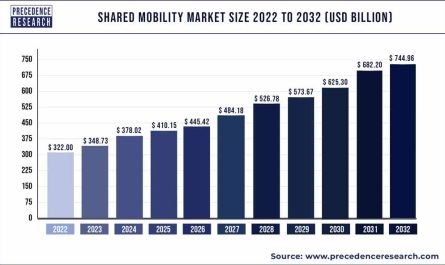

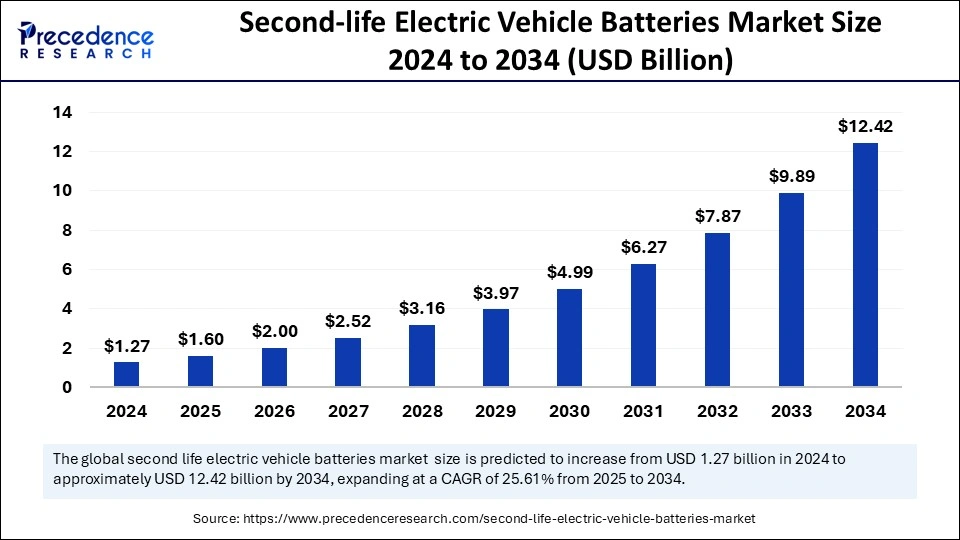

The global second-life electric vehicle batteries market size was valued at USD 1.27 billion in 2024 and is predicted to be worth around USD 12.42 billion by 2034, expanding at a CAGR of 25.61% from 2025 to 2034.

Unlocking Value from Used EV Batteries

The second-life electric vehicle (EV) battery market is emerging as a critical enabler of the circular economy in the clean energy space. These batteries, no longer fit for vehicle propulsion, can still serve in less demanding energy storage roles, such as powering buildings or supporting the grid. As EV adoption accelerates, the number of batteries available for second-life use is growing rapidly, creating new commercial and environmental value streams. This trend is helping reduce electronic waste and offering a cost-efficient alternative to new battery storage systems.

What’s Powering the Market Surge?

Several factors are driving market momentum. The most significant is the growing global fleet of electric vehicles, which guarantees a rising stream of retired batteries. In parallel, renewable energy expansion has created a strong demand for affordable energy storage solutions, especially for solar and wind integration. Government policies focused on battery recycling and sustainability, along with falling costs of battery diagnostics and repurposing technologies, are also acting as key accelerators. Together, these elements are transforming used batteries from a waste management problem into a business opportunity.

Smarter Batteries Through AI Integration

Artificial Intelligence is rapidly becoming a game-changer in second-life battery operations. With AI, companies can accurately evaluate battery health, predict remaining useful life, and classify batteries based on reuse potential. This allows for automated sorting and improved safety. AI also enables smart energy management systems that optimize the performance of battery storage in real time, helping balance grid loads and reduce operational costs. In short, AI is making second-life batteries smarter, safer, and more scalable for widespread deployment.

Trends Reshaping the Second-Life Battery Ecosystem

The market is witnessing a surge in stationary energy storage applications, such as grid backup, residential systems, and industrial power reserves. Automakers are collaborating with energy companies to launch battery repurposing programs, while modular designs are becoming popular for flexibility and scalability. Moreover, startups are leveraging IoT and blockchain to improve battery traceability and monitor performance. These trends indicate a shift toward more structured and technologically advanced second-life battery solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.42 Billion |

| Market Size in 2025 | USD 1.60 Billion |

| Market Size in 2024 | USD 1.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.61% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. |

What’s Driving Industry Momentum?

The market’s rapid growth is being propelled by several strong drivers:

-

Rising need to reduce environmental impact of battery disposal.

-

Increasing demand for low-cost, scalable energy storage.

-

Global surge in EV sales, providing a future pipeline of retired batteries.

-

Incentives and regulations supporting recycling and circular usage.

-

Technological advances in battery testing and repackaging.

Read Also: Artificial Intelligence in Self-Driving Cars Market Size, Share, Report by 2034

Where Are the Next Big Opportunities?

There’s a wealth of untapped potential across the second-life battery landscape. Off-grid and rural electrification projects, especially in developing nations, could benefit from inexpensive and reliable storage. Commercial and industrial facilities can use these systems to reduce peak energy costs. Emerging smart city infrastructure — like EV charging networks and intelligent street lighting — represents another high-growth opportunity. The sector also opens doors for battery lifecycle management providers, logistics firms, and diagnostics tech innovators.

What’s Holding Back Wider Adoption?

Despite its promise, the market faces some critical hurdles. Lack of standardized testing protocols and evolving safety regulations make scalability difficult. The variation in battery chemistries and form factors adds complexity to refurbishment processes. Performance uncertainty may limit use in mission-critical systems. Logistical issues, including collection, transportation, and storage costs, remain significant. Finally, limited consumer education and fragmented supply chains are slowing momentum, though these issues are expected to ease as the ecosystem matures.

Second-life Electric Vehicle Batteries Market Companies

- Enel X

- Nissan Motors Corporation

- Fortum

- Renault Group

- Mercedes-Benz Group

- Hyundai Motor Company

- RWE

- Mitsubishi Motors Corporation

- BELECTRIC

- BeePlanet Factory SL

- B2U Storage Solutions, Inc.

- RePurpose Energy Inc.

- ReJoule

- Cactos Oy

- ECO STOR AS

- Connected Energy Ltd.

- Smartville Inc.

- Lohum Cleantech Private Limited

- DB Bahnbau Gruppe GmbH

Company Profile-

1. Refurb battery, Netherlands

The Refurb Battery offers low-carbon battery storage containers that will be scalable from 300 kWh up to 1 MWh. They offer solutions for battery optimization and to enhance its longevity via advanced data gathering and monitoring. This is useful for electrification across sectors like remote construction, outdoor events, and e-mobility.

Leader’s Announcements

- In June 2023, MG Motor India, a British automotive brand with a legacy spanning 99 years, joined forces with LOHUM, the largest producer of sustainable energy transition material in India, to create a comprehensive system for the reuse and lifecycle management of electric vehicle batteries.

Recent Developments in Second-Life Electric Vehicle Batteries Market

- In March 2025, the leading players Stena Recycling and Nissan came together under a strategic alliance to adopt and scale up the reuse of second-life electric vehicle batteries in Norway. Nissan has a fully developed network of value chains for batteries, which helps to reach the end of their lifespan for road use. This collaboration uses recycling expertise offered by Stena, with the sustainability and experience of Nissan in electric vehicle technology.

- In October 2024, Vision Mechatronics and JSW MG Motor entered into a collaboration and launched the India’s first high-voltage (HV) second-life battery with an indigenous active balancing battery management system.

- In February 2023, B2U Storage Solutions, Inc., a prominent provider of large-scale energy storage systems that utilize second-life electric vehicle batteries, revealed that its SEPV Sierra hybrid solar + storage facility in Lancaster, California, has achieved 25 MWh of operational storage capacity. This project’s storage capacity consists of 1,300 repurposed EV battery packs obtained from Honda and Nissan.