2034, expanding at a CAGR of 7.94% from 2025 to 2034, is largely attributed to the expanding demand for construction, agricultural, and mining equipment, as well as rising safety standards across heavy-duty vehicle operations. Urbanization and infrastructural modernization are intensifying the use of heavy equipment in non-road environments, where superior lighting is essential for operational efficiency and safety. At the same time, the integration of advanced technologies, such as adaptive lighting and artificial intelligence, coupled with the global shift toward sustainability and low-emission solutions, is transforming traditional lighting into smart, eco-efficient systems.

What Exactly Is Off-Highway Vehicle Lighting, and Why Does It Matter?

Off-highway vehicle lighting refers to lighting systems engineered specifically for vehicles that operate off public roads, such as in construction sites, farms, mines, and remote forests. Unlike conventional automotive lighting, these systems must endure harsher environments, including dust, moisture, extreme vibrations, and low-visibility conditions. The lighting serves multiple critical functions: ensuring visibility for operators during low-light or night operations, signaling other vehicles or personnel in the vicinity, and adhering to occupational safety standards. These lighting systems are crucial not only for preventing accidents and enhancing productivity but also for complying with industry-specific regulations that mandate robust illumination in hazardous work zones.

Get a Sample: https://www.precedenceresearch.com/sample/5964

What Forces Are Shaping the Future of This Market?

The key growth catalysts of this market are embedded in the rapid advancement of several industrial sectors. First, the rise of global construction activities, from smart cities to energy infrastructure, is driving the use of off-highway vehicles like excavators, dump trucks, and cranes, each of which relies on optimized lighting for safe operation. Similarly, the agricultural sector is undergoing mechanization and automation, demanding reliable lighting for tractors and harvesters operating through dusk and dawn. The mining industry, driven by demand for minerals and raw materials, also requires robust lighting to ensure underground and open-pit operations run safely.

Another powerful influence is technological innovation. The development of LED lighting, adaptive beam systems, and AI-enabled smart lighting is reshaping how lighting supports off-road operations. Government mandates and international safety regulations are encouraging manufacturers to integrate these high-tech solutions, especially in developed markets. On the flip side, the relatively high cost of LED lights, primarily due to expensive materials such as indium gallium nitride and aluminum gallium arsenide—continues to hinder mass adoption in price-sensitive regions.

Nevertheless, this restraint is giving rise to new opportunities. The push for green technologies is encouraging the development of energy-efficient lighting. Smart lighting systems, empowered by AI and IoT, are enabling dynamic illumination based on environmental inputs, vehicle movement, or hazard proximity. These advancements are making off-highway vehicle lighting more intelligent, sustainable, and operationally indispensable.

Can Artificial Intelligence Really Improve Vehicle Lighting?

Artificial intelligence is proving to be a game-changer in the realm of off-highway vehicle lighting. AI facilitates real-time adaptive lighting, which can automatically adjust brightness and beam direction depending on terrain, weather, or time of day, dramatically improving visibility and safety. Additionally, AI systems are now capable of hazard detection using integrated sensors and machine learning algorithms. These systems can recognize objects, changes in road conditions, or human presence, and automatically trigger lighting adjustments or alerts.

AI also plays a vital role in optimizing energy usage. By analyzing operational patterns and external conditions, AI-enabled lighting systems can reduce unnecessary power consumption, contributing to longer battery life in electric off-highway vehicles and aligning with sustainability goals. A prominent example is Marelli’s launch of a lighting domain control unit in China in March 2024. This innovation not only controls front and rear lighting but also enables 360-degree illumination, showcasing how AI and electronics are revolutionizing traditional lighting hardware.

How Are Different Product Types Performing in the Market?

Among all lighting technologies, halogen lights held the largest market share in 2024, accounting for approximately 57% of the total revenue. Their popularity stems from low production costs, widespread availability, and the ease of replacement. Halogen systems are particularly favored in regions with budget constraints or where high-performance features are not mandatory.

However, LED lighting is emerging as the most transformative segment, projected to expand at the fastest pace from 2025 to 2034. LEDs offer unmatched energy efficiency, longevity, and brightness. As manufacturers overcome cost barriers through scale and innovation, LED solutions are increasingly replacing halogen and HID (High-Intensity Discharge) technologies in premium and standard equipment lines alike. Although HID and incandescent lighting systems still serve certain niche markets, they are gradually being phased out due to their relatively lower performance and energy inefficiency.

Which Vehicles Are Powering Demand for Advanced Lighting?

In terms of vehicle types, tractors dominated the off-highway lighting market in 2024. This is a reflection of their extensive usage in both agriculture and construction. The mechanization of farming and the growing adoption of smart tractors equipped with GPS, sensors, and intelligent lighting are propelling this segment’s growth.

Meanwhile, dump trucks are expected to see the fastest growth in lighting demand during the forecast period. These vehicles are critical in mining and large-scale construction operations, where visibility in dark or dusty environments is paramount. The safety and compliance standards in these sectors often require the integration of premium lighting solutions, spurring OEMs and suppliers to innovate with rugged, high-lumen systems that can withstand extreme conditions.

Where Is Lighting Technology Being Used Most Effectively?

The headlamp segment accounted for the lion’s share of the market in 2024 and is expected to retain its lead throughout the forecast period. Headlamps are essential for safe operation in low-light, foggy, or dusty conditions and are often the first line of safety in worksite navigation. The growing adoption of LED and HID technologies is enhancing the brightness, energy efficiency, and durability of headlamps.

Other lighting components such as tail lamps and work lights are also gaining traction. Work lights are particularly crucial in scenarios involving nighttime construction, harvesting, or emergency repairs, while tail lamps enhance safety through clear signaling and visibility from the rear.

Which End-Use Sectors Are Investing the Most in Lighting Solutions?

The construction sector held the largest share of the off-highway vehicle lighting market in 2024, underpinned by global infrastructure initiatives ranging from bridges to commercial buildings. Construction sites often involve continuous operation, where robust lighting systems improve both efficiency and safety in potentially dangerous work environments.

Looking forward, the agriculture, farming, and forestry segment is expected to grow at the fastest rate. The increasing global population is driving food production needs, resulting in widespread agricultural mechanization. Farming operations frequently occur in early mornings or evenings, necessitating dependable lighting for activities such as plowing, harvesting, and transportation. Additionally, forestry operations in remote areas demand specialized lighting capable of functioning in dense, dark environments with minimal power sources.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.58 Billion |

| Market Size in 2025 | USD 1.3 Billion |

| Market Size in 2024 | USD 1.2 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.94% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Vehicle, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Which Regions Are Leading the Charge—and Why?

Asia Pacific: Why Is This Region Leading the Market?

Asia Pacific led the global market in 2024, accounting for approximately 33% of global revenues. The regional market size is projected to grow from USD 396 million in 2024 to USD 864.3 million by 2034, expanding at a CAGR of 8.12%. China, in particular, has established itself as a major player thanks to a robust manufacturing ecosystem, widespread electrification efforts, and smart city initiatives. The government’s strong push for electric vehicle adoption is creating demand for advanced, energy-efficient lighting technologies.

Countries such as Japan, India, and South Korea are also significantly contributing to market growth, with a focus on LED adoption and infrastructure development.

Europe: Can Strict Regulations Fuel Innovation?

Europe is forecasted to be the fastest-growing regional market, primarily due to stringent safety and environmental regulations. Countries like Germany, the UK, and France are pushing OEMs to adopt cutting-edge technologies in off-highway vehicles. In June 2024, Lazer Lamps Ltd launched its Elite+ range, featuring yellow LED modules combined with high-output white light—demonstrating the region’s commitment to innovation and premium performance.

Read Also: Artificial Intelligence in Self-Driving Cars Market Size, Forecast by 2034

North America: How Are OEMs Responding to Market Demands?

North America is expected to witness substantial growth driven by the well-established presence of OEMs and high demand in construction, mining, and agriculture sectors. The U.S., in particular, is leading with initiatives in adaptive lighting technologies and matrix LED solutions. Yamaha’s 2025 ATV lineup, unveiled in August 2024, showcased advanced off-road lighting features focused on safety, comfort, and capability—highlighting how product innovation is central to competitive strategy.

Who Are the Key Players and What Are They Doing?

The competitive landscape is comprised of both long-established companies and innovative disruptors. Key players include:

- ABL Lights Group

- Truck-Lite

- APS Lighting and Safety

- Hamsar Diversco Inc.

- J.W. Speaker Corporation

- WESEM

- HELLA GmbH and Co. KGaA

- Grote Industries

- ECCO Safety Group

- Peterson Manufacturing Co.

- Valeo

Launches Shaping the Market?

In recent developments, Kia showcased its off-road capable EV9 concept at SEMA 2024, integrating unique light bars for aesthetic and safety appeal. Similarly, Dongfeng launched the M-Hero 917 Dragon Armor Edition in collaboration with the film “Operation Leviathan”illustrating how lighting is becoming a key differentiator in vehicle branding and user experience.

What Does the Future Hold for This Market?

The off-highway vehicle lighting market is set to experience robust and sustained growth through 2034. As the need for safer, smarter, and more sustainable machinery increases, so too will the demand for advanced lighting systems. Stakeholders should embrace AI integration, invest in LED innovation, and align with sustainability and compliance standards to capture long-term value.

Strategic recommendations include:

-

Investing in smart lighting systems with AI and IoT capabilities

-

Collaborating with technology firms to co-develop intelligent lighting platforms

-

Accelerating the transition from halogen to LED systems

-

Enhancing regulatory compliance while optimizing energy usage