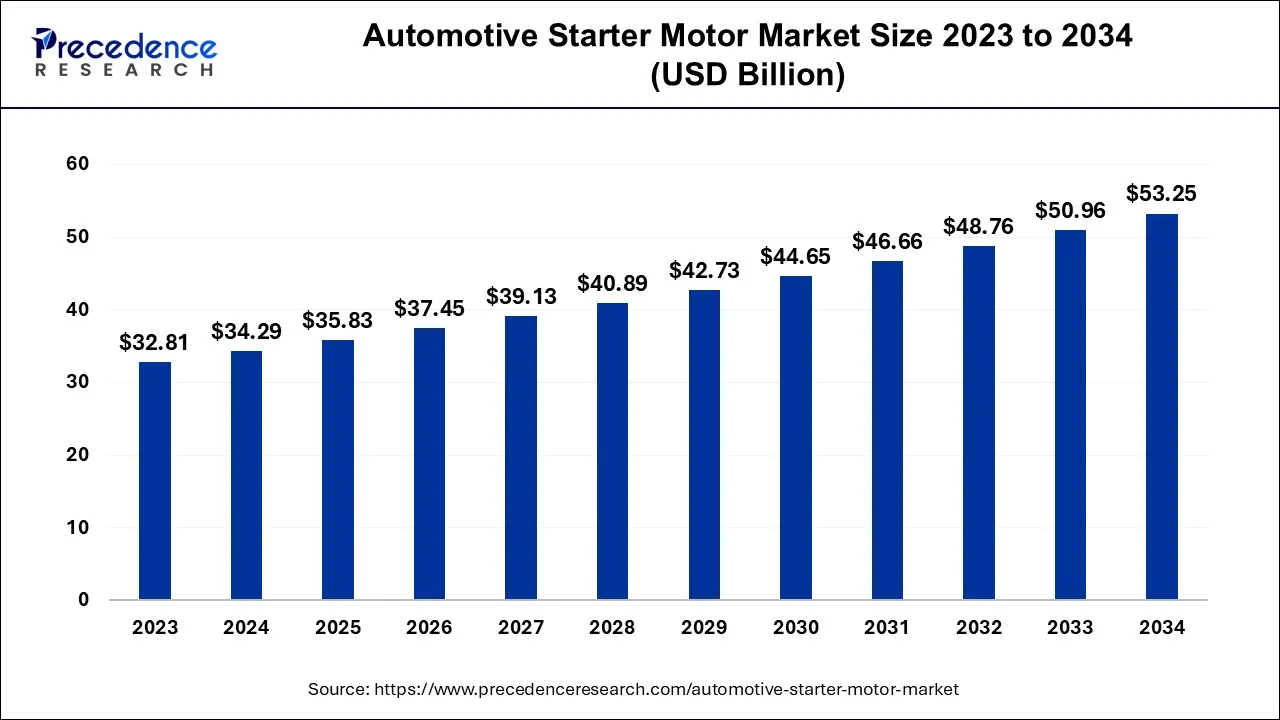

The automotive starter motor market size was valued at USD 34.29 billion in 2024 and is expected to cross around USD 53.25 billion by 2034 with a CAGR of 4.50%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/3453

What Is an Automotive Starter Motor and How Does It Work?

An automotive starter motor is an essential component in a vehicle’s ignition system responsible for initiating the engine’s operation. When the ignition key is turned or the start button is pressed, the starter motor engages with the engine’s flywheel to crank the engine and start the combustion process. It converts electrical energy from the vehicle’s battery into mechanical energy, providing the necessary torque to turn over the engine.

Starter motors typically consist of an electric motor and a solenoid. The solenoid acts as a switch that connects the motor to the battery and simultaneously pushes the starter gear to mesh with the engine’s flywheel. Once the engine starts running, the starter motor disengages automatically to avoid damage. Reliable starter motors are crucial for smooth and quick engine startups and are used in almost all internal combustion engine vehicles, including gasoline, diesel, and hybrid models.

Automotive Starter Motor Market Key Highlights

- The automotive starter motor market is valued at $35.83 billion in 2025.

- It is expected to reach $53.25 billion by 2034.

- The market is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- In terms of region, Asia-Pacific accounted for more than 41% of the revenue share in 2024, while North America is forecasted to grow at the fastest CAGR during the forecast period.

- By vehicle type, the commercial vehicles segment held the largest share of 65% in 2024, whereas the passenger cars segment is anticipated to grow at a strong CAGR of 5.8% between 2025 and 2034.

- By application, the internal combustion engine (ICE) segment dominated with a 60% market share in 2024, while the hybrid and micro-hybrid powertrain segment is expected to register the fastest growth over the coming years.

- By type, the electric starter motor segment led the market with a 32% share in 2024, whereas the hydraulic segment is projected to experience the highest CAGR during the forecast period.

- By sales channel, the OEM segment accounted for 55% of the market share in 2024, while the replacement and aftermarket segment is expected to grow at the fastest rate moving forward.

The Growing Role of AI in Enhancing Starter Motor Efficiency and Reliability

Artificial Intelligence (AI) is increasingly influencing the automotive starter motor market by enhancing design, manufacturing, and maintenance processes. AI-powered simulation tools enable engineers to optimize starter motor designs for improved efficiency, durability, and performance. Machine learning algorithms analyze operational data to predict potential failures and maintenance needs, reducing downtime and improving reliability. AI-driven quality control systems also help detect defects during production, ensuring higher product standards and lower warranty costs.

Furthermore, AI supports the integration of starter motors in advanced vehicle systems, particularly in hybrid and electric powertrains, where precise control and energy management are critical. Predictive analytics assist manufacturers and aftermarket providers in forecasting demand and managing supply chains more efficiently. Overall, AI is driving innovation, cost reduction, and improved customer satisfaction in the automotive starter motor market, helping stakeholders meet the evolving demands of modern vehicles.

Automotive Starter Motor Market Growth Factors

The automotive starter motor market is driven by the growing demand for reliable and efficient engine starting systems, especially as the global vehicle population continues to rise. Increasing production of commercial vehicles, which require robust starter motors to handle heavy-duty operations, significantly contributes to market growth. Additionally, the rising adoption of hybrid and micro-hybrid vehicles is boosting demand for advanced starter motors capable of integrating with complex powertrains. Technological advancements leading to more efficient, lightweight, and durable starter motors are also fueling market expansion. Moreover, expanding automotive manufacturing activities in emerging regions like Asia-Pacific, coupled with government initiatives promoting cleaner and fuel-efficient vehicles, are further accelerating market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 34.29 Billion |

| Market Size in 2025 | USD 35.83 Billion |

| Market Size by 2034 | USD 53.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle Type, By Type, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The automotive starter motor market is largely driven by the increasing global production of vehicles and the rising demand for reliable and efficient engine starting systems. The expansion of the commercial vehicle segment, which requires durable and high-performance starter motors, further fuels market growth. In addition, the shift toward hybrid and micro-hybrid vehicles has increased the need for advanced starter motors compatible with complex powertrains. Innovations in design, including lightweight and energy-efficient solutions, are also enhancing the performance and appeal of modern starter motors. Moreover, stricter emission regulations are encouraging automakers to adopt starter motor systems that support cleaner and fuel-efficient vehicle technologies.

Opportunities

Significant growth opportunities exist due to the rapid adoption of electric and hybrid vehicles, which often require more advanced starter motor systems. The integration of AI and IoT in vehicle systems opens the door for smart starter motors with predictive maintenance and improved energy management. Increasing demand in the automotive aftermarket—especially in developing regions—presents additional revenue streams as vehicle fleets age and require replacements. Moreover, rising investments in research and development are enabling technological breakthroughs that can further boost market competitiveness and efficiency.

Challenges

Despite the positive outlook, the automotive starter motor market faces a few notable challenges. The high cost of technologically advanced starter motors can be a barrier in cost-sensitive regions. The integration of starter motors into modern hybrid and electric powertrains adds complexity and requires specialized engineering expertise. Additionally, competition from start-stop systems and integrated starter generator technologies may impact traditional starter motor demand. Raw material price volatility and global supply chain disruptions are also potential hindrances to consistent market growth.

Regional Outlook

Asia-Pacific is the dominant region in the global automotive starter motor market, driven by large-scale automotive manufacturing in countries like China, India, Japan, and South Korea. The region benefits from robust demand for both commercial and passenger vehicles, supported by growing economies and infrastructure development. North America is anticipated to experience the fastest growth during the forecast period due to rising adoption of hybrid vehicles, technological advancements, and increased focus on sustainable transport solutions. Europe also presents promising prospects, bolstered by strict environmental regulations and a strong push toward electrification, with Germany, France, and the UK leading the regional market.

Automotive Starter Motor Market Companies

- Bosch

- Denso Corporation

- Valeo

- Hitachi Automotive Systems

- Mitsubishi Electric

- Mitsuba Corporation

- Hella KGaA Hueck & Co.

- BorgWarner Inc.

- Mahle GmbH

- Prestolite Electric

- Lucas Electrical

- ASIMCO

- Remy International, Inc.

Recent Developments

- In January 2024, SEG Automotive revealed plans to expand its starter motor manufacturing facility in Hungary to satisfy the rising demand throughout Europe. The new line will concentrate on energy-efficient starter motors designed for vehicles equipped with start-stop systems, thus supporting emissions reduction efforts.

- In October 2024, Valeo announced a renewed partnership with Renault aimed at electric and hybrid components, including advanced starter motors. This collaboration is designed to create integrated solutions for the next generation of vehicles.

- In June 2023, Renault unveiled its Rafale SUV, featuring a 1.2L turbo engine paired with a starter-generator system. This hybrid configuration underscores the growing use of starter-based electrification technologies in European passenger vehicles.

- In 2021, SEG Automotive introduced an upgraded version of its SC60 and S78 starter motors, setting new benchmarks in the industry. The SC60, touted as one of the most compact in its class, is tailored to snugly fit into smaller vehicles, particularly compact cars. It impressively delivers up to 1.2kW of starting power, ensuring reliable ignition. In parallel, the S78 platform for start-stop motors offers a substantial power output of up to 2.2kW. This technology not only enhances the efficiency of start-stop systems but also caters to more demanding applications, particularly in larger and more power-hungry vehicles.

Segments Covered in the Report

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Application Type

- Internal Combustion Engine (IC Engine)

- Hybrid/Micro-Hybrid Powertrain

By Type

- Electric

- Pneumatic

- Hydraulic

- Starter Motor Generator

By Sales Channel

- OEM

- Replacement/Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Also Read: Automotive Fuel Cell Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/automotive-starter-motor-market