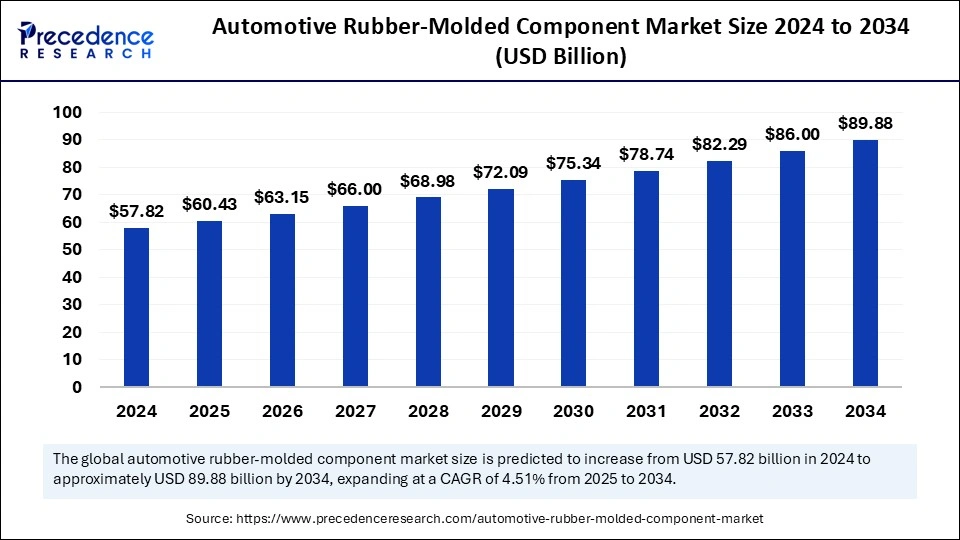

The global automotive rubber-molded component market size was valued at USD 57.82 billion in 2024 and is expected to gain around USD 89.88 billion by 2034, growing at a CAGR of 4.51% from 2025 to 2034.

Automotive Rubber-Molded Component Market Key Points

-

Asia Pacific led the market with the largest share in 2024.

-

North America is anticipated to experience notable growth during the forecast period.

-

By material, the ethylene propylene diene monomer (EPDM) segment held the highest market share in 2024.

-

The styrene-butadiene rubber (SBR) segment is projected to witness significant growth over the forecast period.

-

By component, the seals segment dominated the market in 2024.

-

The gaskets segment is expected to grow at a significant rate throughout the projection period.

-

In terms of vehicle type, the passenger cars segment held the largest market share in 2024.

-

The commercial vehicles segment is expected to register notable growth during the studied period.

What Are Automotive Rubber-Molded Components and Why Are They Essential?

Automotive rubber-molded components are critical parts made by shaping rubber into specific forms using molding techniques such as compression, injection, or transfer molding. These components are used extensively throughout vehicles to serve sealing, vibration damping, insulation, and protective functions. Common examples include gaskets, seals, O-rings, bushings, mounts, hoses, and weatherstrips.

Rubber’s unique properties—such as flexibility, durability, heat resistance, and chemical inertness—make it ideal for withstanding harsh automotive environments like extreme temperatures, oils, and mechanical stress. These components play a vital role in ensuring vehicle performance, safety, and comfort, particularly by reducing noise, vibration, and harshness (NVH) levels and protecting against leaks and contaminants.

How Is the Automotive Rubber-Molded Component Market Shaping Up?

The automotive rubber-molded components market is experiencing steady growth, driven by increasing global vehicle production, stringent emission and safety regulations, and the rising demand for enhanced ride quality. The market is also influenced by the adoption of lightweight and high-performance materials to improve fuel efficiency and reduce carbon emissions.

Electric vehicles (EVs) are opening new avenues for rubber component applications, especially for thermal insulation, battery sealing, and electrical protection. Additionally, advancements in rubber compounding and molding technologies are enabling manufacturers to meet complex design and durability requirements. Major players in this market include Continental AG, Freudenberg Group, Sumitomo Riko, Cooper-Standard Automotive, and NOK Corporation, who focus on innovation and material optimization to maintain competitiveness in a rapidly evolving automotive landscape.

How is AI Driving Innovation in the Automotive Rubber-Molded Component Market?

AI is significantly improving the automotive rubber-molded component market by optimizing design and manufacturing processes. Machine learning algorithms analyze material properties and performance requirements to create advanced rubber formulations with better durability, flexibility, and resistance to heat or wear. This enables manufacturers to produce high-quality components tailored for modern vehicle needs.

In production, AI enhances efficiency through predictive maintenance, real-time quality control, and automated defect detection. By monitoring machinery and production data, AI systems reduce downtime, minimize waste, and ensure consistent output. These capabilities help manufacturers meet stringent automotive standards while reducing costs, making AI a key enabler of smarter, more reliable rubber-molded components.

Growth Factors in the Automotive Rubber-Molded Component Market

The market is being driven by automakers’ increasing focus on lightweight and fuel-efficient vehicles. Rubber-molded components—such as seals, gaskets, hoses, bushings, and vibration-dampening parts—are increasingly replacing heavier materials to reduce overall vehicle weight, improve fuel economy, and meet stringent emissions regulations. This shift is particularly pronounced in electric and hybrid vehicles, which require specialized rubber parts for high-voltage system safety, battery sealing, and thermal management. The emphasis on vehicle comfort, noise and vibration reduction (NVH), and interior quality is also boosting demand for advanced rubber components in both passenger cars and commercial vehicles.

Regionally, the Asia-Pacific market leads in growth, thanks to rapid automotive production in countries like China, India, and Japan and favorable manufacturing costs. North America and Europe follow, driven by established automotive industries and stricter environmental regulations. The rise of autonomous driving and EVs with advanced systems demands durable, flexible, and lightweight rubber solutions, while innovation in materials—such as EPDM and bio-based rubbers—and smart manufacturing techniques like automation and AI further support market expansion. Finally, the growing automotive aftermarket, including replacement parts and e-commerce channels, presents additional opportunities for component suppliers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 89.88 Billion |

| Market Size in 2025 | USD 60.43 Billion |

| Market Size in 2024 | USD 57.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Component Type, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The automotive rubber-molded component market is driven by the increasing production of vehicles worldwide, coupled with the rising demand for high-performance, durable, and vibration-resistant automotive components. Rubber-molded parts such as seals, gaskets, bushings, mounts, hoses, and weatherstrips are critical for ensuring safety, noise reduction, thermal insulation, and fluid containment in vehicles. As vehicles become more sophisticated, the need for precision-engineered components that can withstand high temperatures, mechanical stress, and chemical exposure has intensified, fueling the demand for advanced rubber materials like EPDM, silicone, and nitrile.

The expansion of the electric vehicle (EV) market is also creating a new demand for rubber-molded components customized for battery protection, noise and vibration dampening, and sealing solutions in high-voltage systems. Additionally, the increasing consumer preference for quieter and more comfortable rides is encouraging automakers to invest in rubber components that improve NVH (noise, vibration, and harshness) characteristics.

Market Opportunities

The market is ripe with opportunities for innovation and growth, especially as automotive trends shift toward electrification, lightweighting, and sustainability. One key opportunity lies in the development of eco-friendly and recyclable rubber compounds that meet stringent environmental regulations while maintaining performance standards. Manufacturers that can offer sustainable solutions using bio-based or low-emission materials will be well-positioned to win contracts from environmentally conscious OEMs. Another promising area is the integration of rubber components with sensors and smart materials that offer self-healing, temperature monitoring, or adaptive sealing capabilities.

As vehicle designs evolve with more complex architectures and modular platforms, there is also a growing need for rubber-molded components that are compatible with various assemblies and adaptable across multiple models. In emerging markets, the growing adoption of personal and commercial vehicles, combined with infrastructure development, creates long-term growth opportunities for local rubber component suppliers and global players looking to expand their footprint.

Market Challenges

Despite robust demand, the automotive rubber-molded component market faces several challenges. Volatility in raw material prices—especially synthetic rubber and additives derived from petrochemicals—can significantly impact profit margins for manufacturers. Additionally, the production of high-quality rubber components requires precise process control and strict compliance with safety, performance, and environmental standards, which can be capital- and technology-intensive.

Competition from low-cost manufacturers in Asia adds pricing pressure and necessitates continuous cost optimization and innovation. Another challenge lies in meeting the differing specifications of OEMs and tier-1 suppliers across global regions, which can complicate product standardization and supply chain logistics. Furthermore, the increasing shift toward EVs poses both an opportunity and a challenge, as many traditional combustion-engine-specific rubber parts (like fuel hoses and engine mounts) are becoming obsolete, requiring suppliers to pivot quickly and re-engineer their product portfolios to remain relevant.

Regional Outlook

Asia-Pacific dominates the automotive rubber-molded component market, led by high vehicle production in China, Japan, South Korea, and India. The presence of a strong supply chain, lower production costs, and a growing middle-class population with rising car ownership continue to drive market expansion in the region. China, in particular, is a global hub for both traditional and electric vehicle manufacturing, offering extensive opportunities for rubber component suppliers.

North America represents a significant market due to its mature automotive industry and focus on innovation, quality, and advanced manufacturing technologies. The U.S. continues to invest heavily in EVs and autonomous vehicle development, creating a demand for specialized rubber components. Europe also holds a substantial share, driven by strict emission regulations, high-end vehicle production, and the presence of prominent automakers in Germany, France, and Italy.

Meanwhile, Latin America and the Middle East & Africa show potential for growth as urbanization and infrastructure development lead to increased vehicle usage. However, political and economic instability, as well as limited industrial capabilities in some countries, may pose short-term challenges to market penetration.

Automotive Rubber-Molded Component Market Companies

- NOK Corporation

- Trelleborg AB

- AB SKF

- Continental AG

- Federal-Mogul Corporation

- ALP Group

- Bohra Rubber Pvt. Ltd

- Cooper-Standard Automotive

- DANA Holding Corporation

- Freudenberg and Co. Kg

- Hebei Shinda Seal Group

- Hutchinson SA

- Steele Rubber Products

- Sumitomo Riko Co. Ltd

- Jayem Auto Industries Pvt Ltd

- Bony Polymers Pvt Ltd

Segments Covered in the Report

By Material Type

- Ethylene Propylene Diene Monomer (EPDM)

- Natural Rubber (NR)

- Styrene-butadiene Rubber (SBR)

- Others

By Component Type

- Seals

- Gaskets

- Hoses

- Weather-strips

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Also Read: Automotive Overhead Console Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/5738

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344