Low Rolling Resistance Tire Market Key Points

-

North America led the low rolling resistance tire market with the largest market share of 36% in 2024.

-

Asia Pacific is anticipated to grow at a notable CAGR of 13.9% in the coming years.

-

By vehicle type, the passenger cars segment accounted for the largest market share of 42% in 2024.

-

The electric vehicles segment is projected to grow at the fastest rate during the forecast period.

-

By width, the wide band segment dominated the market in 2024.

-

The dual width segment is expected to grow at a steady rate over the forecast period.

-

By sales channel, the OEMs segment contributed the largest market share of 61% in 2024.

-

The aftermarket segment is projected to expand rapidly in the upcoming period.

Role of AI in Low Rolling Resistance Tire Market

Artificial Intelligence (AI) is playing a crucial role in advancing the Low Rolling Resistance (LRR) Tire market by improving tire design, material development, and performance optimization. AI-driven simulations and machine learning algorithms help engineers analyze complex interactions between tire components, road surfaces, and vehicle dynamics. This enables the precise design of tread patterns, sidewall structures, and rubber compounds that reduce energy loss during tire deformation, thus enhancing fuel efficiency and lowering CO₂ emissions. By using AI to model and test various formulations virtually, manufacturers can accelerate R&D processes, reduce prototyping costs, and bring innovative LRR tires to market faster.

Furthermore, AI is enhancing production and quality control processes. Predictive analytics are employed to monitor manufacturing parameters in real time, ensuring consistent product quality and minimizing defects. AI also aids in supply chain optimization and demand forecasting by analyzing data from sales, seasonal trends, and transportation patterns. In the aftermarket and fleet management space, AI-integrated sensors and IoT platforms collect real-time data on tire wear, pressure, and temperature. This helps predict maintenance needs, extends tire life, and ensures optimal rolling resistance performance. Overall, AI is instrumental in making the LRR tire segment more efficient, sustainable, and responsive to evolving consumer and regulatory demands.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/5871

Low Rolling Resistance (LRR) Tire Market Growth Factors

The market for low rolling resistance (LRR) tires is experiencing a significant surge due to escalating environmental concerns and stringent global emission regulations. As governments and regulatory bodies worldwide push for reduced CO₂ emissions from vehicles, automakers and tire manufacturers are heavily investing in LRR technologies, which can improve fuel economy by up to 10%. This heightened emphasis on sustainability extends to electric vehicles as well, where efficiency gains directly contribute to increased vehicle range making LRR tires an essential component in the EV ecosystem.

Technological innovation is another major force propelling market growth. Advanced tire compounds incorporating silica blends, optimized tread designs, and refined sidewall constructions are enhancing fuel efficiency without compromising grip or durability. Breakthroughs in production methods—such as advanced mixing and compounding, nanotechnology, and precision molding—are enabling manufacturers to scale up these innovations cost-effectively. Increasing consumer awareness about total cost of ownership, including fuel savings and environmental impact, is also shifting preference toward LRR tires. With more tire manufacturers offering certified LRR products and OEMs frequently equipping new vehicles with them, market penetration continues to expand rapidly.

Market Scope

| Report Coverage | Details |

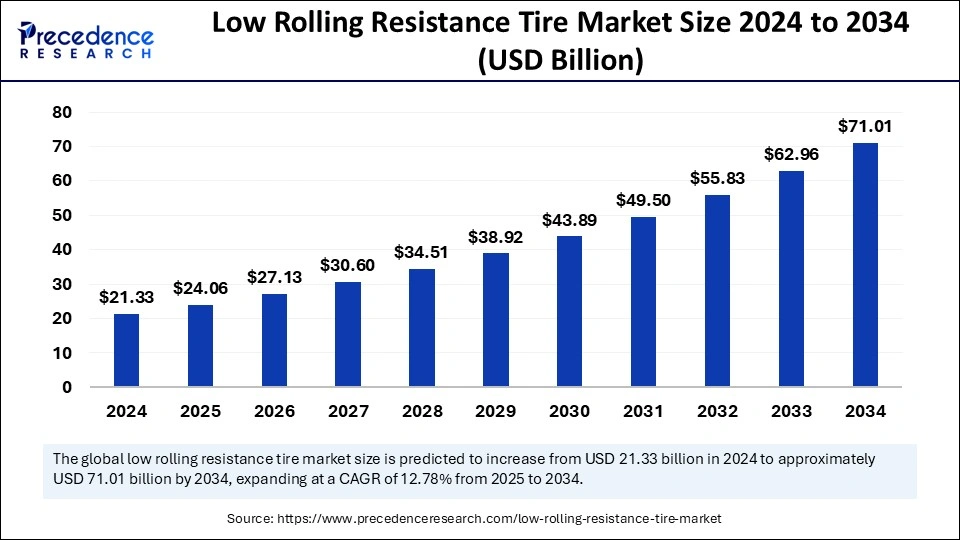

| Market Size by 2034 | USD 71.01 Billion |

| Market Size in 2025 | USD 24.06 Billion |

| Market Size in 2024 | USD 21.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.78% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Width, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The Low Rolling Resistance (LRR) tire market is primarily driven by the global push for fuel efficiency and stringent environmental regulations. LRR tires are designed to reduce the energy lost as heat when a tire rolls, thereby lowering fuel consumption and greenhouse gas emissions. With rising fuel prices and growing concerns about climate change, automakers and consumers alike are seeking solutions that enhance vehicle efficiency, making LRR tires an attractive option.

The increasing adoption of these tires in both passenger and commercial vehicles is being propelled by government mandates and regulatory frameworks promoting eco-friendly automotive technologies. For example, fuel economy standards such as the Corporate Average Fuel Economy (CAFE) regulations in the U.S. and CO₂ emissions targets in the EU are pushing manufacturers to adopt components that improve efficiency, including LRR tires. Moreover, the rapid expansion of the electric vehicle (EV) market is further fueling demand. EV manufacturers are increasingly using LRR tires to extend driving range by minimizing energy loss.

These tires play a vital role in optimizing the performance of EVs, where energy efficiency is critical. Additionally, advancements in tire materials and design, such as the incorporation of silica-based compounds and innovative tread patterns, have enabled manufacturers to improve rolling resistance without compromising safety or durability. This has increased the appeal of LRR tires across a wider segment of consumers and vehicle types.

Market Opportunities

The global shift toward sustainable transportation presents considerable opportunities for the Low Rolling Resistance Tire market. As nations and cities commit to net-zero targets and green mobility initiatives, demand for LRR tires is expected to surge, particularly in urban and public transportation sectors. There is a growing opportunity to integrate LRR tires into fleet vehicles, including buses, delivery vans, and ride-sharing cars, where improved fuel economy directly translates into lower operational costs and reduced emissions. Fleet operators, logistics companies, and municipalities are becoming increasingly aware of the long-term economic and environmental benefits offered by LRR tires, driving their adoption.

Additionally, there is an untapped opportunity in emerging markets where vehicle ownership is on the rise, and governments are beginning to implement fuel economy and emissions regulations. As infrastructure improves and consumer awareness of environmental issues increases in countries like India, Brazil, and South Africa, LRR tires are likely to see significant penetration. Furthermore, continuous innovation in materials science, including the development of bio-based and recyclable compounds, offers the potential to manufacture next-generation LRR tires that are both high-performing and sustainable. These advancements could unlock new product categories and applications, such as high-performance sports tires with low rolling resistance or LRR tires tailored for hybrid vehicles and SUVs.

Market Challenges

Despite their benefits, Low Rolling Resistance tires face several challenges that may hinder widespread adoption. One of the most prominent is the trade-off between rolling resistance and other performance attributes, such as traction, durability, and braking performance. While recent innovations have mitigated this to an extent, some consumers and fleet managers remain concerned about safety and long-term performance, especially in adverse weather conditions. These concerns can limit uptake in regions where road safety under diverse climatic conditions is a top priority.

Cost is another barrier to adoption. LRR tires are generally more expensive than conventional tires due to the use of advanced materials and complex manufacturing processes. For budget-conscious consumers, especially in price-sensitive markets, the upfront cost may outweigh the long-term fuel savings, reducing their appeal. Moreover, lack of awareness among consumers about the benefits of LRR tires and limited availability in aftermarket sales channels pose additional hurdles. The absence of standardized labeling and consistent definitions for rolling resistance efficiency in some regions can also lead to confusion and mistrust among buyers, slowing market penetration.

Regional Outlook

North America remains a strong market for Low Rolling Resistance tires, supported by regulatory policies, high consumer awareness, and the presence of major automotive OEMs. The United States, in particular, has been a leader in adopting LRR technologies, driven by CAFE standards and the growing emphasis on energy conservation. The region also benefits from a well-developed EV market, where LRR tires are increasingly becoming standard equipment.

Europe is another leading market, thanks to stringent emissions targets and sustainability mandates from the European Union. Countries such as Germany, France, and the Netherlands are investing heavily in green mobility, creating robust demand for LRR tires across passenger and commercial vehicle segments. Moreover, the well-established tire labeling system in Europe helps educate consumers about energy-efficient options, further boosting adoption.

Asia-Pacific is expected to register the fastest growth in the coming years. Rapid urbanization, increasing vehicle ownership, and rising fuel prices are compelling consumers and governments in countries like China, India, and Japan to consider fuel-saving technologies. The region also serves as a manufacturing hub for tires and automobiles, making it a focal point for product innovation and export. Government policies aimed at reducing vehicular emissions, along with subsidies for fuel-efficient and electric vehicles, are contributing to the regional demand for LRR tires.

In contrast, Latin America and the Middle East & Africa are emerging markets with growth potential but face challenges such as limited consumer awareness, economic instability, and weaker regulatory enforcement. However, as these regions continue to modernize and adapt global standards for fuel efficiency and emissions, the LRR tire market is likely to gain traction.

Low Rolling Resistance Tire Market Companies

- Bridgestone Corporation

- Michelin

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Hankook Tire

- Yokohama Rubber Co. Ltd.

- Apollo Tyres Ltd.

- Cheng Shin Rubber Industry Co. (Maxxis)

- Kumho Tire

- Zhongce Rubber Group Co., Ltd. (ZC-Rubber)

- Nokian Tyres plc

- MRF Tyres

- Sumitomo Rubber Industries, Ltd.

- Firestone Tire and Rubber Company

- Cooper Tire & Rubber Company

- Toyo Tire & Rubber Company

Segments Covered in the Report

By Vehicle

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

By Width

- Dual Width

- Wide Band

By Sales Channel

- OEM

- Aftermarket

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Also Read: Micro Electric Vehicle Market

Source: https://www.precedenceresearch.com/low-rolling-resistance-tire-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344