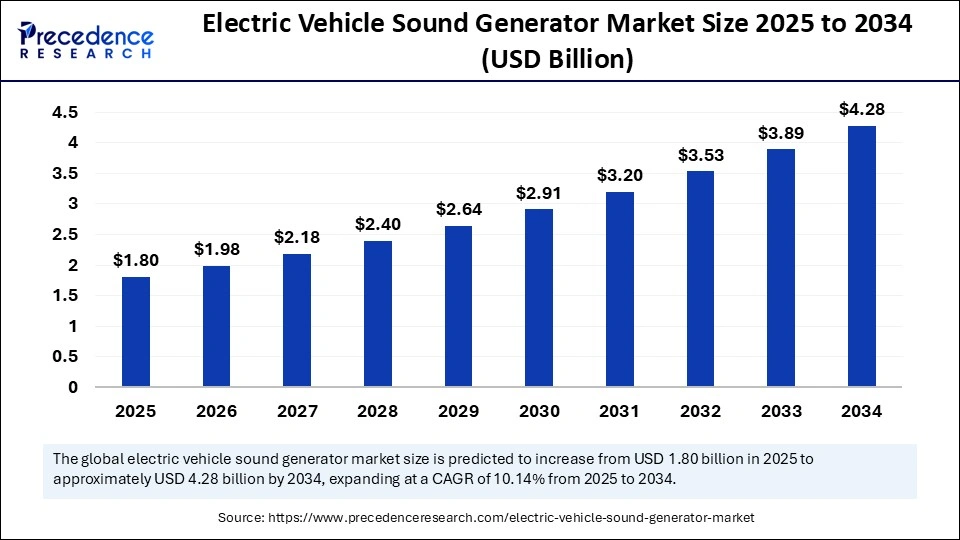

The global electric vehicle sound generator market size is exhibited at USD 1.80 billion in 2025 and is anticipated to reach around USD 4.28 billion by 2034, growing at a CAGR of 10.14% from 2025 to 2034.

The Electric Vehicle Sound Generator market is rapidly gaining momentum as the global shift toward electric mobility accelerates. One of the unique challenges posed by electric vehicles (EVs) is their near-silent operation at low speeds. While this quietness is often seen as a benefit, it creates a significant safety risk, especially for pedestrians and cyclists who rely on auditory cues to detect nearby vehicles. To address this issue, the EVSG—also known as Acoustic Vehicle Alerting Systems (AVAS)—has become a mandatory feature in many countries. These systems emit artificial sounds to alert pedestrians of an approaching EV. In response to regulatory mandates, automakers are increasingly integrating sound generators into their EVs during the production phase, while the aftermarket for retrofitting existing vehicles is also growing. According to market research, the global EVSG market was valued at approximately USD 145 million in 2023 and is projected to grow to over USD 2.1 billion by 2032, representing a compound annual growth rate (CAGR) of about 34%. Other forecasts suggest an even larger market—up to USD 7.4 billion by 2035—indicating the sector’s dynamic expansion.

Get a Sample: https://www.precedenceresearch.com/sample/6121

The Role of AI in EV Sound Systems

Artificial Intelligence is playing an increasingly pivotal role in reshaping EVSG technology. In its early stages, sound generation was largely a mechanical or pre-programmed function, emitting static tones at specific vehicle speeds. However, with advancements in AI and machine learning, modern EV sound systems are becoming far more intelligent and adaptive. AI-powered EVSGs can adjust the volume, tone, and direction of emitted sounds based on real-time data such as speed, location, pedestrian proximity, and ambient noise levels. Some advanced systems can even detect specific environmental factors—like a crowded urban street or a quiet residential area—and adapt their sounds accordingly. Research into generative AI is also unlocking possibilities for customizable sound profiles that align with a brand’s identity or a driver’s personal preferences. This opens up the potential for creating a richer and more intuitive acoustic environment that enhances safety without contributing to urban noise pollution. In the long term, AI-driven systems are expected to become essential components in the broader vehicle communication ecosystem, integrating seamlessly with autonomous driving technologies and vehicle-to-everything (V2X) systems.

Growth Factors Driving Market Expansion

Several critical factors are fueling the explosive growth of the EVSG market. First and foremost are global regulatory mandates. The European Union has required all new electric and hybrid vehicles to include AVAS since July 2019, and similar regulations have been enacted in the United States, Japan, South Korea, and China. These legal requirements create a built-in demand for sound generators across all EV segments. Another key driver is the rapid adoption of electric vehicles, spurred by global decarbonization goals, government incentives, and declining battery costs. As the global EV fleet grows, so too does the market for sound generators. Additionally, heightened awareness around pedestrian and cyclist safety is prompting both public institutions and private manufacturers to prioritize audible alert systems. Beyond compliance and safety, EVSGs are also becoming a means for automakers to differentiate their vehicles. A distinctive, branded sound can enhance the driving experience and serve as an acoustic signature that reinforces brand identity. The convergence of these trends—regulatory, technological, and experiential—is setting the stage for robust long-term growth in the EVSG market.

Regional Insights

Regional dynamics in the EVSG market vary significantly based on regulatory maturity, EV adoption rates, and industrial capacity. North America currently holds a substantial share of the market, driven by strict safety mandates from the National Highway Traffic Safety Administration (NHTSA) and a strong push for EV adoption in states like California and New York. The market in the United States alone is expected to grow from USD 350 million in 2023 to over USD 1.2 billion by 2032. Europe is also a leading region, with early and strict implementation of AVAS regulations. Countries like Germany, the UK, and France have seen strong EV penetration, which is contributing to a projected market size of around USD 1.47 billion by 2032. Meanwhile, Asia-Pacific is emerging as the fastest-growing market, fueled by large-scale EV production in China, Japan’s early AVAS regulations, and India’s burgeoning two-wheeler EV segment. The region is projected to grow from USD 250 million in 2023 to nearly USD 1 billion by 2032. Latin America and the Middle East & Africa are currently smaller markets but show strong growth potential as their EV infrastructure and policy frameworks evolve.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.28 Billion |

| Market Size in 2025 | USD 1.80 Billion |

| Market Size in 2024 | USD 1.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.14% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sales Channel, Propulsion, Product, Vehicle, Component, Speed Range, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The primary driver of the EVSG market is the implementation of government regulations mandating sound generation in electric and hybrid vehicles. These regulations aim to protect pedestrians, particularly those who are visually impaired, from the risks posed by silent EVs operating at low speeds. Another significant driver is the increasing consumer awareness of safety in urban mobility. As more people shift to walking and cycling in congested cities, the demand for safer transportation solutions—like AVAS-equipped vehicles—continues to rise. Furthermore, OEMs are increasingly viewing sound generation not just as a compliance requirement but as a branding opportunity. Sound signatures can become a unique selling point, similar to how exhaust notes have historically differentiated internal combustion engines. On the technology front, advancements in acoustic engineering, digital signal processing, and AI integration are enabling more versatile and cost-effective EVSG solutions. All of these factors together create a compelling case for sustained market growth over the next decade.

Read Also: Mining Robotics Market Size to Surpass USD 3.70 Billion by 2034

Emerging Opportunities

As the EVSG market matures, new opportunities are emerging across both OEM and aftermarket channels. One of the most promising areas is the development of customizable sound profiles. Automakers can now offer unique acoustic branding—allowing consumers to choose or even design the sound their vehicle makes. This can become a key differentiator in the crowded EV market. Another opportunity lies in the integration of EVSGs with broader vehicle systems. Future models may use radar, lidar, or V2X technologies to trigger directional sounds or adjust alerts based on real-time conditions. This opens up possibilities for more intelligent pedestrian interactions, especially in autonomous vehicles. There’s also a growing aftermarket for retrofitting sound generators in older or budget EVs, particularly in regions like Southeast Asia where two- and three-wheel EVs are popular but often lack built-in AVAS systems. Finally, the commercial vehicle segment—including electric buses, delivery vans, and emergency vehicles—represents a high-growth niche with specific AVAS requirements. Tailoring solutions for these use cases could unlock new revenue streams for manufacturers.

Key Challenges

Despite strong momentum, the EVSG market faces several challenges. One major concern is the potential for urban noise pollution. As more EVs emit artificial sounds, city soundscapes could become cluttered and uncomfortable, undermining one of the core benefits of EVs—their quietness. Striking the right balance between safety and noise is critical. Another challenge is regulatory inconsistency across markets. For example, while the European Union mandates AVAS systems that emit sound from startup to 20 km/h, the UK allows drivers to disable the system at night. In the U.S., the AVAS must be operational whenever the vehicle is moving at low speeds, without manual override. This lack of harmonization complicates global manufacturing and compliance strategies for OEMs. Furthermore, the cost of high-tech systems, particularly those incorporating AI and real-time sensors, can be prohibitive for budget EV models. Finally, consumer acceptance poses a nuanced challenge. While some drivers appreciate the added safety, others find artificial sounds intrusive or gimmicky. Manufacturers must carefully design sounds that are both effective and pleasant to ensure broad adoption and user satisfaction.

Electric Vehicle Sound Generator Market Key Players

- Ansys

- Aptiv

- Brigade Electronics

- Continental

- Denso

- ECCO

- Forvia Hella

- Harman International

- Hyundai

- STMicroelectronics

Recent Developments

- In March 2025, Toyota announced the integration of Innova Hycross with the AVAS system, which is a pedestrian-safety device commonly found in electric and hybrid, and plug-in hybrid vehicles as these cars have no engine sound, which may cause danger to pedestrians. This system alerts pedestrians about their presence by emitting a low-frequency sound. (Source: https://timesofindia.indiatimes.com)

- In July 2024, Brose developed its own Acoustic Vehicle Alerting System that generates artificial driving noise at speeds below 50 km/h. The mechatronics specialist drew on its expertise in the fields of acoustics and electronics, where the company will equip several million electric and hybrid vehicles in Europe and North America with the new product. (Source- https://www.autocarpro.in)