How Fast Is the Micro Electric Vehicle Market Growing?

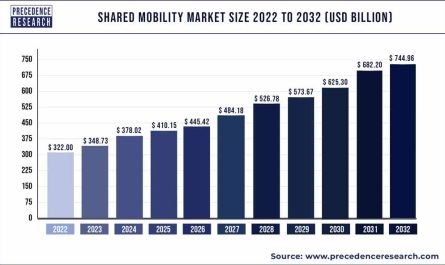

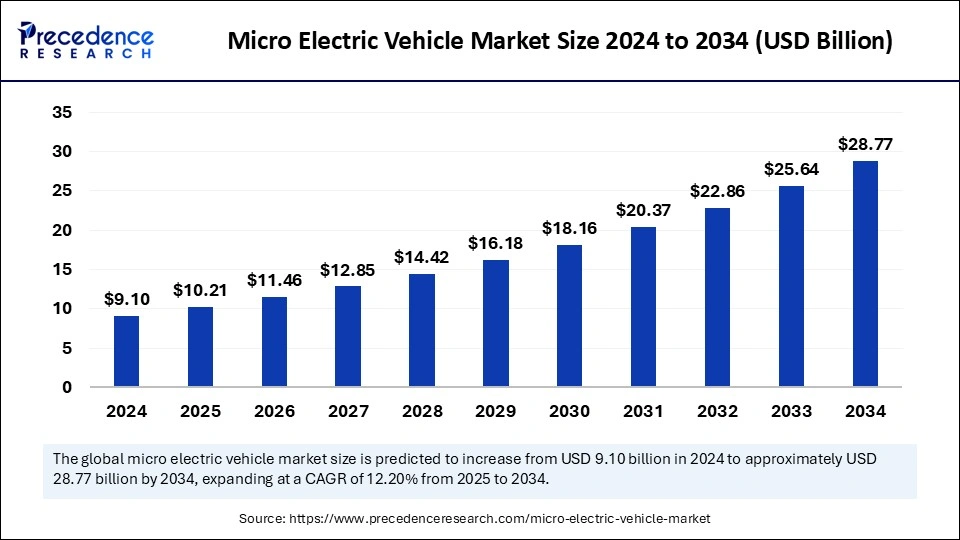

The global micro electric vehicle (MEV) market is experiencing a significant growth trajectory. From a valuation of USD 9.10 billion in 2024, the market is set to expand to USD 10.21 billion in 2025 and is projected to reach USD 28.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.20%. This impressive expansion is largely driven by rising urban density, surging demand for cost-effective personal and commercial transport, and a broader global transition toward electric mobility. Governments, businesses, and consumers alike are embracing MEVs for their compact form factor, low emissions, and suitability for congested environments.

What Are the Key Trends Defining the Future of MEVs?

Several pivotal trends are shaping the MEV landscape. In 2024, North America led the market with a dominant 41% share due to strong policy backing and EV infrastructure. Yet, Asia Pacific is on track to become the fastest-growing region, powered by urban development and electrification policies in China, India, and Japan. Among vehicle types, golf carts captured the largest market share thanks to their commercial versatility, while quadricycles are forecasted to expand rapidly due to their appeal for urban commuting. In the battery segment, lithium-ion technology remains dominant due to its superior performance, but lead-acid batteries are gaining traction in emerging markets for their affordability. Meanwhile, commercial use cases such as last-mile delivery and municipal fleets are currently leading demand, while personal use segments are gaining momentum as consumers seek low-cost, eco-friendly mobility options.

How Are Technology and Urbanization Reshaping MEV Demand?

Urban congestion and sustainability goals are accelerating demand for MEVs worldwide. As cities push smart mobility agendas, MEVs are emerging as ideal solutions for urban commuting, last-mile delivery, and shared mobility services. Advanced battery technologies—such as high-energy lithium-ion batteries and smart battery management systems—are enhancing range, efficiency, and durability. The use of lightweight materials such as carbon composites is improving energy efficiency and maneuverability. Moreover, AI integration is revolutionizing micro EVs, enabling features like predictive maintenance, adaptive cruise control, and voice-activated interfaces. As smart cities continue to evolve, these innovations are transforming MEVs from basic electric carts into intelligent, connected vehicles.

Why Are Certain Regions Driving MEV Growth Faster Than Others?

The United States is a stronghold for MEVs, with the market forecasted to grow from USD 2.80 billion in 2024 to USD 9.01 billion in 2034, backed by a supportive policy environment, EV tax credits, and robust public transport electrification initiatives. Cities like Los Angeles and San Francisco are integrating MEVs into ride-share systems and municipal fleets. In contrast, Asia Pacific is emerging as the fastest-growing region, bolstered by China’s large-scale subsidies, India’s fuel price sensitivity, and Japan’s push for low-emission vehicles tailored to an aging population. In Europe, MEV adoption is driven by carbon-neutrality commitments, EV-friendly regulations, and growing interest in car-sharing models. Countries like Germany and France are pioneering policies that align with urban electrification and last-mile logistics, boosting MEV integration across the region.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.77 Billion |

| Market Size in 2025 | USD 10.21 Billion |

| Market Size in 2024 | USD 9.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.20% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Battery Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Makes Micro Electric Vehicles So Relevant Today?

Micro electric vehicles are small, battery-powered vehicles designed for urban and short-range transport, typically offering a top speed between 60 to 100 km/h and a range of up to 200 km. Built using compact, lightweight materials, MEVs consume less power and are easier to maneuver in tight urban spaces. Their affordability, zero-emission profile, and compact structure make them especially attractive for eco-conscious individuals and organizations. MEVs are used in diverse environments, from city centers and residential neighborhoods to industrial campuses, recreational resorts, and university towns. In an era of increasing climate awareness and urban congestion, MEVs present a scalable and sustainable mobility solution.

What’s Fueling the MEV Market, and What’s Holding It Back?

The MEV market is buoyed by strong growth drivers. Governments across the globe are offering incentives such as purchase subsidies, EV tax breaks, and carbon credits to promote clean transportation. Rising fuel prices, urban traffic issues, and the e-commerce boom are also accelerating MEV demand, particularly in logistics and shared mobility sectors. On the downside, the limited driving range of many MEVs—often lower than traditional EVs—can restrict their usability. Additionally, infrastructure constraints, especially in developing regions lacking adequate charging stations, remain a barrier. Despite these challenges, investments in smart city planning and battery innovation are expected to unlock new opportunities and mitigate these restraints in the coming years.

How Is the Market Segmented, and What Does That Mean for Stakeholders?

The MEV market is segmented across vehicle types, power sources, battery chemistries, applications, and regions, offering diverse entry points for investors and developers. By vehicle type, passenger MEVs are popular for daily commuting, while commercial and cargo MEVs are rapidly gaining traction in logistics, hospitality, and utility services. In terms of power source, battery electric vehicles (BEVs) dominate, offering zero-emission performance, followed by hybrids and plug-in hybrids in regions with transitional infrastructure. Lithium-ion batteries lead due to efficiency and lifecycle benefits, though lead-acid batteries remain favored in budget-conscious markets. Application-wise, MEVs serve everything from urban mobility and last-mile delivery to recreational use. Geographically, the market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each with unique drivers and adoption rates depending on local infrastructure, policy, and economic conditions.

Who Are the Industry Leaders Shaping the MEV Landscape?

- Yamaha Golf Cart Company

- Club Car LLC

- Textron Inc.

- Renault Group

- Toyota Motor Corporation

- Italcar Industrial S.r.l.

- PMV Electric Pvt. Ltd.

- Alke

- Polaris

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd

Read Also: Second-Life EV Batteries Set for a $12.42 Billion Boom by 2034

What’s New in the MEV Space in 2024 and 2025?

The MEV space is witnessing a burst of innovation and deployment activity. In April 2024, Geely launched the Panda Mini EV in China with a sporty new design tailored for urban dwellers. In August 2024, Indian startup Wings EV unveiled the Robin, a compact two-seater microcar designed for affordability, agility, and environmental performance. Meanwhile, Siemens partnered with Astor Enerji in October 2023 to roll out 200 fast chargers across Turkey, strengthening the EV ecosystem and encouraging MEV adoption nationwide. These developments reflect not just product evolution but a shift toward infrastructure and ecosystem readiness—critical elements for sustained MEV growth.

What Lies Ahead for Investors, Innovators, and Policymakers?

The future of the MEV market looks bright, powered by technological innovation, supportive regulation, and shifting consumer preferences toward compact and sustainable transportation. Investors will find rich opportunities in battery tech, smart infrastructure, and fleet electrification. For automakers, differentiation will come from delivering MEVs that are affordable, connected, and adaptable to urban challenges. Policymakers have a unique chance to integrate MEVs into public transport networks, emissions targets, and smart city planning. As the world reimagines urban mobility, micro electric vehicles are no longer a fringe solution—they are the linchpin of tomorrow’s transport revolution.