Intelligent Battery Sensor Market Key Points

-

Asia Pacific accounted for the largest revenue share of 33% in 2024.

-

North America is projected to grow at a CAGR of 10.1% from 2025 to 2034.

-

By sensor type:

-

The integrated sensors segment held the highest revenue share of 42% in 2024.

-

The voltage sensors segment is expected to grow at a remarkable CAGR during the forecast period.

-

-

By sales channel:

-

The OEM segment dominated the intelligent battery sensor market in 2024.

-

The aftermarket segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

-

-

By application:

-

The battery management systems segment held the largest market share in 2024.

-

The telematics segment is projected to grow rapidly between 2025 and 2034.

-

-

By end use:

-

The automotive manufacturers segment led the market in 2024.

-

The renewable energy providers segment is forecasted to grow at the highest CAGR during the forecast period.

-

Intelligent Battery Sensor Overview

An Intelligent Battery Sensor (IBS) is a smart device integrated into a vehicle’s battery system to monitor key parameters such as voltage, current, temperature, and state of charge (SoC). It provides real-time data to the vehicle’s energy management system, ensuring optimal battery performance and helping prevent battery failures. IBS plays a critical role in modern vehicles, especially those equipped with start-stop systems, by managing battery loads and improving fuel efficiency.

Applications and Benefits

IBS enhances vehicle reliability by enabling proactive battery maintenance and diagnostics. It supports energy-efficient functions like idle stop-start, regenerative braking, and electric power steering. In electric and hybrid vehicles, IBS contributes to battery longevity and performance optimization. As vehicles become more electrified and connected, the demand for advanced battery monitoring solutions like IBS is growing rapidly across automotive segments.

How Does AI Enhance the Functionality of Intelligent Battery Sensors?

AI significantly boosts the performance of Intelligent Battery Sensors (IBS) by enabling accurate, real-time analysis of battery health, charge levels, and energy consumption patterns. Through machine learning algorithms, AI can detect subtle changes in voltage, temperature, and current to predict battery failures or inefficiencies before they occur. This predictive capability ensures optimized battery management, enhances vehicle safety, and extends battery life, especially in electric and hybrid vehicles.

Can AI Improve Energy Efficiency and Vehicle Intelligence through Battery Sensors?

Absolutely. AI empowers Intelligent Battery Sensors to communicate more effectively with vehicle management systems, enabling smarter energy distribution based on driving behavior, environmental conditions, and power demands. This leads to improved energy efficiency, better regenerative braking strategies, and seamless integration with other vehicle systems like start-stop functions and hybrid powertrains, making the vehicle more responsive, sustainable, and intelligent overall.

Intelligent Battery Sensor Market Growth Factors

The Intelligent Battery Sensor (IBS) market is being driven primarily by the increasing adoption of electric vehicles (EVs), hybrids (HEVs and PHEVs), and start-stop systems in modern automobiles. These advanced vehicles require precise, real-time monitoring of battery status—such as charge level, voltage, current, and temperature—to ensure efficiency, safety, and longer battery life. Additionally, governments around the world are implementing stricter fuel economy and emission regulations, pushing automakers to adopt intelligent battery sensors even in conventional vehicles to enhance energy management and reduce carbon footprints.

Another major factor contributing to the market’s growth is the rise in global vehicle production, especially in rapidly developing countries across Asia-Pacific, such as China and India. As automotive electronics become more sophisticated, intelligent battery sensors are essential for supporting advanced features like CAN/LIN communication, onboard diagnostics, and energy recovery systems. These sensors play a critical role in ensuring battery performance and longevity while enabling efficient energy distribution throughout the vehicle, further accelerating their demand across both passenger and commercial vehicle segments.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6194

Intelligent Battery Sensor Market Scope

| Report Coverage | Details |

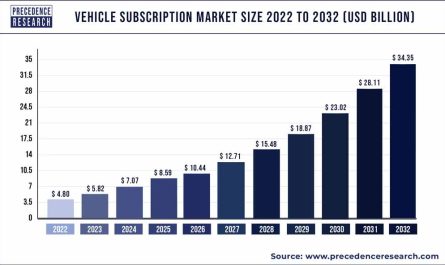

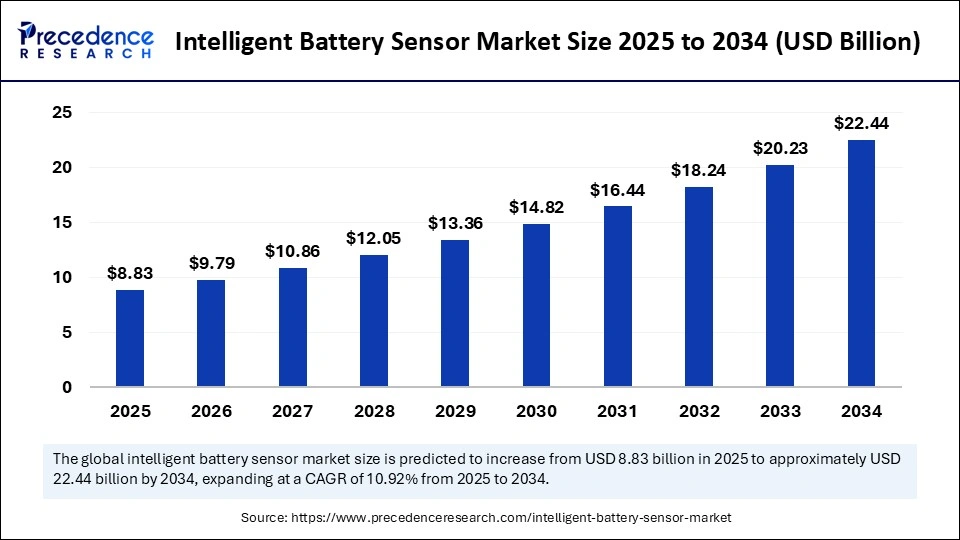

| Market Size by 2034 | USD 22.44 Billion |

| Market Size in 2025 | USD 8.83 Billion |

| Market Size in 2024 | USD 7.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component, Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Intelligent Battery Sensor Market Dynamics

Market Drivers

The intelligent battery sensor (IBS) market is gaining momentum due to the growing demand for fuel-efficient and reliable vehicles. Modern vehicles increasingly rely on electronics, and IBS plays a crucial role in monitoring battery parameters such as voltage, current, temperature, and state of charge (SoC), which are essential for optimizing energy usage and maintaining battery health. The surge in adoption of start-stop systems and regenerative braking in both conventional and hybrid vehicles further accelerates the need for intelligent battery sensors.

Additionally, stringent emission regulations and growing consumer demand for enhanced safety, reliability, and battery performance are driving OEMs to integrate advanced battery monitoring technologies. The proliferation of electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) also fuels market growth, as these vehicles rely heavily on efficient battery management systems (BMS), where IBS is a core component.

Opportunities

The ongoing electrification of the automotive industry presents vast opportunities for the intelligent battery sensor market. With the rise in electric mobility, the need for precise and real-time battery monitoring solutions is becoming critical. Innovations in connected vehicles and smart diagnostics open up possibilities for integrating IBS with cloud-based platforms for predictive analytics and remote diagnostics. Moreover, advancements in sensor technology, miniaturization, and IoT integration can enable the development of more intelligent and multifunctional battery sensors.

As governments around the world offer incentives and infrastructure support for EV adoption, the demand for intelligent battery monitoring and management solutions is expected to soar. Emerging applications in industrial battery systems, renewable energy storage, and unmanned vehicles (such as drones and delivery robots) further extend the use cases for IBS beyond the automotive sector.

Challenges

Despite its growth potential, the intelligent battery sensor market faces several challenges. One of the primary concerns is the high cost of advanced sensors, which can affect the pricing of mid-range and budget vehicles. Additionally, the complexity of integrating IBS into existing vehicle architectures, especially in older or low-end models, can be a barrier to widespread adoption. Reliability and long-term durability of sensors in harsh automotive environments also remain critical issues.

Furthermore, data accuracy and sensor calibration must be maintained to ensure optimal performance, which requires continuous innovation and quality control. The transition to electric vehicles adds complexity in terms of thermal management, safety compliance, and system integration, placing additional technical and regulatory burdens on IBS developers and manufacturers.

Regional Outlook

Europe holds a significant share in the intelligent battery sensor market, driven by strong environmental regulations, high vehicle electrification rates, and a well-established automotive industry. Germany, in particular, is a leader in IBS adoption due to its advanced vehicle engineering capabilities and push toward sustainability. North America is another major market, led by the U.S., where the growing adoption of start-stop technology, hybrid powertrains, and connected vehicle systems supports IBS deployment.

The Asia-Pacific region is poised for the fastest growth, fueled by rapid expansion in automotive manufacturing in countries like China, Japan, South Korea, and India. China’s aggressive EV adoption policies and large-scale production of electric vehicles create a massive demand for battery sensors. Meanwhile, Latin America and the Middle East & Africa are emerging markets, where the uptake of smart automotive technologies is slower but steadily growing, offering long-term growth potential for IBS manufacturers.

Intelligent Battery Sensor Market Companies

- Robert Bosch GmbH

- Continental AG

- HELLA GmbH & Co. KGaA

- NXP Semiconductors N.V.

- Midtronics, Inc.

- Valence Technology, Inc.

- Texas Instruments Inc.

- DENSO Corporation

- Analog Devices, Inc.

- Infineon Technologies AG

- TE Connectivity Ltd.

- Eberspaecher Vecture Inc.

- Current Ways Inc.

- Murata Manufacturing Co., Ltd.

- Delphi Technologies

Intelligent Battery Sensor Market Recent Developments

- In December 2024, Butlr announced the launch of a wireless and anonymous AI sensor featuring a multi-year battery life, scalability, and real-time ultra precise insights into how people interact in their environments. Data from Butlr sensors is used to transform buildings into adaptive, data-driven spaces that enhance human experience while improving operational efficiency.

- In November 2023, the United Safety & Survivability Corporation announced the launch of its latest innovation, a Lithium-Ion Battery Failure Detection Sensor. This groundbreaking product sets a new standard for safety for electric vehicles across industries.

Segment Covered in the Report

By Sensor Type

- Voltage Sensors

- Current Sensors

- Temperature Sensors

- Integrated Sensors

By Sales Channel

- OEM

- Aftermarket

By Application

- Battery Management Systems (BMS)

- Telematics

- Start-Stop Systems

By End Use

- Automotive Manufacturers

- Fleet Operators

- Telecommunications Companies

- Renewable Energy Providers

- Aerospace & Defense

- Consumer Electronics

- Others

By Region

- North America

- APAC

- Europe

- Latin America

- MEA

Also Read: Automotive Drivetrain Market

Source: https://www.precedenceresearch.com/intelligent-battery-sensor-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344